CBSE Class 12 Accountancy Question Paper 2024 PDF (Set 2- 67/1/2) will be available for download here. CBSE will conduct the Accountancy exam on March 23, 2024 from 10:30 AM to 1:30 PM. The total marks for the theory paper are 80. The question paper will contain 20% MCQ-based questions, 40% competency-based questions, and 40% short and long answer type questions.

CBSE Class 12 Accountancy Question Paper 2024 (Set 2- 67/1/2) with Answer Key PDF

| CBSE Class 12 2024 Accountancy Question Paper (Set 2- 67/1/2) with Answer Key | Check Solution |

Piyush, Rajesh, and Avinash were partners in a firm sharing profits and losses equally. Shiva was admitted as a new partner for an equal share. Shiva brought his share of capital and premium for goodwill in cash. The premium for goodwill amount will be divided among:

View Solution

Step 1: Goodwill premium is distributed to old partners in their sacrificing ratio.

Step 2: Calculate the sacrificing ratio:

Sacrificing ratio = Old ratio - New ratio = 1 : 1 : 1. Quick Tip: Goodwill premium compensates old partners for the share of profits they sacrifice in favor of the new partner.

Alex, Benn, and Cole were partners in a firm sharing profits and losses in the ratio of 5 : 3 : 2. They admitted Dona as a new partner for \(\frac{1}{5}\) share in the future profits. Dona agreed to contribute proportionate capital. On the date of admission, capitals of Alex, Benn, and Cole after all adjustments were Rs.1,20,000; Rs.80,000; and Rs.1,00,000, respectively. The amount of capital brought in by Dona will be:

View Solution

Step 1: Determine the total capital of the firm.

The total capital of Alex, Benn, and Cole after adjustments is: Total Capital = Alex's Capital + Benn's Capital + Cole's Capital.

Substituting the values: Total Capital = Rs.1,20,000 + Rs.80,000 + Rs.1,00,000 = Rs.3,00,000.

Step 2: Calculate Dona's proportionate capital.

Dona is admitted with a share in the future profits. The proportionate capital for Dona is calculated as: \[ Dona's Capital = \frac{Dona's Share}{Remaining Partners' Share} \times Total Capital. \]

Dona's share is \(\frac{1}{5}\), and the remaining partners' share is \(1 - \frac{1}{5} = \frac{4}{5}\). Substituting the values: \[ Dona's Capital = \frac{\frac{1}{5}}{\frac{4}{5}} \times 3,00,000 = \frac{1}{4} \times 3,00,000 = Rs.75,000. \]

Step 3: Finalize Dona's capital contribution.

Dona's proportionate capital to be brought into the firm is Rs.75,000. Quick Tip: When admitting a new partner, calculate their capital based on the proportionate share in total adjusted capital.

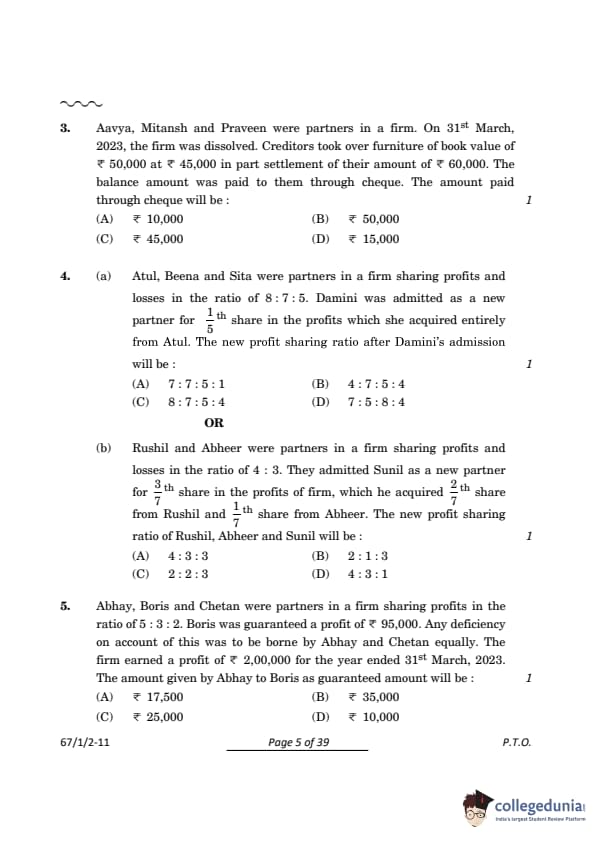

Aavya, Mitansh, and Praveen were partners in a firm. On 31st March, 2023, the firm was dissolved. Creditors took over furniture of book value of Rs.50,000 at Rs.45,000 in part settlement of their amount of Rs.60,000. The balance amount was paid to them through cheque. The amount paid through cheque will be:

View Solution

Step 1: Total creditors' amount = Rs.60,000.

Step 2: Adjust amount against furniture = Rs.45,000.

Step 3: Balance payable = Rs.60,000 - Rs.45,000 = Rs.15,000. Quick Tip: In dissolution, liabilities are settled by adjusting available assets first before paying the remaining balance.

(a).Atul, Beena, and Sita were partners in a firm sharing profits and losses in the ratio of 8 : 7 : 5. Damini was admitted as a new partner for \(\frac{1}{5}\) share in the profits, which she acquired entirely from Atul. The new profit-sharing ratio after Damini’s admission will be:

View Solution

Step 1: Understand the initial profit-sharing ratio and Damini's share.

The initial profit-sharing ratio of Atul, Beena, and Sita is \( 8 : 7 : 5 \), and Damini is admitted with a \(\frac{1}{5}\) share in the profits. Damini's share is acquired entirely from Atul.

Step 2: Calculate Atul's new share after giving Damini \(\frac{1}{5}\).

Atul's original share is \(\frac{8}{20}\). Damini’s share, \(\frac{1}{5} = \frac{4}{20}\), is subtracted entirely from Atul’s share. Thus, Atul's new share is: \[ \frac{8}{20} - \frac{4}{20} = \frac{4}{20}. \]

Step 3: Beena and Sita's shares remain unchanged.

Beena’s share is \(\frac{7}{20}\), and Sita’s share is \(\frac{5}{20}\). These remain the same as Damini's share only affects Atul's share.

Step 4: Finalize the new profit-sharing ratio.

The new profit-sharing ratio of Atul, Beena, Sita, and Damini is: \[ 4 : 7 : 5 : 4. \] Quick Tip: When a new partner is admitted, their share is deducted from the contributing partner(s), and the new ratio is calculated accordingly.

(b).Rushil and Abheer were partners in a firm sharing profits and losses in the ratio of 4 : 3. They admitted Sunil as a new partner for \(\frac{3}{7}\) share in the profits of the firm, which he acquired \(\frac{2}{7}\) share from Rushil and \(\frac{1}{7}\) share from Abheer. The new profit-sharing ratio of Rushil, Abheer, and Sunil will be:

View Solution

Step 1: Determine new shares:

Rushil’s new share = \(4 - \frac{2}{7} = \frac{28}{7} - \frac{2}{7} = \frac{26}{7}\).

Abheer’s new share = \(3 - \frac{1}{7} = \frac{21}{7} - \frac{1}{7} = \frac{20}{7}\).

Sunil’s share = \(\frac{3}{7}\).

Step 2: Combine shares and simplify: \[ Rushil : Abheer : Sunil = \frac{26}{7} : \frac{20}{7} : \frac{3}{7} = 26 : 20 : 3 = 2 : 2 : 3. \] Quick Tip: Ensure the shares transferred match the agreed new partner contribution.

Abhay, Boris, and Chetan were partners in a firm sharing profits in the ratio of 5 : 3 : 2. Boris was guaranteed a profit of Rs.95,000. Any deficiency on account of this was to be borne by Abhay and Chetan equally. The firm earned a profit of Rs.2,00,000 for the year ended 31st March, 2023. The amount given by Abhay to Boris as guaranteed amount will be:

View Solution

Step 1: Determine Boris's entitled profit:

Boris’s share as per the profit ratio = \(\frac{3}{10} \times 2,00,000 = Rs.60,000\).

Step 2: Calculate the shortfall:

Shortfall = Rs.95,000 - Rs.60,000 = Rs.35,000.

Step 3: Share the shortfall:

Abhay and Chetan bear the shortfall equally: \[ Abhay's contribution to Boris = \frac{Rs.35,000}{2} = Rs.17,500. \] Quick Tip: Profit guarantees ensure the guaranteed partner receives the committed amount, with the burden shared as per the agreement.

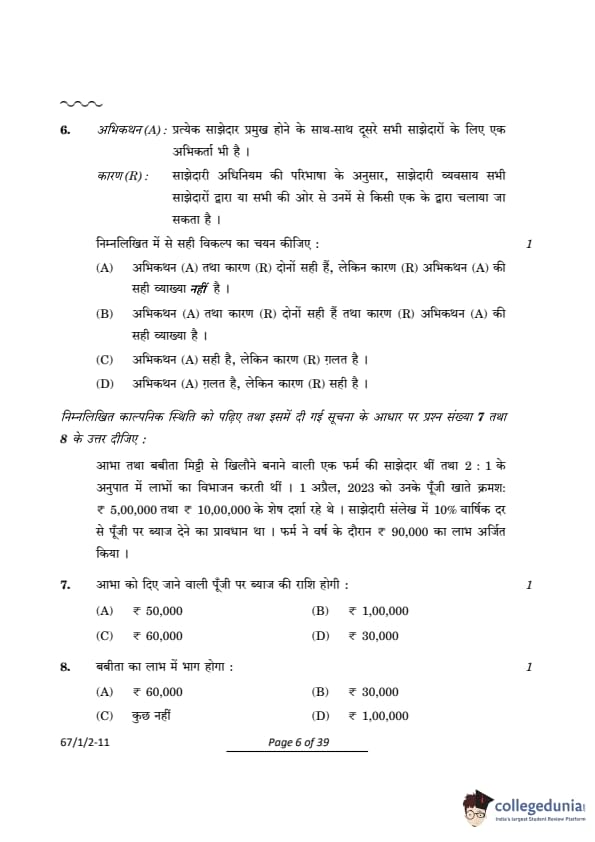

Assertion (A): Each partner is a principal as well as an agent for all the other partners.

Reason (R): As per the definition of the Partnership Act, partnership business may be carried on by all the partners or any of them acting for all.

View Solution

Step 1: Role of partners:

According to the Partnership Act, each partner acts as both a principal and an agent.

Step 2: Explanation of Reason (R):

The Partnership Act defines that the business can be conducted collectively by all partners or by one partner acting on behalf of the rest.

Step 3: Conclusion:

Reason (R) accurately explains Assertion (A), making both the assertion and the reason correct. Quick Tip: In partnerships, each partner plays a dual role as both a principal and an agent for the other partners.

Read the following hypothetical situation and answer questions No. 7 and 8 on the basis of the given information.

Abha and Babita were partners in a clay toy making firm sharing profits in the ratio of 2 : 1. On 1st April, 2023, their capital accounts showed balances of < 5,00,000 and < 10,00,000 respectively. The partnership deed provides for interest on capital @ 10% p.a. The firm earned a profit of < 90,000 during the year.

Abha and Babita were partners in a clay toy-making firm sharing profits in the ratio of 2 : 1. On 1st April, 2023, their capital accounts showed balances of Rs.5,00,000 and Rs.10,00,000 respectively. The partnership deed provides for interest on capital @ 10% p.a. The firm earned a profit of Rs.90,000 during the year. The amount of interest on capital allowed to Abha will be:

View Solution

Step 1: Determine the interest on capital as per the partnership deed.

The partnership deed provides for interest on capital at 10% per annum. For Abha: \[ Interest on Abha's capital = Rs.5,00,000 \times \frac{10}{100} = Rs.50,000. \]

Step 2: Check the adequacy of profits to provide full interest on capital.

