The UP Board Class 12 Accountancy Syllabus for the academic year 2025-26 has been officially released on the UPMSP website,upmsp.edu.in and you can check and download the syllabus PDF from there or from the link.

- The paper is theory-based, and the syllabus is divided into two parts: Part A and Part B, with a total of 100 marks.

- Part A of the accountancy syllabus is based on nonprofit organizations and partnership accounts and carries 45 marks.

- Part B of the accountancy syllabus is based on company accounts and financial statement analysis and carries 55 marks.

In the article below you can check the part-wise syllabus and weightage for the UP Board Class 12 accountancy syllabus for the session 2025-26.

Quick Links:

Key Summary

In this article we discussed the UP board class 12 accountancy syllabus for 2025-26, including the part-wise syllabus, weightage, and exam preparation tips.

- The UP Board Class 12 Accountancy Syllabus for the academic year 2025-26 has been officially released on the UPMSP website.

- Part A of the accountancy syllabus is based on nonprofit organizations and partnership accounts and carries 45 marks.

- Part B of the accountancy syllabus is based on company accounts and financial statement analysis and carries 55 marks.

- The paper is theory-based, and the syllabus is divided into two parts: Part A and Part B, with a total of 100 marks.

- The exam preparation tips help you to score excellent marks in class 12.

What is the UP Board Class 12 Accountancy Syllabus?

The UP Board Class 12 Accountancy syllabus PDF is released on the official website for 2025-26, and the syllabus is divided into two parts.

- Part A focuses on nonprofit organizations and partnership accounts, while Part B focuses on company accounts and financial statement analysis.

The detailed part-wise syllabus for the UP Board Class 12 Accountancy exam is outlined below.

UP Board Class 12 Accountancy Syllabus: Overview

| Component | Details |

|---|---|

| Conducting Authority | UP Madhyamik Shiksha Parishad (UPMSP) |

| Official Website | upmsp.edu.in |

| Exam Type | Theory Paper |

| Subject Code | 156 |

| Exam Duration | 3 hours and 15 minutes (including 15 min reading time) |

| Total Marks | 100 |

| Paper Structure | Section A: 20 MCQsSection B: Short & Long Answer Questions |

| Syllabus Coverage | Part A: Nonprofit Organizations and Partnership AccountsPart B: Company Accounts & Financial Statement Analysis |

UP Board Class 12 Accountancy Syllabus: Part-Wise

The paper is theory-based, and the syllabus is divided into two parts: Part A and Part B, with a total of 100 marks.

- Part A of the accountancy syllabus is based on nonprofit organizations and partnership accounts.

- Part B of the accountancy syllabus is based on company accounts and financial statement analysis.

The detailed part-wise syllabus for the UP Board Class 12 Accountancy exam is outlined below.

UP Board Class 12 Accountancy Syllabus: Part A

The table below summarises Part A of the UP Board Class 12 Accountancy syllabus, highlighting each unit, its topic, and key points in brief for quick reference.

| Part A: Nonprofit Organisations and Partnership Accounts | ||

|---|---|---|

| Unit | Topic | Details (Key Topics) |

| 1 | Fundamentals of Partnership Accounting |

|

| 2 | Reconstitution of Partnership Firm – Admission of a Partner |

|

| 3 | Reconstitution of Partnership Firm – Retirement/Death of a Partner |

|

| 4 | Dissolution of Partnership Firm |

|

UP Board Class 12 Accountancy Syllabus: Part B

The following table provides a concise overview of Part B of the UP Board Class 12 Accountancy syllabus, emphasising each unit, its subject, and important details for easy access.

| Part B: Company Accounts and Financial Statement Analysis | ||

|---|---|---|

| Unit | Topic | Details (Key Topics) |

| 5 | Accounting for Share Capital |

|

| 6 | Accounting for Debentures |

|

| 7 | Financial Statements of a Company |

|

| 8 | Analysis of Financial Statements |

|

| 9 | Cash Flow Statement |

|

| 10 | Accounting Ratios |

|

Ques. Is the UP board class 12 accountancy exam theory-based or practical?

