Bihar Board Class 12 Entrepreneurship Question Paper 2024 (Code 218 Set – I) with Solutions pdf is available for download here. The exam was conducted by Bihar School Examination Board (BSEB). The question paper comprised a total of 96 questions divided among 2 sections.

Bihar Board Class 12 Entrepreneurship Question Paper 2024 (Code 218 Set – I) with Solutions

| Bihar Board Class 12 Entrepreneurship Question Paper with Answer Key | Check Solutions |

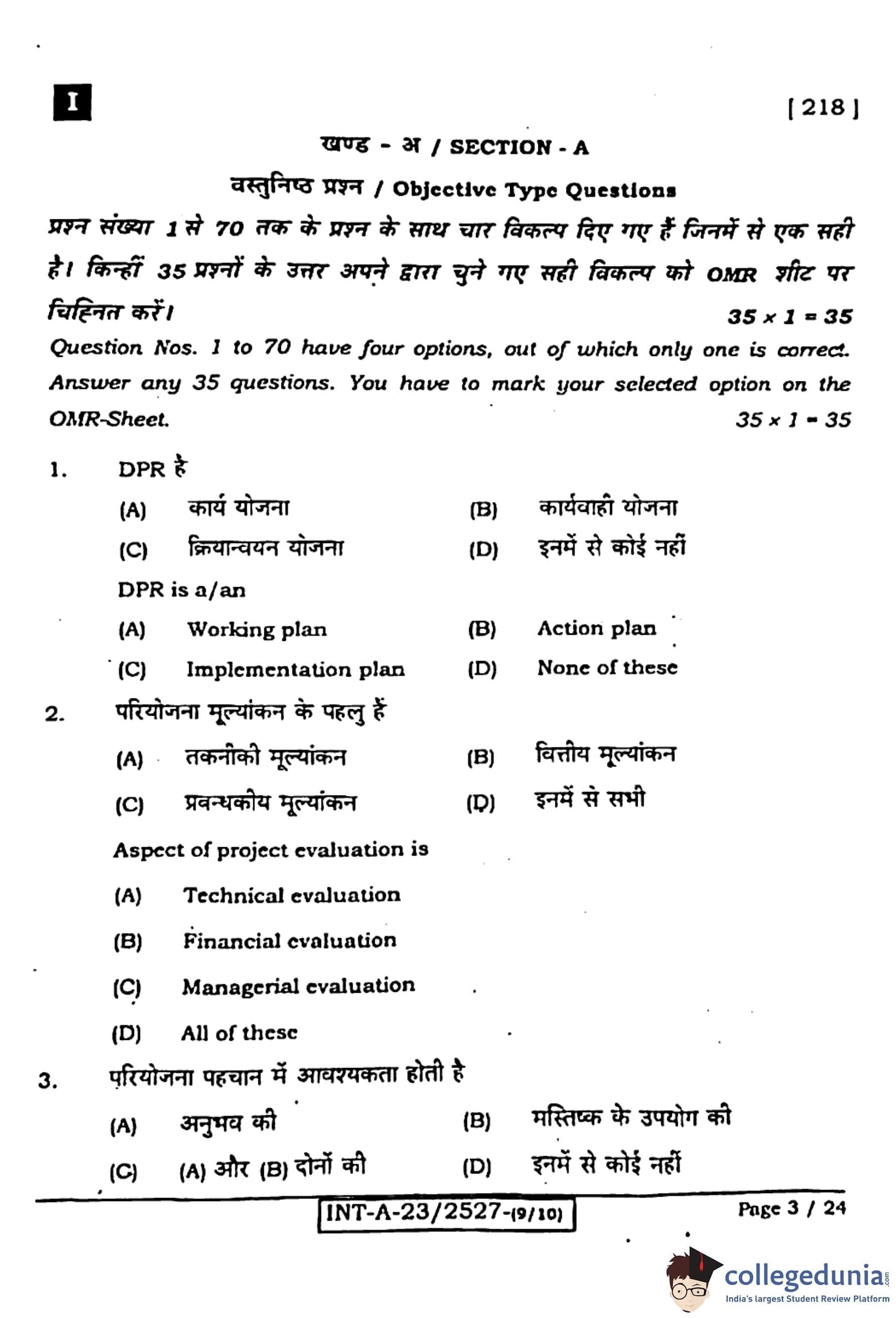

DPR is a/an

View Solution

Step 1: Understanding the meaning of DPR.