The firm's total profit for the year is Rs.90,000. The total interest on capital for both partners is: \[ Interest on Abha's capital + Interest on Babita's capital = Rs.50,000 + (Rs.10,00,000 \times \frac{10}{100}) = Rs.50,000 + Rs.1,00,000 = Rs.1,50,000. \]

Since the available profit (Rs.90,000) is less than the total interest on capital (Rs.1,50,000), the interest will be distributed proportionally to their capital balances.

Step 3: Distribute the available profit in proportion to capital balances.

The capital balances of Abha and Babita are Rs.5,00,000 and Rs.10,00,000, respectively. The ratio of their capitals is: \[ \frac{Abha's capital}{Babita's capital} = \frac{5,00,000}{10,00,000} = 1 : 2. \]

The available profit of Rs.90,000 will be distributed in the ratio \( 1 : 2 \): \[ Abha's share of interest = \frac{1}{3} \times 90,000 = Rs.30,000. \]

Step 4: Finalize the interest on capital for Abha.

The amount of interest on capital allowed to Abha is Rs.30,000. Quick Tip: Interest on capital is an appropriation of profit, not a charge against profit, and is calculated based on the agreement.

Babita’s share in profit will be:

View Solution

Step 1: Total profit available for the firm.

The firm earned a total profit of Rs.90,000 for the year. As per the partnership deed, interest on capital is provided before distributing the remaining profit.

Step 2: Calculate the total interest on capital.

The capital balances of Abha and Babita are Rs.5,00,000 and Rs.10,00,000, respectively. The interest on capital is calculated at 10% per annum: \[ Interest on Abha's capital = Rs.5,00,000 \times \frac{10}{100} = Rs.50,000, \] \[ Interest on Babita's capital = Rs.10,00,000 \times \frac{10}{100} = Rs.1,00,000. \]

The total interest on capital required is: \[ Rs.50,000 + Rs.1,00,000 = Rs.1,50,000. \]

Step 3: Check if the available profit is sufficient to cover the interest on capital.

The available profit (Rs.90,000) is less than the required interest on capital (Rs.1,50,000). Hence, the available profit is distributed proportionally to the partners’ capital balances.

Step 4: Distribute the available profit.

The ratio of capital balances is: \[ \frac{Abha's capital}{Babita's capital} = \frac{5,00,000}{10,00,000} = 1 : 2. \]

The available profit of Rs.90,000 is distributed in the ratio \(1 : 2\): \[ Abha's share of interest = \frac{1}{3} \times 90,000 = Rs.30,000, \] \[ Babita's share of interest = \frac{2}{3} \times 90,000 = Rs.60,000. \]

Step 5: Check if Babita's profit share remains.

Babita's interest on capital (Rs.60,000) is fully covered by the available profit. Since all the available profit has been used to pay the interest on capital, no additional profit remains to be distributed. Therefore, Babita’s share in profit is: \[ Nil. \] Quick Tip: Profit is allocated according to the profit-sharing ratio specified in the partnership deed or agreement.

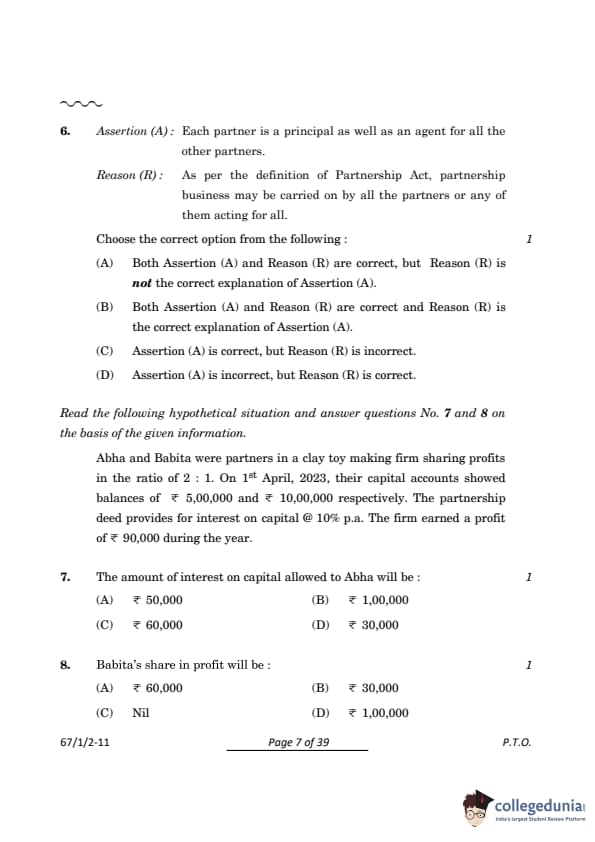

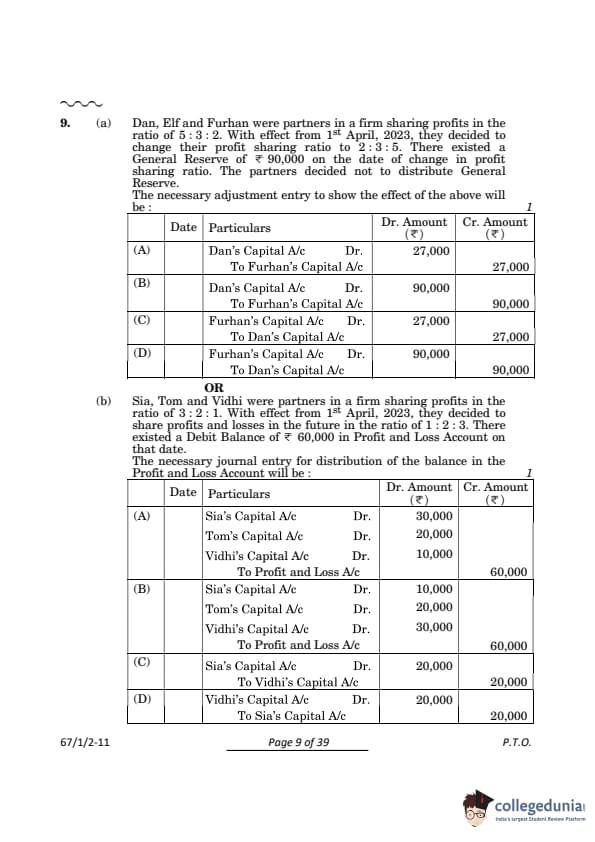

(a) Dan, Elf, and Furhan were partners in a firm sharing profits in the ratio of 5 : 3 : 2. With effect from 1st April, 2023, they decided to change their profit-sharing ratio to 2 : 3 : 5. There existed a General Reserve of Rs.90,000 on the date of the change in profit-sharing ratio. The partners decided not to distribute the General Reserve.

The necessary adjustment entry for the above is as follows:

View Solution

Step 1: Identify the profit-sharing ratios:

Old ratio = 5 : 3 : 2.

New ratio = 2 : 3 : 5.

Step 2: Calculate the change in ratios: \[ Gain or loss = Old Ratio - New Ratio. \]

Step 3: Adjust General Reserve:

Dan’s gain = \(\frac{5}{10} - \frac{2}{10} = \frac{3}{10}\).

Furhan’s loss = \(\frac{2}{10} - \frac{5}{10} = -\frac{3}{10}\).

Adjustment amount = General Reserve × Change in Ratio = Rs.90,000 × \(\frac{3}{10}\) = Rs.27,000. Quick Tip: Changes in profit-sharing ratios require adjustments for reserves and profits among partners using the gaining and sacrificing ratios.

(b) Sia, Tom, and Vidhi were partners in a firm sharing profits in the ratio of 3 : 2 : 1. With effect from 1st April, 2023, they decided to share profits and losses in the future in the ratio of 1 : 2 : 3. There existed a Debit Balance of Rs.60,000 in the Profit and Loss Account on that date.

View Solution

Step 1: Determine the old profit-sharing ratio:

Old ratio = 3 : 2 : 1.

Step 2: Distribute the debit balance of Profit and Loss Account:

- Sia’s share = \(\frac{3}{6} \times Rs.60,000 = Rs.30,000\).

- Tom’s share = \(\frac{2}{6} \times Rs.60,000 = Rs.20,000\).

- Vidhi’s share = \(\frac{1}{6} \times Rs.60,000 = Rs.10,000\).

Step 3: Record the adjustment:

The journal entry reflects the adjustment of the debit balance against the partners’ capital accounts. Quick Tip: Debit balances in the Profit and Loss Account are adjusted among partners in their old profit-sharing ratio before changes to the ratio are applied.

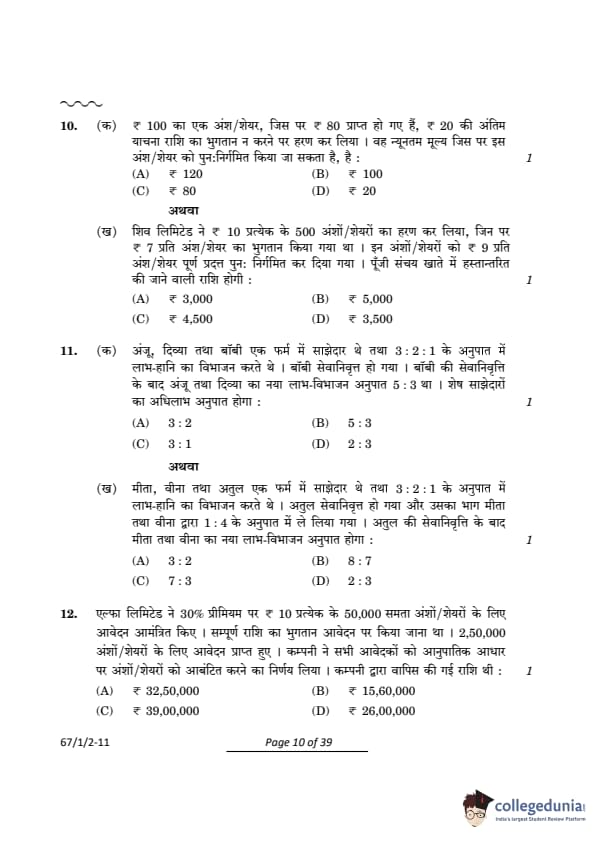

(a) A share of Rs.100 on which Rs.80 is received is forfeited for non-payment of the final call of Rs.20. The minimum price at which this share can be reissued is:

View Solution

Step 1: Rules for reissue of forfeited shares:

As per the Companies Act, forfeited shares can be reissued at a price not less than the unpaid amount.

Step 2: Calculate the unpaid amount:

Unpaid amount = Rs.100 (face value) - Rs.80 (amount received) = Rs.20.

Step 3: Determine the minimum price:

The minimum price for reissue is Rs.20, which is the unpaid amount on the share. Quick Tip: The minimum reissue price for forfeited shares is always equal to the unpaid amount on those shares.

(b) Shiv Ltd. forfeited 500 shares of Rs.10 each on which Rs.7 per share was paid. These shares were reissued for Rs.9 per share fully paid. Amount transferred to Capital Reserve Account will be:

View Solution

Step 1: Calculate the total amount forfeited.

The amount paid on forfeited shares was Rs.7 per share. For 500 shares, the total amount forfeited is: \[ Total Forfeited Amount = 500 \times 7 = Rs.3,500. \]

Step 2: Calculate the total amount reissued.

The shares were reissued for Rs.9 per share. For 500 shares, the total amount reissued is: \[ Total Reissued Amount = 500 \times 9 = Rs.4,500. \]

Step 3: Determine the total nominal value and premium.

The nominal value of each share is Rs.10. Since the shares were reissued for Rs.9 per share, the loss on reissue per share is: \[ Loss on Reissue = Rs.10 - Rs.9 = Rs.1 per share. \]

For 500 shares, the total loss is: \[ Total Loss = 500 \times 1 = Rs.500. \]

Step 4: Calculate the amount transferred to Capital Reserve Account.

The amount forfeited is adjusted against the loss on reissue. The remaining balance is transferred to the Capital Reserve Account: \[ Capital Reserve = Total Forfeited Amount - Total Loss. \]

Substituting the values: \[ Capital Reserve = Rs.3,500 - Rs.500 = Rs.3,000. \]

Step 5: Finalize the answer.

