Check SPPU Admission 2025

SPPU Diploma Taxation Law Admission 2025

The minimum eligibility for admission to Diploma Taxation Law at SPPU is Graduated.

Also Check:

Read More

| Course Highlights | Details |

|---|---|

| duration | 1 Year (Full Time) |

| course level | UG Diploma (Diploma) |

| mode of study | On Campus |

| eligibility | Graduated |

752 Views Last Year

41 Studentsshown interest in the last 30 days

Official Link:

Table of Contents

Course Finder

Search from 20K+ Courses and 35+ Streams

Clear

Popular Streams:

SPPU Latest News

CAT Diversity at IIM: Benefits for Non-Engineers and Female candidates

Written ByBhaskar Dason Sep 25, 2025

CAT LR Preparation 2025: Practice Questions on Cubes

Written ByUddipana Choudhuryon Sep 25, 2025

Tricks to solve QA Questions for CAT 2025 in less than 1 minute

Written BySahaj Anandon Sep 25, 2025

.png?h=78&w=78&mode=stretch)

Discover More Colleges

![Symbiosis Institute of Media and Communication - [SIMC]](https://image-static.collegedunia.com/public/college_data/images/appImage/7502_SIMC_New.jpg?h=111.44&w=263&mode=stretch)

![Tilak Maharashtra Vidyapeeth - [TMV]](https://image-static.collegedunia.com/public/college_data/images/appImage/25730_TMV_NEW.jpg?h=111.44&w=263&mode=stretch)

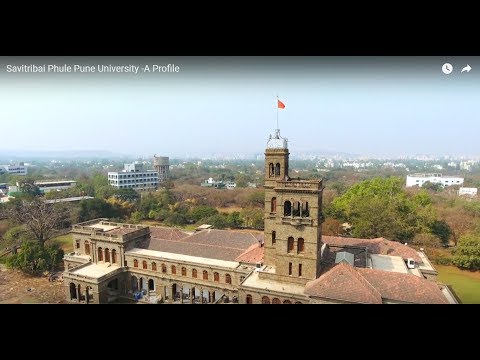

![Savitribai Phule Pune University - [SPPU]](https://image-static.collegedunia.com/public/college_data/images/logos/1483942831uop_logo.jpg?h=71.7&w=71.7&mode=stretch)

.png?h=90.56&w=161&mode=stretch)

.png?h=90.56&w=161&mode=stretch)

![Institute of Bioinformatics and Biotechnology - [IBB]](https://image-static.collegedunia.com/public/college_data/images/logos/1429507807jp.jpg?h=72&w=72&mode=stretch)

![Department of Management Science, Savitribai Phule Pune University - [PUMBA]](https://image-static.collegedunia.com/public/college_data/images/logos/14498279931444025326PUMBA.jpg?h=72&w=72&mode=stretch)

![Interdisciplinary School of Scientific Computing - [ISSC]](https://image-static.collegedunia.com/public/college_data/images/logos/1486384154logo..jpg?h=72&w=72&mode=stretch)

.png?h=72&w=72&mode=stretch)

.png?h=72&w=72&mode=stretch)

![Bharati Vidyapeeth University, Institute of Management and Entrepreneurship Development - [IMED]](https://image-static.collegedunia.com/public/college_data/images/logos/1500616065dvffhgljhfr.png?h=72&w=72&mode=stretch)

![Pimpri Chinchwad University - [PCU]](https://image-static.collegedunia.com/public/college_data/images/logos/1735796030PCULogo211.png?h=72&w=72&mode=stretch)

![Poona College of Arts, Science and Commerce - [PCASC]](https://image-static.collegedunia.com/public/college_data/images/logos/1672983860index.jpg?h=72&w=72&mode=stretch)

![Tilak Maharashtra Vidyapeeth - [TMV]](https://image-static.collegedunia.com/public/college_data/images/logos/1639811614image3.png?h=72&w=72&mode=stretch)

![MIT World Peace University - [MIT-WPU]](https://image-static.collegedunia.com/public/college_data/images/logos/1705479788MITWPUshortformlogoredandblue1.png?h=72&w=72&mode=stretch)

![Rashtrasant Tukadoji Maharaj Nagpur University - [RTMNU]](https://image-static.collegedunia.com/public/college_data/images/logos/1472882750Rashtrasant_Tukadoji_Maharaj_Nagpur_University_logo.jpg?h=72&w=72&mode=stretch)

![Modern College of Arts Science and Commerce - [MCASC] Shivajinagar](https://image-static.collegedunia.com/public/college_data/images/logos/1419512248logo1.gif?h=72&w=72&mode=stretch)

![Brihan Maharashtra College of Commerce - [BMCC]](https://image-static.collegedunia.com/public/college_data/images/logos/1510133643DeccanEducationSocietyLogo.jpg?h=72&w=72&mode=stretch)

Comments