The term DPR stands for Detailed Project Report.

It is an essential document prepared before the execution of any large-scale project.

The DPR provides an in-depth analysis and detailed description of all aspects of a project — including its objectives, background, financial requirements, feasibility, and technical details.

In simple terms, it acts as a roadmap or master plan that guides the implementation of the project from start to finish.

Step 2: Components of a DPR.

A standard DPR usually includes the following key sections:

- Project background and justification

- Objectives and scope of the project

- Technical specifications and design details

- Cost estimates and financing plan

- Implementation schedule and monitoring mechanism

- Risk assessment and mitigation measures

All of these sections are interlinked and designed to ensure that every stage of the project is properly executed.

Step 3: Why it is an Implementation Plan.

Since a DPR provides detailed guidelines on how the project should be executed, it is primarily an Implementation Plan.

It goes beyond being just a proposal or working plan; it sets out the operational framework for the actual execution of the project on the ground.

It outlines the activities, resources, manpower, and timelines necessary for successful completion.

Step 4: Analysis of Options.

- (1) Working plan: A working plan may refer to an internal short-term document, not a detailed guide for entire project execution.

- (2) Action plan: Although DPR includes actions, it is broader and more detailed than a mere action plan.

- (3) Implementation plan: Correct — because the DPR is intended to provide all necessary details to implement the project.

- (4) None of these: Incorrect, as the DPR clearly fits the description of an implementation plan.

Step 5: Conclusion.

Hence, the Detailed Project Report (DPR) is best described as an Implementation Plan.

Quick Tip: Always remember: DPR = Detailed Project Report = Implementation Plan.

It serves as a comprehensive guide for executing, monitoring, and evaluating a project successfully.

Aspect of project evaluation is

View Solution

Step 1: Understanding project evaluation.

Project evaluation is the process of systematically assessing a project to determine its feasibility, effectiveness, and success.

It helps decision-makers understand whether the project’s goals are being achieved in a cost-effective and sustainable manner.

Evaluation also identifies gaps, inefficiencies, and areas for improvement during or after the project’s implementation.

Step 2: Importance of project evaluation.

Project evaluation ensures that the resources allocated to a project are being used efficiently.

It measures the outcomes against predefined objectives and ensures accountability, transparency, and better decision-making for future projects.

Step 3: Major aspects of project evaluation.

(a) Technical Evaluation: This aspect examines the technical soundness and feasibility of the project. It checks whether the technology used is suitable, efficient, and sustainable for the intended purpose.

(b) Financial Evaluation: This involves a detailed financial analysis, including cost-benefit ratio, return on investment (ROI), and economic viability of the project. It ensures that the project delivers maximum output with minimal expenditure.

(c) Managerial Evaluation: This aspect focuses on the organizational and administrative setup of the project. It assesses the management structure, leadership efficiency, coordination among teams, and decision-making processes.

Step 4: Interrelation of the aspects.

All three evaluations are interconnected — technical soundness ensures feasibility, financial analysis confirms affordability, and managerial evaluation ensures smooth execution.

Without any one of these, project success cannot be achieved.

Step 5: Analysis of options.

- (1) Technical evaluation: True but only one part of project evaluation.

- (2) Financial evaluation: True but incomplete alone.

- (3) Managerial evaluation: True but insufficient by itself.

- (4) All of these: Correct — because project evaluation is a multidimensional process covering all these aspects.

Step 6: Conclusion.

Thus, the correct answer is (4) All of these, as a complete evaluation process includes technical, financial, and managerial perspectives.

Quick Tip: A holistic project evaluation always combines technical, financial, and managerial assessments to ensure efficiency, feasibility, and sustainability of outcomes.

.............. is needed in project identification.

View Solution

Step 1: Understanding project identification.

Project identification is the process of recognizing and defining a project idea that has potential benefits and feasibility for execution.

It involves determining areas where new projects are needed or where improvement opportunities exist in existing systems.

Step 2: Key skills required for project identification.

The process of identifying viable projects is not random — it requires both experience and the use of mind (analytical thinking).

Experience provides practical insight into past projects, industry trends, and lessons learned.