Ans. The UP board class 12 accountancy is mainly theory-based and given below:

| Exam Type | Total Marks | Key Focus Areas/Details |

|---|---|---|

| Theory-based | 100 |

|

Ques. How many units are there in the UP board class 12 accountancy syllabus?

Ans. The details given below for the UP board class 12 accountancy syllabus are:

| Part | Number of Units | Topics Covered | Details / Focus Areas |

|---|---|---|---|

| Part A | 4 | Partnership Accounts |

|

| Part B | 6 | Company Accounts & Financial Statement Analysis |

|

| Total | 10 | — |

UP Board Class 12 Accountancy Syllabus: Part-Wise Weightage

The UP Board Class 12 accountancy syllabus includes part-wise marks weightage for 2025-26:

The paper is theory-based with a total of 100 marks.

- Accountancy Syllabus Part A: Based on nonprofit organizations and partnership accounts and carries 45 marks.

- Accountancy Syllabus Part B: Based on company accounts and financial statement analysis and carries 55 marks.

UP Board Class 12 Accountancy Syllabus: Part A

The table below shows Part A of the accountancy syllabus, highlighting the marks' weightage for each unit, which carries a total of 45 marks.

| Unit | Topic | Marks |

|---|---|---|

| 1 | Fundamentals of Partnership Accounting | 06 |

| 2 | Reconstitution of Partnership Firm – Admission of a Partner | 13 |

| 3 | Reconstitution of Partnership Firm – Retirement/Death of a Partner | 13 |

| 4 | Dissolution of Partnership Firm | 13 |

UP Board Class 12 Accountancy Syllabus: Part B

The table below shows Part B of the accountancy syllabus, highlighting the mark weightage for each unit, which carries a total of 55 marks.

| Unit | Topic | Marks |

|---|---|---|

| 5 | Accounting for Share Capital and debentures | 13 |

| 6 | Financial Statements of a Company | 12 |

| 7 | Analysis of Financial Statements | 12 |

| 8 | Cash Flow Statement | 09 |

| 9 | Accounting Ratios | 09 |

Ques. Which section of the UP board class 12 accountancy syllabus carries more marks?

Ans. The section-wise marks given below for the UP board class 12 accountancy syllabus:

| Part | Topic | Marks |

|---|---|---|

| Part A | Partnership Accounts | 45 |

| Part B | Company Accounts & Financial Statement Analysis | 55 |

| Total | — | 100 |

Ques. What are the syllabus's high-weightage units?

Ans. The UP board class 12 accountancy syllabus high-weightage units are given below:

| Unit/Topic | Marks/Weightage | Notes |

|---|---|---|

| Accounting for Share Capital | 13 | High-weightage unit; important for scoring well |

| Accounting for Debentures | 13 | High-weightage unit; requires practice for accuracy |