The amount transferred to the Capital Reserve Account is Rs.3,000.

Quick Tip: The profit on reissue of forfeited shares is calculated as the difference between the total share value and the reissued value and is credited to the Capital Reserve Account.

(a) Anju, Divya, and Bobby were partners in a firm sharing profits and losses in the ratio \(3 : 2 : 1\). Bobby retired. The new profit-sharing ratio between Anju and Divya after Bobby's retirement was \(5 : 3\). The gaining ratio of the remaining partners will be:

View Solution

Step 1: Understand the initial profit-sharing ratio.

The initial profit-sharing ratio of Anju, Divya, and Bobby is \(3 : 2 : 1\). Therefore: \[ Anju's share = \frac{3}{6}, \quad Divya's share = \frac{2}{6}, \quad Bobby's share = \frac{1}{6}. \]

Step 2: Determine the new profit-sharing ratio.

After Bobby's retirement, the new profit-sharing ratio between Anju and Divya is \(5 : 3\). Therefore: \[ Anju's new share = \frac{5}{8}, \quad Divya's new share = \frac{3}{8}. \]

Step 3: Calculate the gaining ratio.

The gaining ratio is calculated as the difference between the new share and the old share for each partner.

\[ Anju's gain = Anju's new share - Anju's old share = \frac{5}{8} - \frac{3}{6}. \]

Converting \(\frac{3}{6}\) to a denominator of 8: \[ Anju's gain = \frac{5}{8} - \frac{4}{8} = \frac{1}{8}. \]

Similarly, for Divya: \[ Divya's gain = Divya's new share - Divya's old share = \frac{3}{8} - \frac{2}{6}. \]

Converting \(\frac{2}{6}\) to a denominator of 8: \[ Divya's gain = \frac{3}{8} - \frac{4}{12} = \frac{3}{8} - \frac{2}{8} = \frac{1}{8}. \]

Step 4: Express the gaining ratio.

The gaining ratio between Anju and Divya is: \[ Gaining Ratio = 3 : 1. \]

Quick Tip: To calculate the gaining ratio, subtract the old profit-sharing ratio from the new profit-sharing ratio for each partner and simplify.

(b) Mita, Veena, and Atul were partners in a firm sharing profits and losses in the ratio \(3 : 2 : 1\). Atul retired, and his share was taken over by Mita and Veena in the ratio \(1 : 4\). The new profit-sharing ratio between Mita and Veena after Atul's retirement will be:

View Solution

Step 1: Calculate Atul's share:

Atul's share = \(\frac{1}{6}\) (as total ratio = \(3 + 2 + 1 = 6\)).

Step 2: Distribute Atul's share between Mita and Veena:

- Mita's additional share = \(\frac{1}{6} \times \frac{1}{5} = \frac{1}{30}\).

- Veena's additional share = \(\frac{1}{6} \times \frac{4}{5} = \frac{4}{30} = \frac{2}{15}\).

Step 3: Calculate new profit-sharing ratios:

- Mita's new share = \(\frac{3}{6} + \frac{1}{30} = \frac{15}{30} + \frac{1}{30} = \frac{16}{30} = \frac{8}{15}\).

- Veena's new share = \(\frac{2}{6} + \frac{4}{30} = \frac{10}{30} + \frac{4}{30} = \frac{14}{30} = \frac{7}{15}\).

The new profit-sharing ratio between Mita and Veena is \(8 : 7\).

Quick Tip: When a retiring partner's share is distributed, the additional shares are calculated based on the specified ratio and added to the remaining partners’ shares to determine the new ratio.

Alfa Ltd. invited applications for 50,000 equity shares of Rs.10 each at a premium of 30%. The whole amount was payable on application. Applications were received for 2,50,000 shares. The company decided to allot the shares on a pro-rata basis to all the applicants. The amount refunded by the company was:

View Solution

Step 1: Understand the pro-rata allotment.

The company invited applications for 50,000 equity shares, but applications were received for 2,50,000 shares. Hence, the pro-rata allotment ratio is: \[ Pro-rata ratio = \frac{Shares Allotted}{Shares Applied} = \frac{50,000}{2,50,000} = \frac{1}{5}. \]

This means for every 5 shares applied, only 1 share was allotted.

Step 2: Calculate the total amount received on applications.

The application money for each share is \(Rs.10 + Rs.3\) (premium) = \(Rs.13\). The total amount received for 2,50,000 shares is: \[ Total Amount Received = 2,50,000 \times 13 = Rs.32,50,000. \]

Step 3: Calculate the amount retained by the company.

Since 50,000 shares were allotted, the company retained application money for only these shares. The total amount retained is: \[ Amount Retained = 50,000 \times 13 = Rs.6,50,000. \]

Step 4: Calculate the amount refunded.

The amount refunded to the applicants is the difference between the total amount received and the amount retained: \[ Amount Refunded = Total Amount Received - Amount Retained. \]

Substituting the values: \[ Amount Refunded = Rs.32,50,000 - Rs.6,50,000 = Rs.26,00,000. \]

Step 5: Finalize the refund amount.

The amount refunded by the company is \(Rs.26,00,000\). Quick Tip: For pro-rata allotments, refunds are based on the application price for shares not allotted.

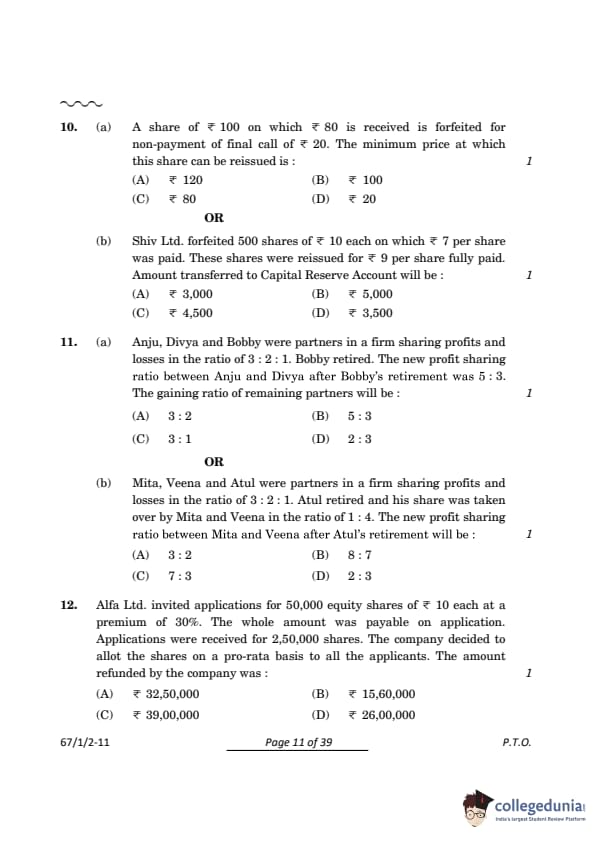

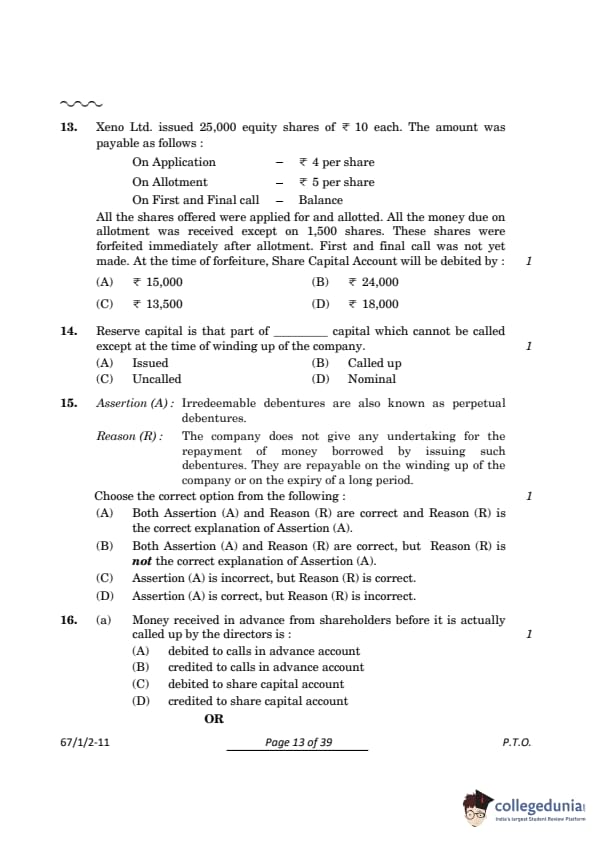

Xeno Ltd. issued 25,000 equity shares of Rs.10 each. The amount was payable as follows:

On Application – Rs.4 per share

On Allotment – Rs.5 per share

On First and Final Call – Balance

All the shares offered were applied for and allotted. All the money due on allotment was received except on 1,500 shares. These shares were forfeited immediately after allotment. First and final call was not yet made. At the time of forfeiture, Share Capital Account will be debited by:

View Solution

Step 1: Determine the called-up capital:

Face value of shares = Rs.10. Called-up capital = Application (Rs.4) + Allotment (Rs.5) = Rs.9.

Step 2: Forfeiture of shares:

Shares forfeited = 1,500. Total amount debited to Share Capital Account = 1,500 × Rs.10 = Rs.15,000. Quick Tip: In share forfeiture, the Share Capital Account is debited with the called-up amount on forfeited shares.

Reserve capital is that part of _____ capital which cannot be called except at the time of winding up of the company.

View Solution

Step 1: Understand reserve capital:

Reserve capital refers to the uncalled portion of the subscribed capital that is earmarked for use only in case of company liquidation.

Step 2: Purpose of reserve capital:

It acts as a safeguard for creditors during the winding-up process. Quick Tip: Reserve capital is a part of uncalled capital that provides financial security to creditors during liquidation.

Assertion (A): Irredeemable debentures are also known as perpetual debentures.

Reason (R): The company does not give any undertaking for the repayment of money borrowed by issuing such debentures. They are repayable on the winding up of the company or on the expiry of a long period.

View Solution

Step 1: Understand irredeemable debentures:

These are long-term debentures without a fixed maturity date.

Step 2: Explanation of the reason:

Repayment of these debentures is either on winding up or as specified by the company after a long duration. Quick Tip: Irredeemable debentures are perpetual liabilities and are repayable only under specific circumstances like winding up.

(a) Money received in advance from shareholders before it is actually called up by the directors is:

View Solution

Step 1: Definition of calls in advance:

Calls in advance refer to the amount received from shareholders before the call is made by the company’s directors.

Step 2: Accounting treatment:

This amount is considered a liability until the call is made and is credited to the Calls in Advance Account. Quick Tip: Calls in advance are recorded as a liability because the company owes this amount back to shareholders until the call is made.