At the same time, intellectual and analytical ability helps assess project feasibility, innovation, and long-term sustainability.

Step 3: Why both are essential.

Only experience without analysis may lead to traditional or repetitive ideas, while only intellectual reasoning without experience might overlook practical challenges.

Thus, combining both — experience and mental analysis — ensures a balanced and realistic project identification process.

Step 4: Analysis of options.

- (1) Experience: Necessary but not sufficient alone.

- (2) Use of mind: Important but incomplete without experience.

- (3) Both (A) and (B): Correct — both are equally vital.

- (4) None of these: Incorrect.

Step 5: Conclusion.

Hence, project identification requires both experience and use of mind.

Quick Tip: Effective project identification blends practical experience with analytical reasoning to ensure both creativity and feasibility.

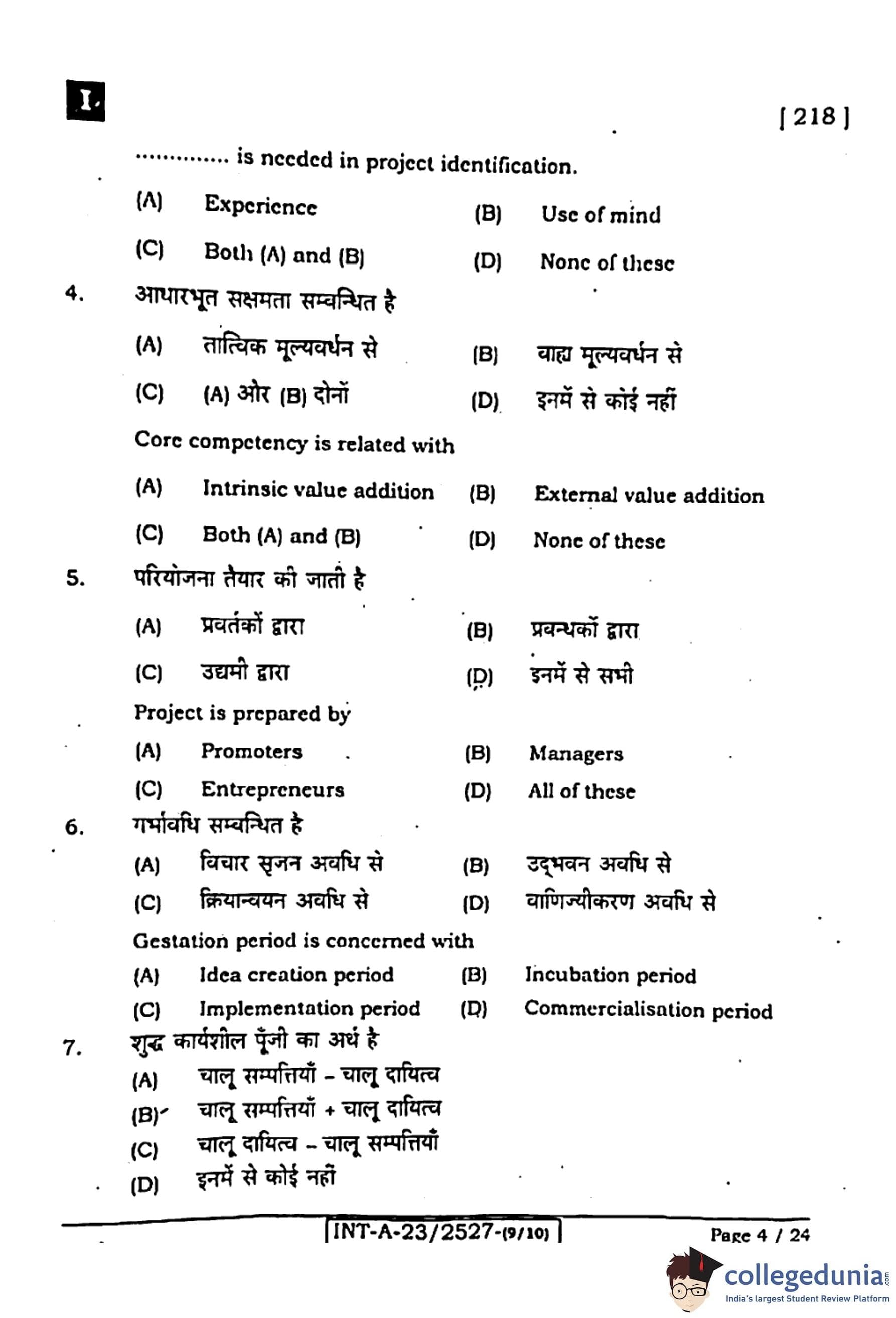

Core competency is related with

View Solution

Step 1: Understanding core competency.