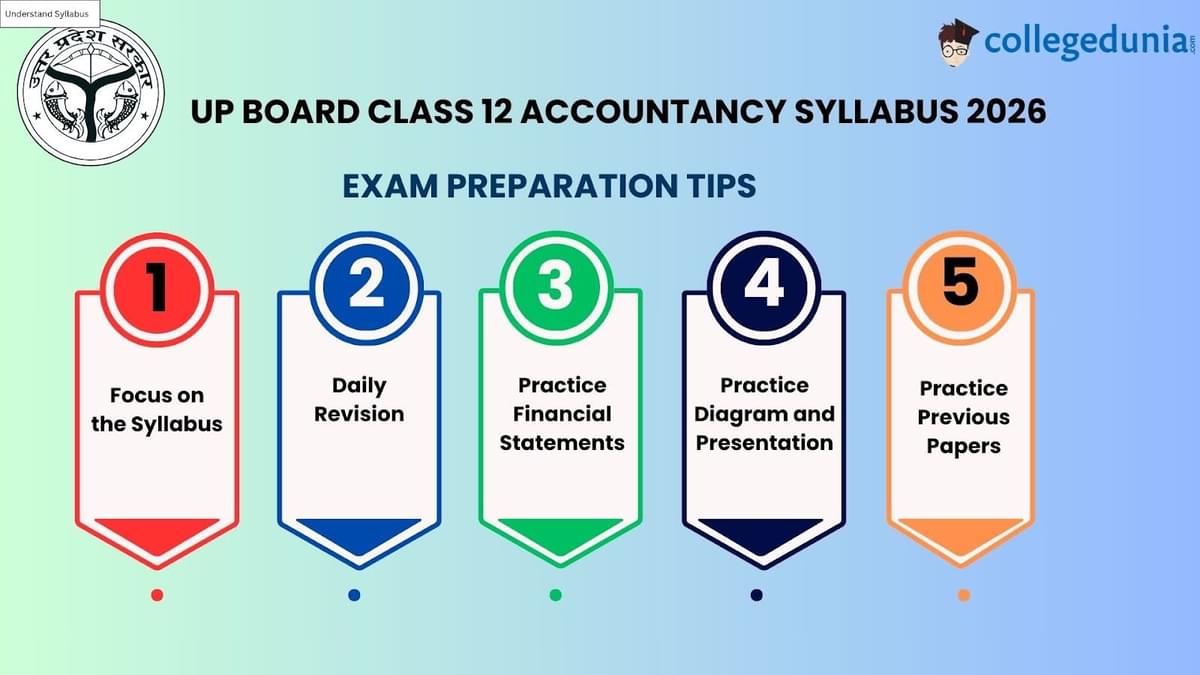

UP Board Class 12 Accountancy Exam Preparation Tips

Some of the important exam preparation tips for the students of UP board class 12 are given below:

| Focus Area | Tips |

|---|---|

| Focus on the Syllabus |

|

| Practice Previous Papers |

|

| Daily Revision |

|

| Practice Diagram and Presentation |

|

| Practice Financial Statements |

|

| Company Accounts |

|

Also Check:

UP Board Class 12 Practice PapersQues. What is the best way to get ready for high-weightage topics?

Ans. The best way to get ready for high-weightage topics is given below:

| Part | Focus Areas/Tips |

|---|---|

| Part A (Partnership Accounts) |

|

| Part B (Company Accounts & Financial Statement Analysis) |

|

Ques. Is understanding formulas necessary for the class 12 exam?

Ans. Yes, understanding formulas is essential for Part B—Company Accounts & Financial Statement Analysis. Students should:

- Understand and memorize ratio formulas.

- Practice financial trend analysis.

- Learn methods for preparing cash flow statements.

- Accurately perform accounting ratio calculations.

Check Previous Years' Question Papers

FAQs

Ques. Which is the hardest chapter in Class 12 Accountancy?

Ans. The accounting for share capital and debentures and the reconstitution of partnership firms (admission, retirement, and death) are the most difficult courses for many students because:

- They require a lot of intricate calculations, journal entries, and adjustments.

Ques. How to get full marks in the Accountancy Class 12 exam?

Ans. To score full marks in the accountancy class 12 exam, follow these steps:

- Regularly practice all numerical problems.

- Learn financial statement formats, ratios, and formulas by heart.

- Make thorough revisions to the ledger, journal entries, and capital adjustments.

- Provide well-organized responses using appropriate headings and formats.

- To understand the exam pattern, solve previous years' papers.

Ques. What is the weightage for Class 12 Accountancy?

Ans. The UP Board Class 12 Accountancy exam carries 100 marks, divided into:

| Part | Focus Area | Marks |

|---|---|---|

| Part A | Partnership Accounts | 45 |

| Part B | Company Accounts & Financial Statement Analysis | 55 |

| Total | — | 100 |

Ques. Which chapter is most important for the Accountancy Class 12?

Ans. The most important chapters for accountancy for class 12 UP board are:

- Accounting for Share Capital

- Accounting for Debentures

- Analysis of Financial Statements

- Fundamentals of Partnership Accounting

Ques. What are the golden rules of accountancy class 12?

Ans. The three golden rules are from the accountancy class 12:

- Debit the Receiver, Credit the Giver – for personal accounts

- Debit What Comes In, Credit What Goes Out—for real accounts

- Debit All Expenses and losses, and Credit All Incomes and gains—for nominal accounts

Ques. Which book is the king of accounting?

Answer: "Double Entry Book Keeping" by T.S. Grewal is generally considered the most well-liked and trustworthy book for preparing for Class 12 accounting.

*The article might have information for the previous academic years, which will be updated soon subject to the notification issued by the University/College.

Comments