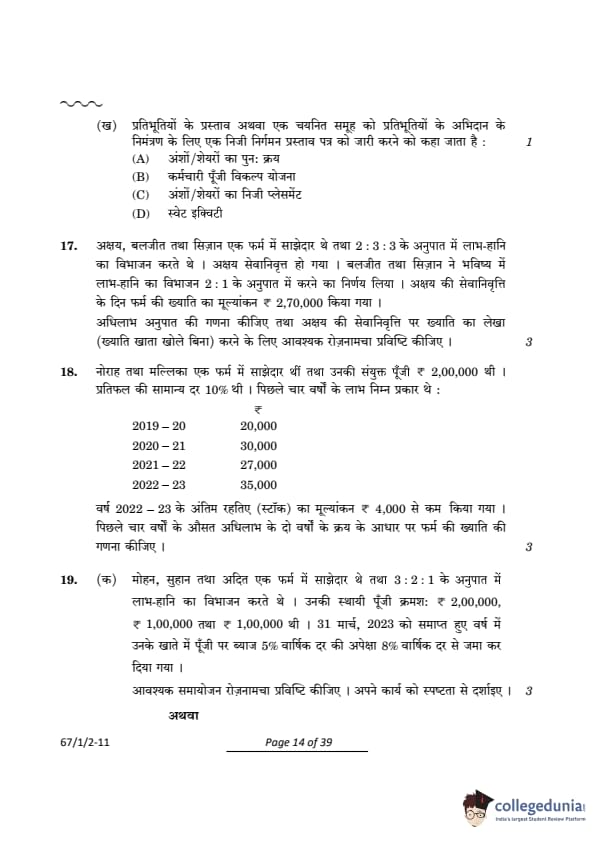

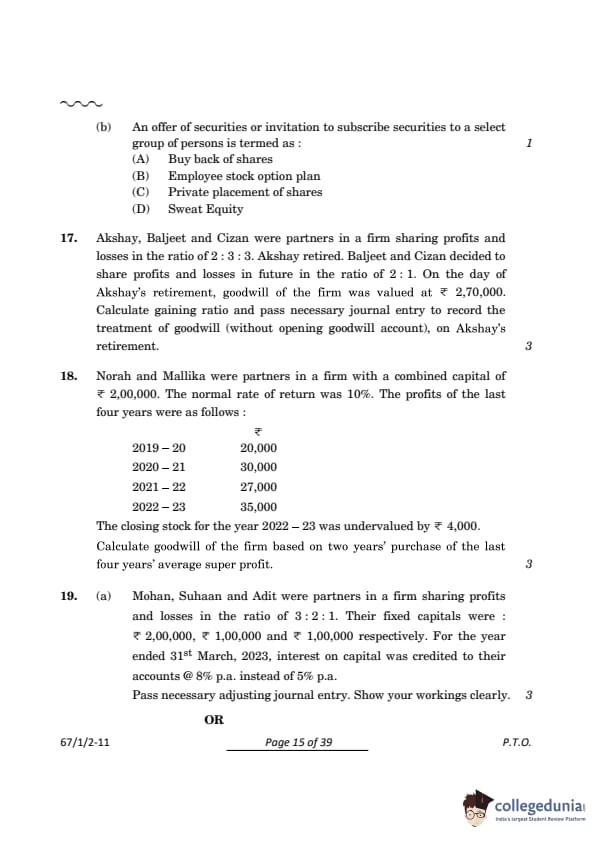

Akshay, Baljeet and Cizan were partners in a firm sharing profits and losses in the ratio of \(2:3:3\). Akshay retired. Baljeet and Cizan decided to share profits and losses in the future in the ratio of \(2:1\). On the day of Akshay’s retirement, goodwill of the firm was valued at Rs.2,70,000. Calculate gaining ratio and pass necessary journal entry to record the treatment of goodwill (without opening goodwill account), on Akshay’s retirement.

View Solution

Step 1: Calculate the gaining ratio.

The old profit-sharing ratio is \( 2:3:3 \), and the new profit-sharing ratio between Baljeet and Cizan is \( 2:1 \).

The calculation of the gaining ratio is as follows: \[ Gaining Ratio = New Ratio - Old Ratio (for remaining partners) \]

For Baljeet: \[ New Ratio = \frac{2}{3}, \quad Old Ratio = \frac{3}{8} \quad \Rightarrow \quad Gain = \frac{2}{3} - \frac{3}{8} = \frac{16}{24} - \frac{9}{24} = \frac{7}{24}. \]

For Cizan: \[ New Ratio = \frac{1}{3}, \quad Old Ratio = \frac{3}{8} \quad \Rightarrow \quad Gain = \frac{1}{3} - \frac{3}{8} = \frac{8}{24} - \frac{9}{24} = \frac{-1}{24}. \]

Step 2: Treatment of goodwill.

The goodwill of the firm is Rs.2,70,000. Akshay’s share of goodwill is: \[ Goodwill Share = \frac{2}{8} \times 2,70,000 = Rs.67,500. \]

The journal entry to record the goodwill treatment is as follows: \[ Baljeet’s Capital A/c Dr. Rs.45,000 \] \[ Cizan’s Capital A/c Dr. Rs.22,500 \] \[ To Akshay’s Capital A/c Rs.67,500 \]

Quick Tip: The gaining ratio is used to adjust goodwill on the retirement of a partner. Ensure that the entries reflect the amount credited to the retiring partner proportionately from the gaining partners' accounts.

Norah and Mallika were partners in a firm with a combined capital of Rs.2,00,000. The normal rate of return was 10%. The profits of the last four years were as follows:

The closing stock for the year 2022-23 was undervalued by Rs.4,000. Calculate goodwill of the firm based on two years' purchase of the last four years' average super profit.

View Solution

Step 1: Adjust the profits for 2022-23.

The profits for the year 2022-23 were undervalued by Rs.4,000. Hence, the adjusted profit for 2022-23 is:

\[ Adjusted Profit for 2022-23 = Rs.35,000 + Rs.4,000 = Rs.39,000. \]

Step 2: Calculate the average profit for the last four years.

\[ Average Profit = \frac{Sum of Adjusted Profits}{Number of Years} \] \[ Sum of Adjusted Profits = Rs.20,000 + Rs.30,000 + Rs.27,000 + Rs.39,000 = Rs.1,16,000 \] \[ Average Profit = \frac{Rs.1,16,000}{4} = Rs.29,000. \]

Step 3: Calculate the normal profit.

The normal profit is calculated as:

\[ Normal Profit = Capital Employed \times Normal Rate of Return \] \[ Normal Profit = Rs.2,00,000 \times 10% = Rs.20,000. \]

Step 4: Calculate the super profit.

\[ Super Profit = Average Profit - Normal Profit \] \[ Super Profit = Rs.29,000 - Rs.20,000 = Rs.9,000. \]

Step 5: Calculate goodwill.

Goodwill is based on two years' purchase of the super profit:

\[ Goodwill = 2 \times Super Profit \] \[ Goodwill = 2 \times Rs.9,000 = Rs.18,000. \]

Final Answer: The goodwill of the firm is Rs.18,000.

Quick Tip: To calculate goodwill using the super profit method, follow these steps:

1. Adjust profits for any discrepancies.

2. Find the average profit over the given period.

3. Subtract the normal profit from the average profit to get super profit.

4. Multiply the super profit by the number of years' purchase to find goodwill.

(a) Mohan, Suhaan, and Adit were partners in a firm sharing profits and losses in the ratio of \( 3:2:1 \). Their fixed capitals were: Rs.2,00,000, Rs.1,00,000, and Rs.1,00,000, respectively. For the year ended 31st March 2023, interest on capital was credited to their accounts @8% p.a. instead of 5% p.a. Pass necessary adjusting journal entry. Show your workings clearly.

View Solution

Step 1: Calculate the difference in interest on capital.

The excess interest on capital credited to the partners’ accounts is calculated as follows:

\[ Excess Rate of Interest = 8% - 5% = 3%. \]

Mohan's Capital: \( Rs.2,00,000 \times 3% = Rs.6,000 \).

Suhaan's Capital: \( Rs.1,00,000 \times 3% = Rs.3,000 \).

Adit's Capital: \( Rs.1,00,000 \times 3% = Rs.3,000 \).

Step 2: Pass the adjusting journal entry.

Explanation: The excess interest credited to the partners’ accounts is debited, and the Profit and Loss Adjustment Account is credited to rectify the error. Quick Tip: When calculating interest on capital, ensure the correct rate is applied. Any discrepancies are adjusted through the Profit and Loss Adjustment Account.

(b) Manoj and Nitin were partners in a firm sharing profits and losses in the ratio of \( 2:1 \). On 31st March 2023, the balances in their capital accounts after making adjustments for profits and drawings were Rs.90,000 and Rs.80,000, respectively. The net profit for the year ended 31st March 2023 amounted to Rs.30,000. During the year, Manoj withdrew Rs.40,000 and Nitin withdrew Rs.20,000. Subsequently, it was noticed that interest on capital @10% p.a. was not provided to the partners. Also, interest on drawings to Manoj Rs.3,000 and to Nitin Rs.2,000 was not charged. Pass necessary adjusting journal entry. Show your workings clearly.

Step 1: Calculate the interest on capital.

• Manoj’s Interest on Capital: Rs 90, 000 × 10% = 9, 000.

• Nitin’s Interest on Capital: 80, 000 × 10% = 8, 000.

Step 2: Adjust for interest on drawings.

• Manoj’s Interest on Drawings: 3,000.

• Nitin’s Interest on Drawings: 2,000.

Step 3: Net adjustment to the partners’ accounts.

• Manoj: 9, 000 − 3, 000 = 6, 000 (net credit).

• Nitin: 8, 000 − 2, 000 = 6, 000 (net credit).

Step 4: Pass the adjusting journal entry

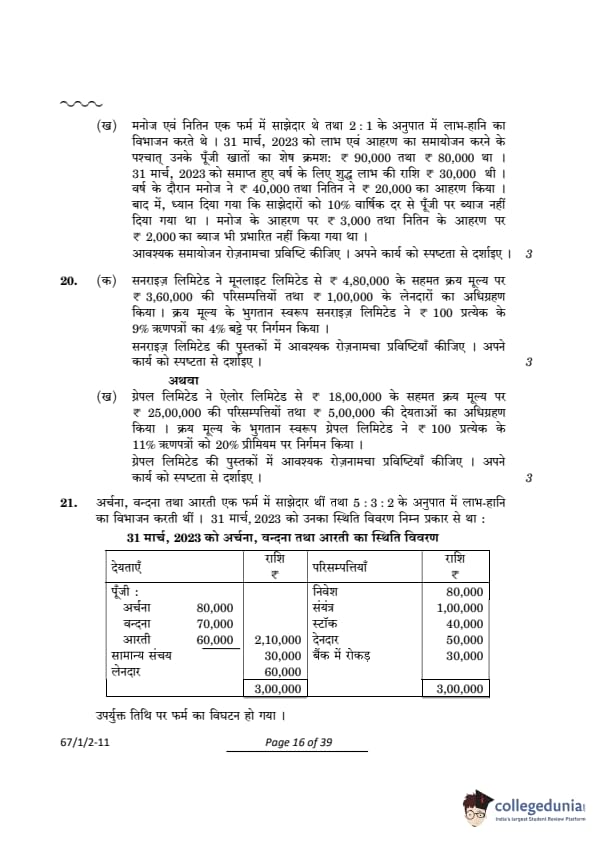

Sunrise Ltd. acquired assets of Rs.3,60,000 and took over creditors of Rs.1,00,000 from Moonlight Ltd. for an agreed purchase consideration of Rs.4,80,000. Sunrise Ltd. issued 9% Debentures of Rs.100 each at a discount of 4% in satisfaction of the purchase consideration. Pass necessary journal entries in the books of Sunrise Ltd.

View Solution

Step 1: Calculate the issue price of debentures:

- Face value of each debenture = Rs.100.

- Discount = \(4%\) of Rs.100 = Rs.4.

- Issue price = Rs.100 - Rs.4 = Rs.96 per debenture.

Step 2: Calculate the number of debentures to be issued: \[ Number of Debentures to be Issued = \frac{Purchase Consideration}{Issue Price} = \frac{Rs.4,80,000}{Rs.96} = 5,000 debentures. \]

Step 3: Journal entries in the books of Sunrise Ltd.:

Quick Tip: When debentures are issued at a discount, the total discount is debited to the "Discount on Issue of Debentures" account and written off over the debenture's tenure.

(b) Grapple Ltd. took over assets of Rs.25,00,000 and liabilities of Rs.5,00,000 from Allore Ltd. for an agreed purchase consideration of Rs.18,00,000. Grapple Ltd. issued 11% Debentures of Rs.100 each at 20% premium in satisfaction of the purchase consideration. Pass necessary journal entries in the books of Grapple Ltd.

View Solution

Step 1: Calculate the issue price of debentures:

- Face value of each debenture = Rs.100.

- Premium = \(20%\) of Rs.100 = Rs.20.

- Issue price = Rs.100 + Rs.20 = Rs.120 per debenture.

Step 2: Calculate the number of debentures to be issued:

\[ Number of Debentures to be Issued = \frac{Purchase Consideration}{Issue Price} = \frac{Rs.18,00,000}{Rs.120} = 15,000 debentures. \]

Step 3: Journal entries in the books of Grapple Ltd.:

Quick Tip: Premium on debenture issues is credited to the "Securities Premium" account and shown under "Reserves and Surplus" in the Balance Sheet.