Core competency refers to the unique capabilities, skills, and expertise that give an organization a competitive advantage in the marketplace.

It is what a company does exceptionally well compared to its competitors.

Core competencies are deeply embedded in an organization’s systems, culture, and employees.

Step 2: Relation with value addition.

Core competencies are directly connected to both intrinsic and external value addition.

- Intrinsic value addition focuses on improving internal processes, innovation, efficiency, and overall organizational strength.

- External value addition emphasizes providing superior products or services that add value to customers and the market.

Step 3: Why both are important.

A company’s true core competency lies in its ability to integrate internal efficiency with customer satisfaction.

For example, a company like Apple has intrinsic strength in design and technology (internal value) and delivers externally through user experience and branding (external value).

Step 4: Analysis of options.

- (1) Intrinsic value addition: True but incomplete.

- (2) External value addition: True but not sufficient by itself.

- (3) Both (A) and (B): Correct — as core competency connects both internal and external value creation.

- (4) None of these: Incorrect.

Step 5: Conclusion.

Hence, core competency is related to both intrinsic and external value addition.

Quick Tip: An organization’s core competency lies where internal efficiency meets external excellence — combining intrinsic and external value addition.

Project is prepared by

View Solution

Step 1: Understanding project preparation.

Project preparation involves the process of planning, designing, and organizing all details required before project implementation begins.

It is the stage where ideas are converted into structured documents outlining objectives, resource requirements, cost estimation, risk assessment, and timelines.

Step 2: Who prepares a project.

A project can be prepared by different stakeholders, depending on its nature, scale, and purpose:

- Promoters: They are individuals or groups who conceive the project idea and initiate its planning. They are responsible for promoting and justifying the project’s feasibility.

- Managers: They handle the organizational and administrative planning — such as defining operational details, manpower, and workflow structure.

- Entrepreneurs: They take on both the creative and financial responsibility of the project, preparing it from an innovation and investment standpoint.

Step 3: Collaborative nature of project preparation.

In most practical cases, all three — promoters, managers, and entrepreneurs — play complementary roles.

Promoters provide vision, managers ensure organization, and entrepreneurs bring innovation and risk-taking ability.

Together, they ensure the project is realistic, efficient, and profitable.

Step 4: Analysis of options.

- (1) Promoters: True, they initiate the project.

- (2) Managers: True, they organize and plan the operational aspects.

- (3) Entrepreneurs: True, they finance and execute the project vision.

- (4) All of these: Correct — all these roles contribute collectively.

Step 5: Conclusion.

Therefore, a project is prepared by promoters, managers, and entrepreneurs — all of them together.

Quick Tip: Project preparation is a team effort — combining the promoter’s vision, the manager’s organization, and the entrepreneur’s initiative.

Gestation period is concerned with

View Solution

Step 1: Understanding the term 'Gestation Period'.

The term Gestation Period refers to the time gap between the conception of a project idea and its actual commencement of operations.

It is the period during which the project is prepared, developed, and brought to an operational stage.

This stage includes activities such as acquiring land, constructing buildings, installing machinery, and completing other preparatory work before production begins.

Step 2: Relation with project phases.

Every project has different phases:

- Idea generation and conceptualization

- Feasibility and planning

- Implementation (gestation period)

- Operation and commercialization

The gestation period lies mainly in the implementation stage — the time when the project is under development but has not yet started producing output.

Step 3: Real-world examples.

For example, when a factory is being constructed, machinery installed, and employees trained — that entire duration is the gestation period.

Only after this period does the plant begin commercial production.

Step 4: Analysis of options.

- (1) Idea creation period: Too early — this involves only concept development.

- (2) Incubation period: Generally refers to startup nurturing, not industrial implementation.

- (3) Implementation period: Correct — as the gestation period covers the time of implementation before output begins.