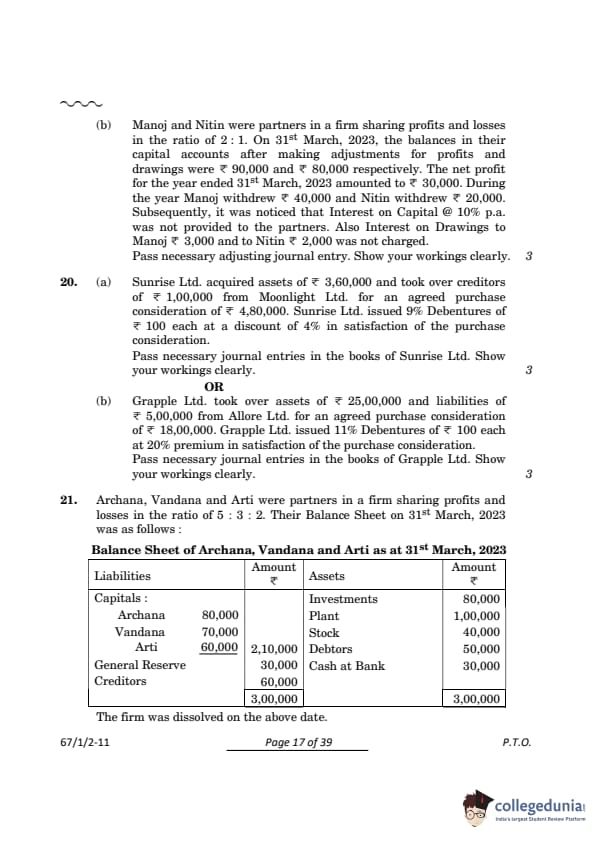

Archana, Vandana, and Arti were partners in a firm sharing profits and losses in the ratio \(5 : 3 : 2\). Their Balance Sheet as at 31st March, 2023, was as follows:

The firm was dissolved on the above date under the following terms:

View Solution

Step 1: Calculate Realisation from Assets and Investments

- Debtors realised Rs.40,000.

- Stock realised Rs.50,000.

- Plant realised Rs.60,000.

- Vandana took \(25%\) of investments = \(\frac{25}{100} \times 80,000 = 20,000\).

She paid Rs.18,000.

- Remaining \(75%\) investments = Rs.60,000.

Archana took these at \(10%\) less = \(60,000 - 6,000 = 54,000.\)

Step 2: Total Realisations: \[ Total = Debtors + Stock + Plant + Vandana + Archana = Rs.40,000 + Rs.50,000 + Rs.60,000 + Rs.18,000 + Rs.54,000 = Rs.2,22,000. \]

Step 3: Deduct Realisation Expenses and Liabilities:

- Realisation expenses = Rs.20,000.

- Creditors paid = Rs.60,000.

Step 4: Calculate Realisation Profit: \[ Profit = Total Realisation - (Expenses + Liabilities). \] \[ Profit = Rs.2,22,000 - (Rs.20,000 + Rs.60,000) = Rs.42,000. \]

Step 5: Share Profit in the Ratio \(5 : 3 : 2\):

- Archana’s share = \(\frac{5}{10} \times 42,000 = Rs.21,000.\)

- Vandana’s share = \(\frac{3}{10} \times 42,000 = Rs.12,600.\)

- Arti’s share = \(\frac{2}{10} \times 42,000 = Rs.8,400.\)

Quick Tip: In Realisation Accounts, all liabilities settled and realisation expenses are debited, while asset realisation is credited. Profit or loss is transferred to partners’ capital accounts in their profit-sharing ratio.

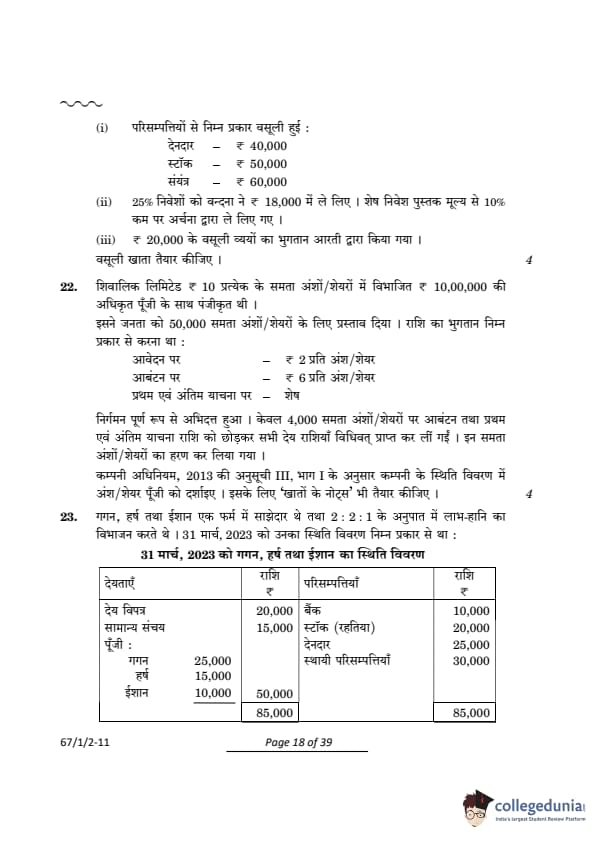

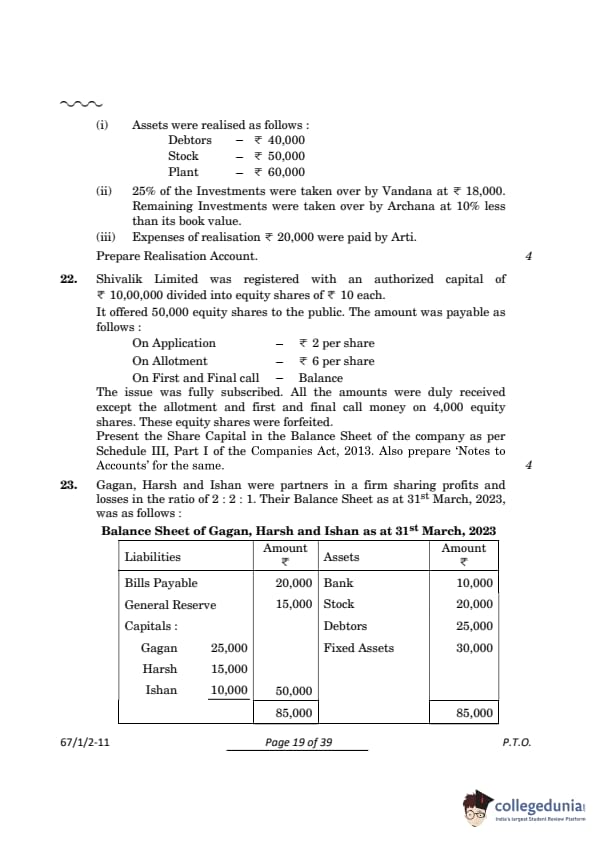

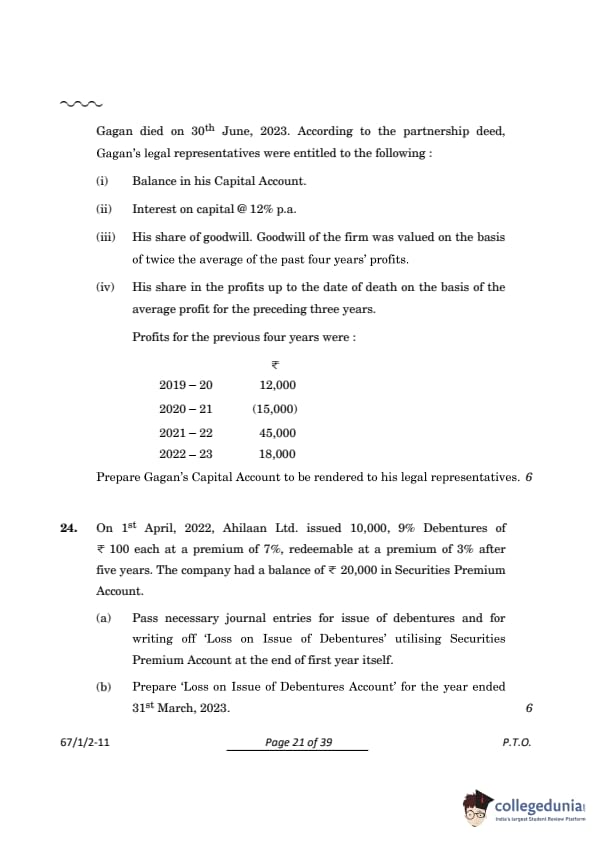

Gagan, Harsh, and Ishan were partners in a firm sharing profits and losses in the ratio of \( 2:2:1 \). Their Balance Sheet as at 31st March, 2023, was as follows:

Gagan died on 30th June, 2023. According to the partnership deed, Gagan’s legal representatives were entitled to the following:

View Solution

Step 1: Calculate the balance in Gagan’s Capital Account.

From the balance sheet, Gagan’s capital is Rs.25,000.

Step 2: Calculate interest on capital.

Interest is provided at 12% p.a. for the period from 1st April 2023 to 30th June 2023 (3 months):

\[ Interest on Capital = Capital \times Rate \times \frac{Time}{12} \] \[ Interest on Capital = Rs.25,000 \times 12% \times \frac{3}{12} = Rs.750. \]

Step 3: Calculate Gagan’s share of goodwill.

Goodwill of the firm is based on twice the average of the past four years’ profits.

\[ Average Profit = \frac{Sum of Profits}{Number of Years} \] \[ Sum of Profits = Rs.12,000 - Rs.15,000 + Rs.45,000 + Rs.18,000 = Rs.60,000 \] \[ Average Profit = \frac{Rs.60,000}{4} = Rs.15,000 \] \[ Goodwill of the Firm = 2 \times Average Profit = 2 \times Rs.15,000 = Rs.30,000. \]

Gagan’s share of goodwill (2/5):

\[ Gagan’s Share of Goodwill = Rs.30,000 \times \frac{2}{5} = Rs.12,000. \]

Step 4: Calculate Gagan’s share of profit up to the date of death.

The profit up to the date of death is based on the average profit of the preceding three years.

\[ Average Profit (Last 3 Years) = \frac{Profits for 2020-21, 2021-22, 2022-23}{3} \] \[ Sum of Profits = -Rs.15,000 + Rs.45,000 + Rs.18,000 = Rs.48,000 \] \[ Average Profit = \frac{Rs.48,000}{3} = Rs.16,000. \]

Profit up to the date of death (3 months):

\[ Profit for 3 Months = Rs.16,000 \times \frac{3}{12} = Rs.4,000. \]

Gagan’s share of this profit (2/5):

\[ Gagan’s Share of Profit = Rs.4,000 \times \frac{2}{5} = Rs.1,600. \]

Step 5: Prepare Gagan’s Capital Account.

Final Answer: The amount payable to Gagan’s legal representatives is Rs.39,350.

Quick Tip: For deceased partners, always account for the following:

1. Balance in their capital account.

2. Interest on capital (pro rata).

3. Share of goodwill.

4. Share of profit up to the date of death (pro rata based on time or sales).

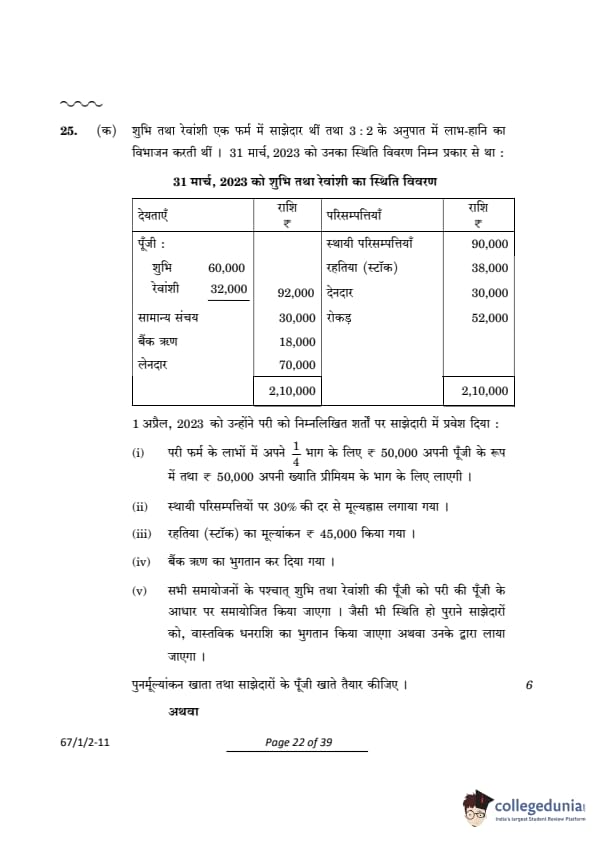

On 1st April, 2022, Ahilaan Ltd. issued 10,000, 9% Debentures of Rs.100 each at a premium of 7%, redeemable at a premium of 3% after five years. The company had a balance of Rs.20,000 in Securities Premium Account.

View Solution

Step 1: Calculate the amounts involved.

Nominal value of debentures: Rs.10,000 \times Rs.100 = Rs.10,00,000.

Premium on issue: Rs.10,00,000 \times 7% = Rs.70,000.

Premium on redemption: Rs.10,00,000 \times 3% = Rs.30,000.

Loss on issue of debentures: Premium on redemption - Premium on issue = Rs.30,000 - Rs.70,000 = Rs.30,000.

Step 2: Journal entries.

Quick Tip: When issuing debentures at a premium or redeeming them at a premium, always calculate the loss or gain carefully. Use Securities Premium first to write off any loss, and charge the remaining amount to Profit and Loss A/c.

(b) Prepare ‘Loss on Issue of Debentures Account’ for the year ended 31st March, 2023.

View Solution

Step 3: Loss on Issue of Debentures Account for the year ended 31st March, 2023.

The journal entries for the issue of debentures and writing off the ‘Loss on Issue of Debentures’ are passed, and the ‘Loss on Issue of Debentures Account’ is balanced as shown above.

Quick Tip: When issuing debentures at a premium or redeeming them at a premium, always calculate the loss or gain carefully. Use Securities Premium first to write off any loss, and charge the remaining amount to Profit and Loss A/c.

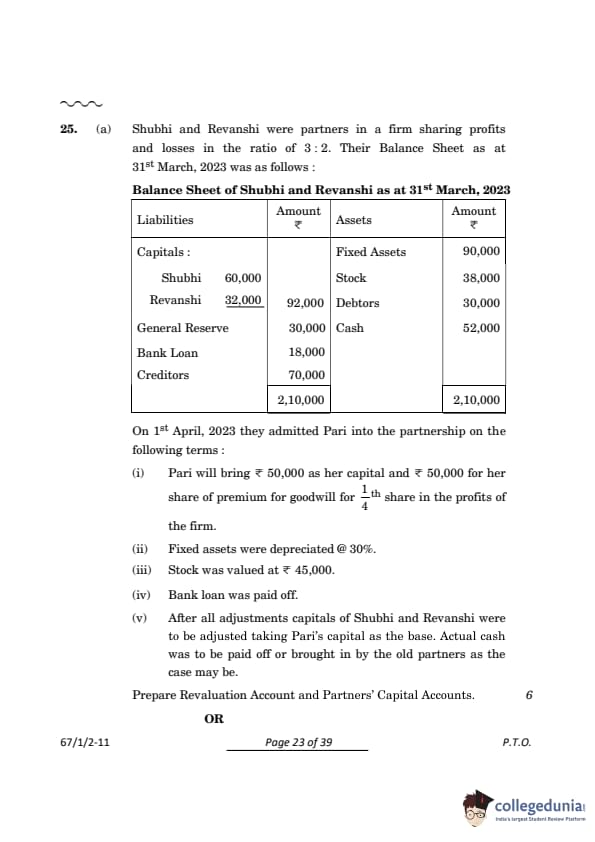

(a) Shubhi and Revanshi were partners in a firm sharing profits and losses in the ratio of \(3 : 2\). Their Balance Sheet as at 31st March, 2023, was as follows:

Adjustments:

View Solution

Step 1: Revaluation of Assets and Liabilities \[ Depreciation on Fixed Assets = 30% of Rs.90,000 = Rs.27,000. \] \[ Increase in Stock Value = Rs.45,000 - Rs.38,000 = Rs.7,000. \] \[ Net Loss on Revaluation = Rs.27,000 - Rs.7,000 = Rs.20,000. \] \[ Revaluation Loss Shared in Ratio \(3 : 2\): \quad Shubhi = Rs.12,000, \quad Revanshi = Rs.8,000. \]

Step 2: Goodwill Adjustment \[ Pari’s Share in Profits = \frac{1}{4}, \quad Remaining Share = \frac{3}{4}. \] \[ Total Goodwill = Rs.50,000 (Pari’s Contribution) \times 4 = Rs.2,00,000. \] \[ Shubhi’s Share = \(\frac{3{5}\) of Rs.1,50,000 = Rs.90,000}. \] \[ Revanshi’s Share = \(\frac{2{5}\) of Rs.1,50,000 = Rs.60,000}. \] \[ Premium for Goodwill Shared: Shubhi = Rs.30,000, \quad Revanshi = Rs.20,000. \]

Step 3: Capital Adjustment Based on Pari’s Capital \[ Pari’s Capital = Rs.50,000 (After Goodwill Adjustment). \] \[ Capitals of Shubhi and Revanshi Adjusted to Match Pari’s Capital Proportionately. \]

Revaluation Account:

Partners’ Capital Accounts:

Explanation:

1. Revaluation Account: Loss on fixed assets and gain on stock were adjusted. Net revaluation loss of Rs.20,000 was shared in the old profit-sharing ratio \(3 : 2\).

2. Goodwill Adjustment: Pari’s contribution for goodwill was credited to Shubhi and Revanshi in their sacrificing ratio \(3 : 2\).

3. Capital Adjustment: Capitals of Shubhi and Revanshi were adjusted proportionately based on Pari’s capital. Quick Tip: Always adjust goodwill contributions and revaluation results before determining the final capital balances of the partners.

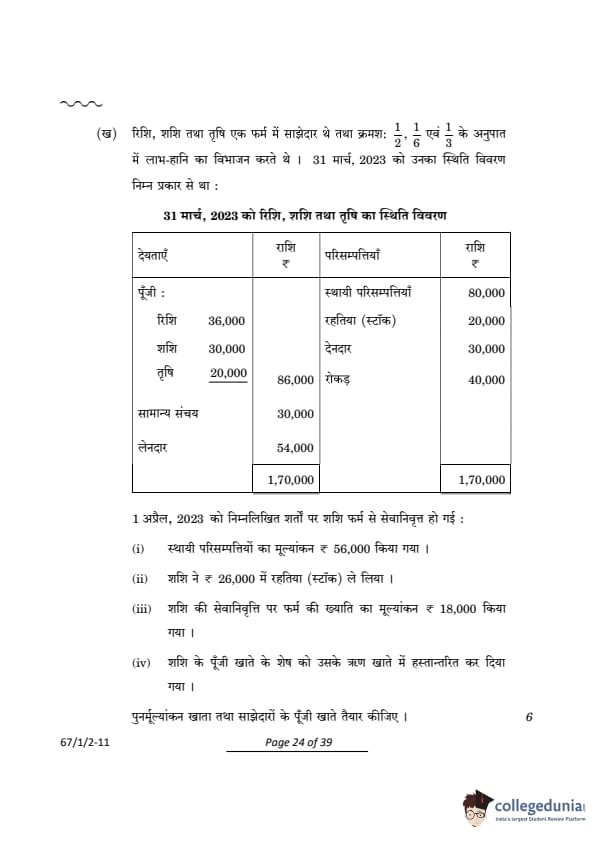

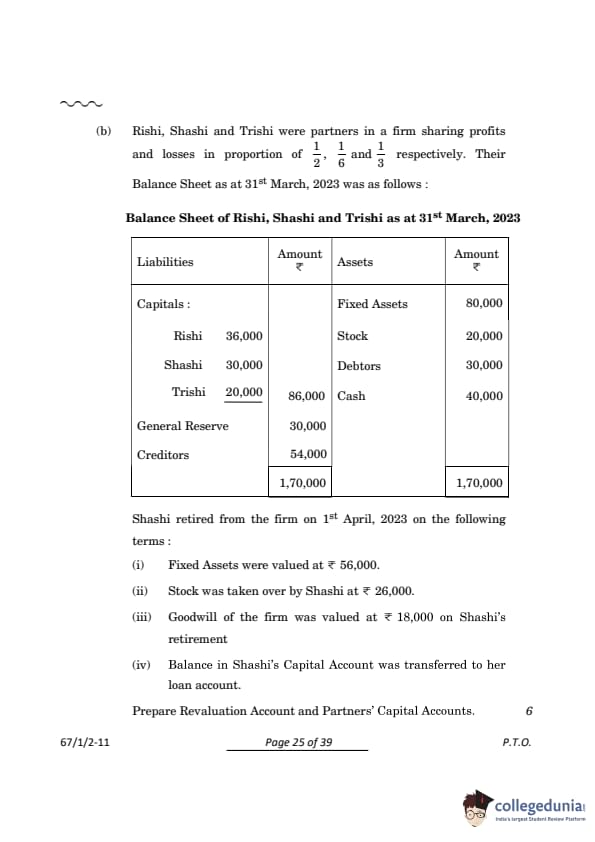

(b) Rishi, Shashi, and Trishi were partners in a firm sharing profits and losses in proportion of \( \frac{1}{2} \), \( \frac{1}{6} \), and \( \frac{1}{3} \), respectively. Their Balance Sheet as at 31st March, 2023, was as follows:

Shashi retired from the firm on 1st April, 2023, on the following terms:

View Solution

Revaluation Account:

Partners’ Capital Accounts:

Final Answer: The Revaluation Account and Partners’ Capital Accounts are prepared as shown above.

Quick Tip: In retirement of a partner: 1. Adjust revaluation of assets and liabilities through the Revaluation Account.

2. Distribute goodwill among continuing partners in their gaining ratio.

3. Transfer retiring partner’s capital to a loan account, if not paid off immediately.

(a) Qumtan Ltd. invited applications for issuing 1,00,000 equity shares of Rs.10 each at a premium of Rs.6 per share. The amount was payable as follows:

On Application and Allotment: Rs.8 per share (including premium Rs.3).

On First and Final Call: Balance (including premium).

Additional Information:

Applications for 1,60,000 shares were received. Applications for 10,000 shares were rejected, and pro-rata allotment was made to the remaining applicants. Excess money received on application was returned. Dheeraj, who was allotted 200 shares, failed to pay the first and final call money. His shares were forfeited and reissued at Rs.5 per share fully paid-up.

View Solution

Step 1: Calculation of Total Application Money Received \[ Total Shares Applied = 1,60,000, \quad Application Money per Share = Rs.8. \] \[ Total Money Received on Application = 1,60,000 \times Rs.8 = Rs.12,80,000. \]

Step 2: Refund for Rejected Shares \[ Shares Rejected = 10,000, \quad Refund Amount = 10,000 \times Rs.8 = Rs.80,000. \]

Step 3: Pro-rata Allotment and Adjustments \[ Shares Allotted = 1,00,000, \quad Excess Money Adjusted Toward Call. \]

Step 4: Forfeiture and Reissue

Dheeraj failed to pay the first and final call for 200 shares. \[ Unpaid Amount (per share) = Face Value + Premium - Amount Already Paid. \] \[ Unpaid = (Rs.10 + Rs.6 - Rs.8) = Rs.8 per share. \] \[ Forfeited Shares = 200, \quad Total Unpaid = 200 \times Rs.8 = Rs.1,600. \]

Shares reissued at Rs.5 per share fully paid.