- (4) Commercialisation period: This comes after the gestation phase.

Step 5: Conclusion.

Thus, the gestation period is concerned with the implementation period.

Quick Tip: The gestation period ends when the project starts generating returns — it’s the implementation phase, not the planning or commercial stage.

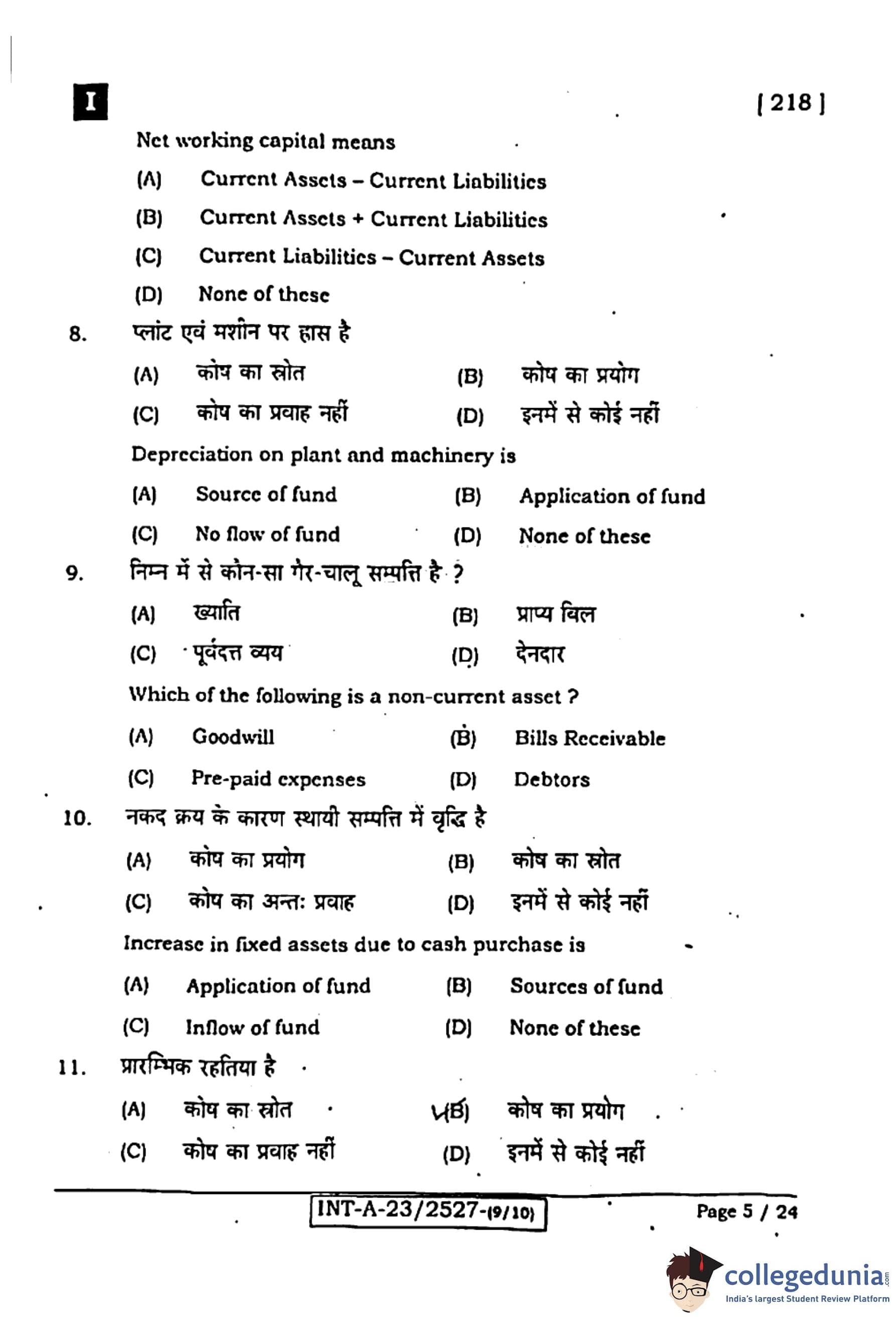

Net working capital means

View Solution

Step 1: Understanding the concept.