Journal Entries in the Books of Qumtan Ltd.:

Quick Tip: In pro-rata allotments, adjust the excess application money received toward future dues like allotment and calls. Refund amounts only for fully rejected shares.

(b) Printkit Limited invited applications for issue of 80,000 equity shares of Rs.10 each. The amount was payable as follows:

On Application: Rs.3 per share

On Allotment: Rs.2 per share

On First and Final Call: Balance

Additional Information:

Applications for 1,50,000 shares were received. Applications for 10,000 shares were rejected, and pro-rata allotment was made to the remaining applicants as follows:

- Category A: Applicants for 80,000 shares were allotted 40,000 shares.

- Category B: Applicants for 60,000 shares were allotted 40,000 shares.

Excess money received on application was adjusted toward the amount due on allotment and first and final call. All the amounts due on allotment and first and final call were duly received.

View Solution

Step 1: Calculation of Application Money Received \[ Total Shares Applied = 1,50,000, \quad Application Money per Share = Rs.3. \] \[ Total Money Received on Application = 1,50,000 \times Rs.3 = Rs.4,50,000. \]

Step 2: Refund for Rejected Applications \[ Shares Rejected = 10,000, \quad Refund Amount = 10,000 \times Rs.3 = Rs.30,000. \]

Step 3: Pro-rata Allotment and Adjustments

Category A: 80,000 applicants were allotted 40,000 shares (ratio \(2:1\)). Excess money = \(80,000 - 40,000 = 40,000\) shares × Rs.3 = Rs.1,20,000.

Category B: 60,000 applicants were allotted 40,000 shares (ratio \(3:2\)). Excess money = \(60,000 - 40,000 = 20,000\) shares × Rs.3 = Rs.60,000.

Total Excess Money Adjusted: Rs.1,20,000 + Rs.60,000 = Rs.1,80,000.

Step 4: Allotment Money Due and Received \[ Allotment Money per Share = Rs.2, \quad Shares Allotted = 80,000. \] \[ Allotment Money Due = 80,000 \times Rs.2 = Rs.1,60,000. \]

\[ Excess Money Adjusted = Rs.1,80,000 > Allotment Due (Rs.1,60,000). \] \[ Excess Remaining After Allotment = Rs.1,80,000 - Rs.1,60,000 = Rs.20,000. \]

Step 5: First and Final Call Money Due and Received \[ Call Money per Share = Rs.5, \quad Call Money Due = 80,000 \times Rs.5 = Rs.4,00,000. \] \[ Excess Money Remaining (Rs.20,000) Adjusted Toward Call, Net Call Money Received = Rs.4,00,000 - Rs.20,000 = Rs.3,80,000. \]

Quick Tip: In pro-rata allotments, calculate excess application money separately for each category and adjust it toward allotment and calls. Only refund amounts for rejected shares.

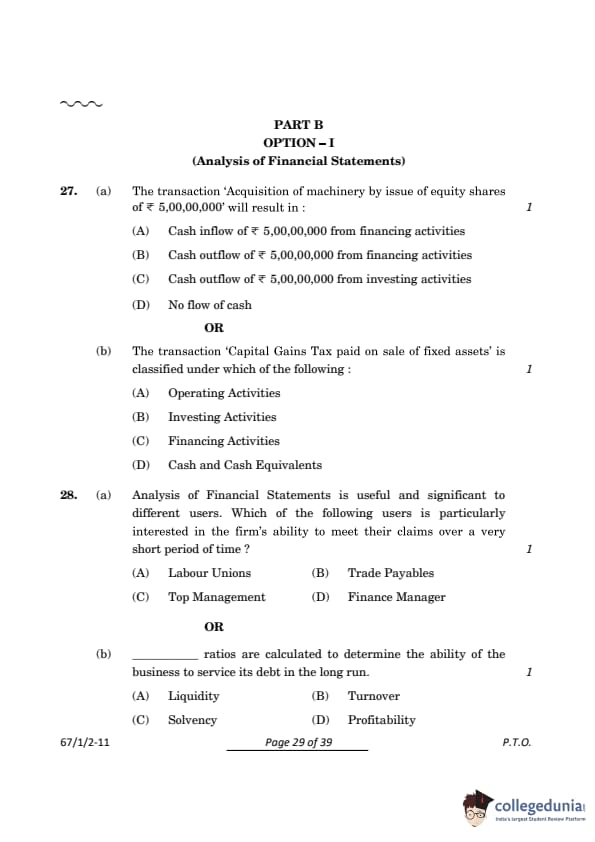

(a) The transaction ‘Acquisition of machinery by issue of equity shares of Rs.5,00,00,000’ will result in:

View Solution

This transaction represents a non-cash item. The company acquires machinery in exchange for equity shares. Since there is no movement of cash in the transaction, it does not appear in the cash flow statement.

Quick Tip: Non-cash transactions such as issuing equity shares for assets are disclosed separately in the notes to financial statements.

(b).The transaction ‘Capital Gains Tax paid on sale of fixed assets’ is classified under which of the following:

View Solution

Capital gains tax is directly related to the sale of fixed assets, which is categorized under investing activities. The payment of such tax reduces the cash inflow generated from the investing activity.

Quick Tip: All cash flows associated with the purchase or sale of fixed assets, including related taxes, are classified under investing activities in the cash flow statement.

(a).Analysis of Financial Statements is useful and significant to different users. Which of the following users is particularly interested in the firm’s ability to meet their claims over a very short period of time?

View Solution

Trade payables are suppliers who provide goods and services on credit. They are interested in the company’s liquidity, as it determines the firm’s ability to repay its short-term liabilities promptly.

Quick Tip: Key liquidity ratios like Current Ratio and Quick Ratio are used to assess the firm’s ability to meet short-term obligations.

(b).______ ratios are calculated to determine the ability of the business to service its debt in the long run.

View Solution

Solvency ratios like Debt-to-Equity Ratio and Interest Coverage Ratio measure the ability of a business to meet its long-term debt obligations. They provide insights into the firm’s financial stability over the long term.

Quick Tip: Solvency ratios are crucial for creditors and investors to evaluate the risk of long-term investments in the company.

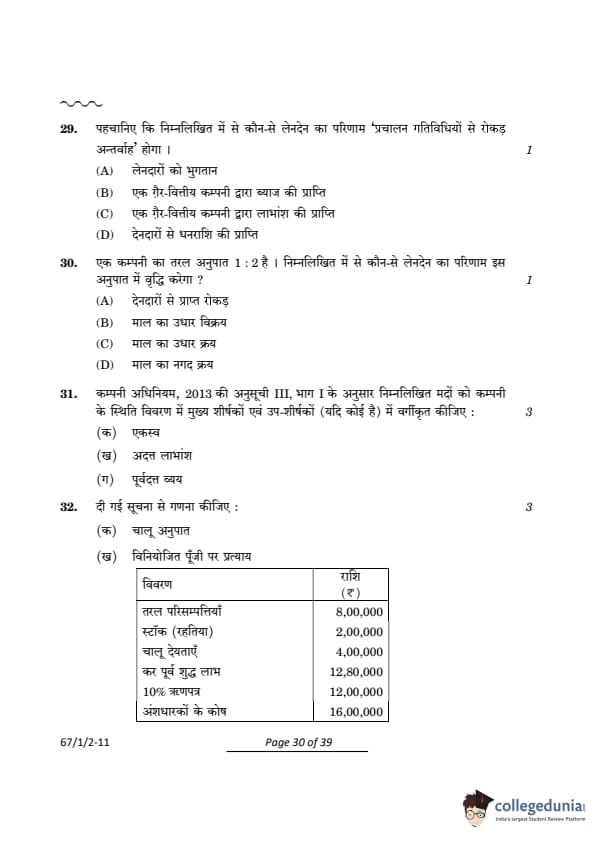

Identify which of the following transactions will result in ‘Cash Inflow From Operating Activities’:

View Solution

Cash inflows from operating activities arise from the principal revenue-generating activities of a business. Receiving cash from debtors represents the collection of amounts from customers, which is a core operating activity.

Quick Tip: The classification of cash flows depends on the nature of the business. For non-financial companies, interest and dividend income are investing activities.

The Quick Ratio of a company is \(1 : 2\). Which of the following transactions will result in an increase of this ratio?

View Solution

The Quick Ratio is calculated as:

\[ Quick Ratio = \frac{Quick Assets}{Current Liabilities} \]

Selling goods on credit increases quick assets (accounts receivable) without impacting current liabilities, thereby increasing the ratio.

Quick Tip: Quick assets include cash, marketable securities, and accounts receivable but exclude inventory and prepaid expenses.

Classify the following items under major heads and sub-heads (if any) in the Balance Sheet of the company as per Schedule III, Part I of the Companies Act, 2013:

View Solution

- Patents: Represent intangible assets, classified under Non-Current Assets in Fixed Assets.

- Unpaid Dividend: An obligation to shareholders, categorized as Current Liabilities under Other Current Liabilities.

- Prepaid Expenses: Payments made in advance for services or benefits to be received in the future, classified under Current Assets in Other Current Assets.

Quick Tip: Use Schedule III of the Companies Act, 2013, for the standard classification of assets and liabilities in financial statements.

From the given information, calculate:

View Solution

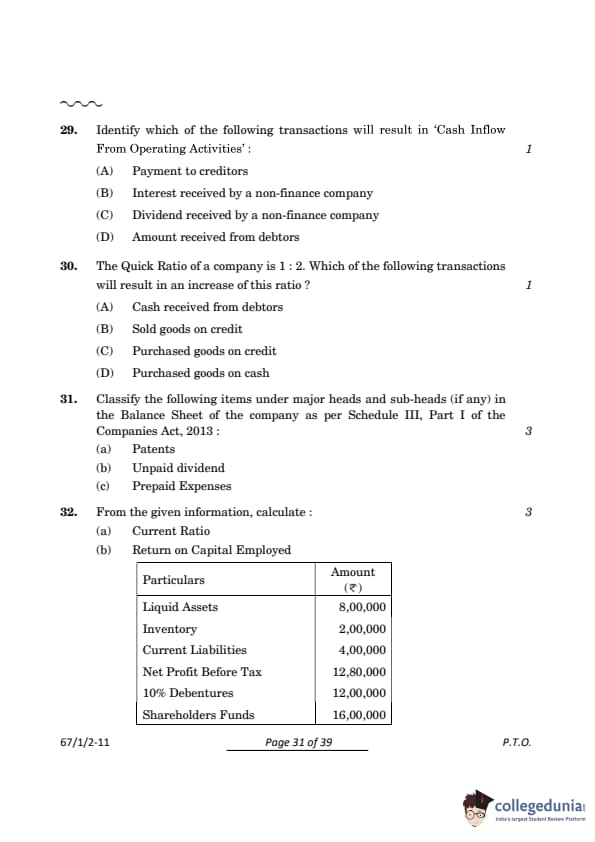

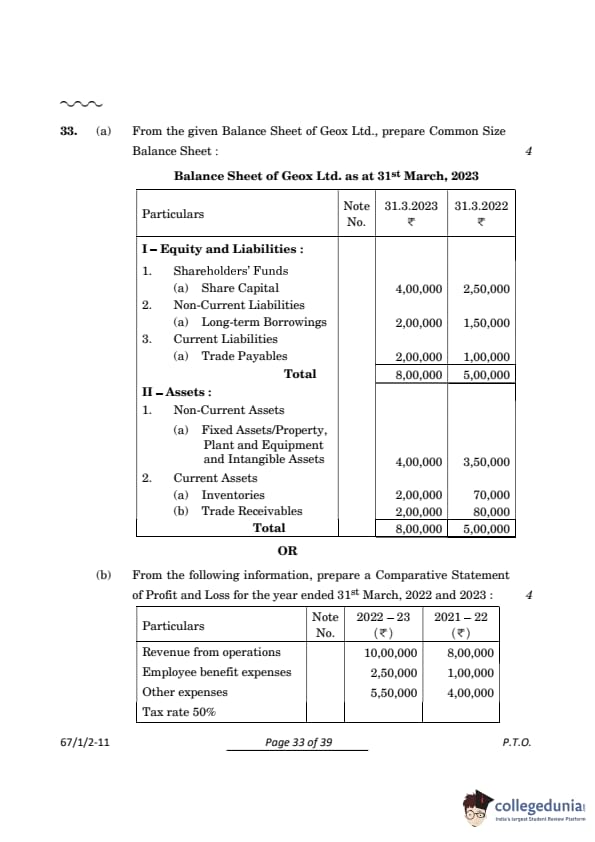

From the given Balance Sheet of Geox Ltd., prepare a Common Size Balance Sheet:

View Solution

Balance Sheet of Geox Ltd. as at 31st March, 2023 (Common Size Format):

Explanation:

1. Purpose of Common Size Statement:

- Each item in the balance sheet is expressed as a percentage of the total assets or liabilities.

- This helps in comparing the relative size of components over different years.

2. Key Observations:

- Share Capital remains constant at 50% of total funds in both years.

- Fixed Assets decreased from 70% in 2022 to 50% in 2023, while Inventories and Trade Receivables increased significantly.

Quick Tip: The common size balance sheet simplifies the comparison of financial performance over time. It identifies changes in proportions, such as shifts between current and non-current components.

(b) From the following information, prepare a Comparative Statement of Profit and Loss:

View Solution

Comparative Statement of Profit and Loss for the years ended 31st March, 2022 and 2023:

Explanation:

1. Purpose of Comparative Statement:

- Comparative financial statements show changes in absolute values and percentage changes between two periods.

- It helps in analyzing trends in revenues, expenses, and profitability.

2. Key Observations:

- Revenue and Employee Benefit Expenses both increased by 25%.

- Other Expenses increased disproportionately by 37.5%, resulting in no change in Profit After Tax (PAT).

Quick Tip: A comparative statement highlights trends and variations over time. Use the percentage change column to identify areas of concern, like disproportionate increases in expenses.

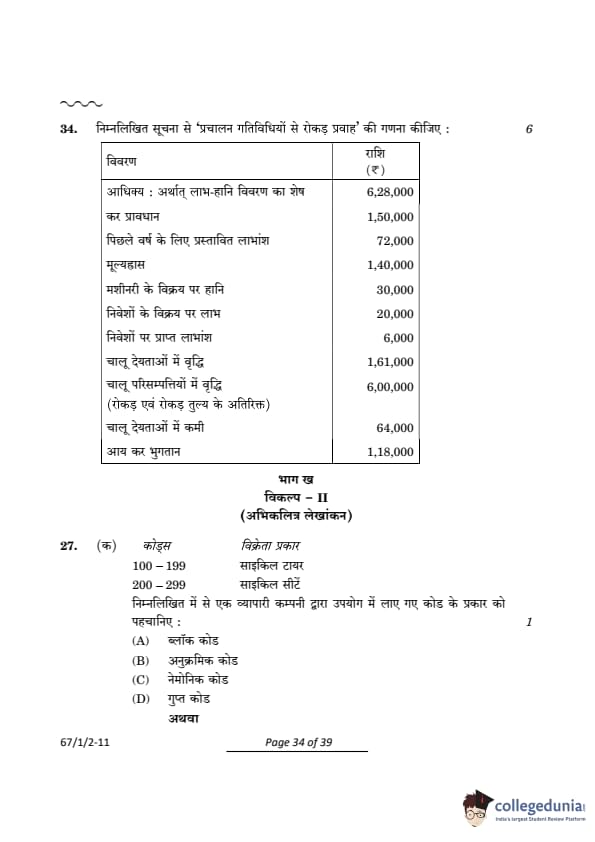

From the following information, calculate ‘Cash Flows from Operating Activities’:

View Solution

Calculation of Net Profit Before Tax and Extraordinary Items:

\[ Net Profit Before Tax and Extraordinary Items = Surplus + Provision for Tax + Proposed Dividend \] \[ = 6,28,000 + 1,50,000 + 72,000 = 8,50,000 \]

Cash Flows from Operating Activities:

Quick Tip: 1. Always start with Net Profit Before Tax for Cash Flows from Operating Activities.

2. Adjust for non-cash items (e.g., depreciation) and non-operating items (e.g., gains/losses, dividends).

3. Account for changes in working capital (current assets and liabilities).

4. Deduct taxes paid to arrive at the final cash flow.

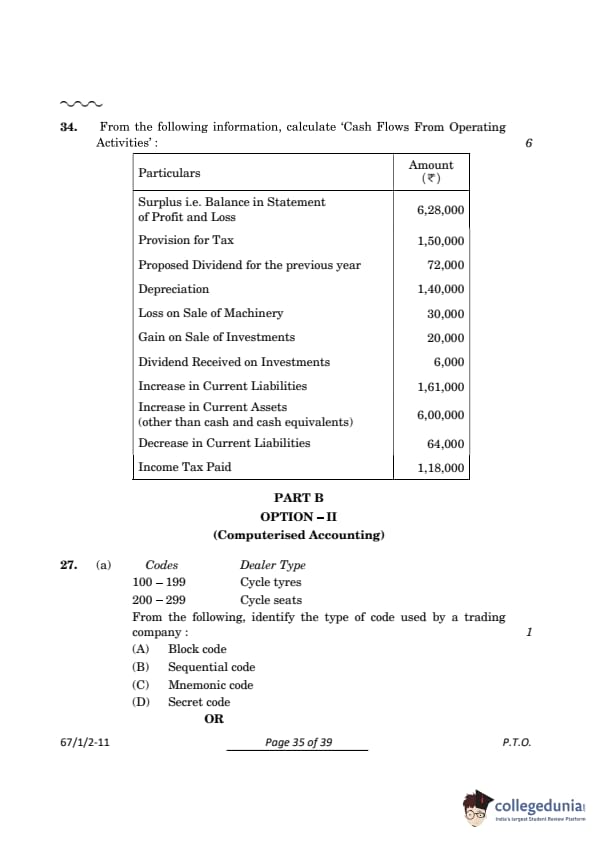

PART B (OPTIONS II)

(a)From the following, identify the type of code used by a trading company:

View Solution

Block codes group categories into distinct ranges for easier organization. For example: \[ 100–199 \rightarrow Cycle tyres, \quad 200–299 \rightarrow Cycle seats. \]

This makes data classification efficient and systematic. Quick Tip: Block codes are ideal for categorizing items into systematic ranges, ensuring streamlined organization and retrieval of data.

(b) Correct \#\#\#\#\# appears:

View Solution

The error “#####” in Excel appears when the column width is too narrow to display the content of a cell.

This happens especially with dates, large numbers, or text values that exceed the width of the column.

To resolve this issue: \[ - Increase the column width by dragging its edge or using AutoFit Column Width. \] Quick Tip: To fix the "#####" error in Excel, adjust the column width manually by dragging its edge or double-clicking the column boundary to auto-fit the content.

How many categories of data can be plotted on a pie chart in Excel software?

View Solution

Excel pie charts effectively display data for up to 7 categories. \[ - More than 7 categories make the chart cluttered and unreadable. \]

For larger datasets, bar charts or column charts are better alternatives for clarity. Quick Tip: Limit pie charts to 7 categories for clarity. Use bar or column charts for larger datasets to improve data visualization and readability.

(a) Name the Accounting Information sub-system which deals with receipt and payment of cash and electronic funds transfer:

View Solution

The Cash and Bank sub-system is responsible for managing all cash-related activities such as: \[ - Receipts from customers, \quad Payments to suppliers, \quad Electronic fund transfers (EFTs). \]

It ensures accurate recording, reconciliation of funds, and monitoring of liquidity for smooth operations. Quick Tip: The Cash and Bank sub-system is vital for managing liquid funds, ensuring that cash flows are systematically recorded and reconciled with the bank.

(b) When the accumulated data from various sources is processed in one shot, it is called:

View Solution

Batch processing refers to processing a large volume of data in one operation at a scheduled time. \[ For example: Payroll systems calculate salaries monthly using batch processing. \]

This is effective for routine tasks that don’t require immediate processing. Quick Tip: Batch processing is suited for periodic operations like payroll and billing, where immediate processing isn’t necessary, ensuring efficiency and accuracy.

Data, ______, ______, Hardware, and Software are five pillars of Computerised Accounting System (CAS). From the following, which two pillars of CAS are missing in the above statement?

View Solution

The five pillars of a Computerised Accounting System (CAS) are: \[ 1. Data, \quad 2. People, \quad 3. Procedures, \quad 4. Hardware, \quad 5. Software. \]

The missing pillars in the statement are People and Procedures, both of which are essential for the smooth functioning of CAS. Quick Tip: The five pillars of CAS—Data, People, Procedures, Hardware, and Software—together ensure seamless accounting operations and support informed decision-making.

Explain the advantages of using charts.

View Solution

Charts are essential tools in data representation and analysis due to the following advantages:

(1) Improve Data Visualization:

Charts transform raw data into visual formats like bar graphs, pie charts, or line graphs, making it easier to identify patterns, trends, and insights.

(2) Aid in Decision-Making:

Decision-makers can use charts to understand complex datasets at a glance, allowing for informed and quick decisions.

(3) Highlight Trends and Patterns:

For example, a line chart displaying sales data over the months can immediately highlight which months had peak sales and which had a decline.

(4) Easy Interpretation of Complex Data:

Charts summarize large volumes of data, making them more accessible to a diverse audience, including those without technical expertise. Quick Tip: Use the appropriate chart type (e.g., bar for comparisons, pie for proportions, and line for trends) for effective communication of data.

Explain ‘Sequential Code’ and ‘Mnemonic Code’ with the help of an example.

View Solution

Sequential Code:

This coding system involves assigning numbers in a sequence to items. It is simple and ensures uniqueness.

Example: Invoice numbers assigned as 101, 102, 103, etc. These numbers increase sequentially, allowing for chronological order.

Mnemonic Code:

Mnemonic codes use alphabets or a combination of letters and numbers to provide meaningful identifiers that are easy to remember.

Example: "HDD" for Hard Disk Drive or "CPU" for Central Processing Unit.

Comparison:

- Sequential codes are effective for maintaining chronological or numeric order.

- Mnemonic codes are useful in contexts where quick identification and memorization are needed.

Quick Tip: Mnemonic codes are ideal for systems that prioritize ease of recognition, while sequential codes are suitable for systems where order and chronology are key.

(a) State any four advantages of Computerized Accounting System.

View Solution

N/A

(b)Explain ‘Password security’ and ‘Data audit’ as security features of Computerized Accounting System.

View Solution

(b) Password Security and Data Audit:

Password Security:

Ensures that only authorized users can access the system. Passwords act as a protective barrier, safeguarding sensitive financial information from unauthorized access.

Data Audit:

Maintains a log of all changes made in the system, including the date, time, and user who made the change. This feature ensures accountability and helps track discrepancies in the records. Quick Tip: For enhanced security, implement multi-factor authentication along with password protection and ensure regular audits to identify anomalies.

Explain the two syntax forms of ‘Lookup’ function.

View Solution

The Lookup function in Excel is used to search for a value in a range and return a corresponding value. It has two forms:

(1) Vector Form:

This form searches for a value in a single row or column (vector) and returns a corresponding value from another row or column.

Syntax: \[ =LOOKUP(lookup_value, lookup_vector, result_vector) \]

Example: \[ =LOOKUP(50, A1:A10, B1:B10) \]

Here, it searches for the value `50` in the range `A1:A10` and returns the corresponding value from `B1:B10`.

(2) Array Form:

This form searches for a value in a predefined range and returns a value based on the corresponding position in another range.

Syntax: \[ =LOOKUP(lookup_value, array) \]

Example: \[ =LOOKUP(50, \{10, 20, 50\, \{"Low", "Medium", "High"\})} \]

Here, the function searches for `50` in the array `{10, 20, 50` and returns `"High"`. Quick Tip: Use the vector form for ranges in rows or columns and the array form for small datasets or predefined constant arrays.

Comments