Net Working Capital (NWC) is a key indicator of an organization’s short-term financial health and liquidity position.

It represents the difference between the company’s current assets and current liabilities.

It shows the amount of capital that a company has available for day-to-day operations.

Step 2: Formula and meaning.

The formula for Net Working Capital is:

\[ Net Working Capital = Current Assets - Current Liabilities \]

If this value is positive, it means the company has enough assets to cover its short-term obligations.

If it is negative, it indicates financial strain or poor liquidity.

Step 3: Examples.

For example, if a company has current assets worth ₹5,00,000 and current liabilities of ₹3,00,000, then:

\[ NWC = 5,00,000 - 3,00,000 = 2,00,000 \]

This means ₹2,00,000 is available as working capital for regular business operations.

Step 4: Importance of NWC.

Net Working Capital helps measure operational efficiency and short-term financial stability.

It ensures that the firm can meet its immediate expenses like salaries, raw material costs, and bills.

Step 5: Analysis of options.

- (1) Current Assets - Current Liabilities: Correct definition.

- (2) Current Assets + Current Liabilities: Incorrect, not used in accounting.

- (3) Current Liabilities - Current Assets: Represents negative working capital, not standard NWC.

- (4) None of these: Incorrect.

Step 6: Conclusion.

Therefore, Net Working Capital = Current Assets - Current Liabilities.

Quick Tip: Net Working Capital measures liquidity; a positive NWC shows strong short-term solvency and operational stability.

Depreciation on plant and machinery is

View Solution

Step 1: Understanding depreciation.

Depreciation is the reduction in the value of an asset over time due to wear and tear, usage, or obsolescence.

It is a non-cash expense recorded in the books to allocate the cost of an asset over its useful life.

Step 2: Accounting treatment.

In accounting, depreciation is charged annually to reflect the decline in value of fixed assets like machinery, equipment, or vehicles.

Although it reduces profits, no actual cash outflow occurs at the time of recording depreciation.

Step 3: Why it is 'No flow of fund'.

Since depreciation does not involve any cash transaction, it is neither a source nor an application of funds.

It simply adjusts the book value of assets and reduces taxable income without affecting the actual cash position of the business.

Step 4: Example.

If a company buys a machine worth ₹1,00,000 and charges ₹10,000 as depreciation annually, this ₹10,000 reduces profit but does not involve any cash flow.

Therefore, it is a non-fund or non-cash item.

Step 5: Analysis of options.

- (1) Source of fund: Incorrect — no cash inflow occurs.

- (2) Application of fund: Incorrect — no cash outflow occurs.

- (3) No flow of fund: Correct — depreciation only affects accounting records, not cash flow.

- (4) None of these: Incorrect.

Step 6: Conclusion.

Hence, depreciation on plant and machinery is classified as No flow of fund.

Quick Tip: Depreciation is a non-cash expense — it affects profit but not the flow of funds in or out of the business.

Which of the following is a non-current asset?

View Solution

Step 1: Understanding the concept of non-current assets.

Non-current assets are those assets that are held by a business for long-term use and not intended for immediate sale.

They provide benefits to the business over multiple accounting periods and include tangible and intangible assets.

Step 2: Nature of goodwill.

Goodwill is an intangible non-current asset that represents the reputation, brand value, and customer trust of a business.

It arises when a company acquires another business at a value higher than its net identifiable assets.

For example, if a business purchases another firm for ₹10,00,000 whose net asset value is ₹8,00,000, then ₹2,00,000 is goodwill — reflecting its market reputation.

Step 3: Why goodwill is non-current.

Goodwill provides long-term benefits to a company and cannot be easily converted into cash.

It is not used up or replaced within a year, so it is categorized under non-current or fixed assets.

Step 4: Analysis of options.

- (1) Goodwill: Correct, as it is a long-term intangible asset.

- (2) Bills Receivable: A current asset since it is expected to be realized within a short time.

- (3) Pre-paid expenses: Also a current asset because they relate to current accounting periods.

- (4) Debtors: Represent short-term receivables, hence a current asset.

Step 5: Conclusion.

Therefore, the correct answer is Goodwill, which is a non-current asset.

Quick Tip: Non-current assets include tangible assets like land and machinery and intangible assets like goodwill and patents — all used for long-term operations.

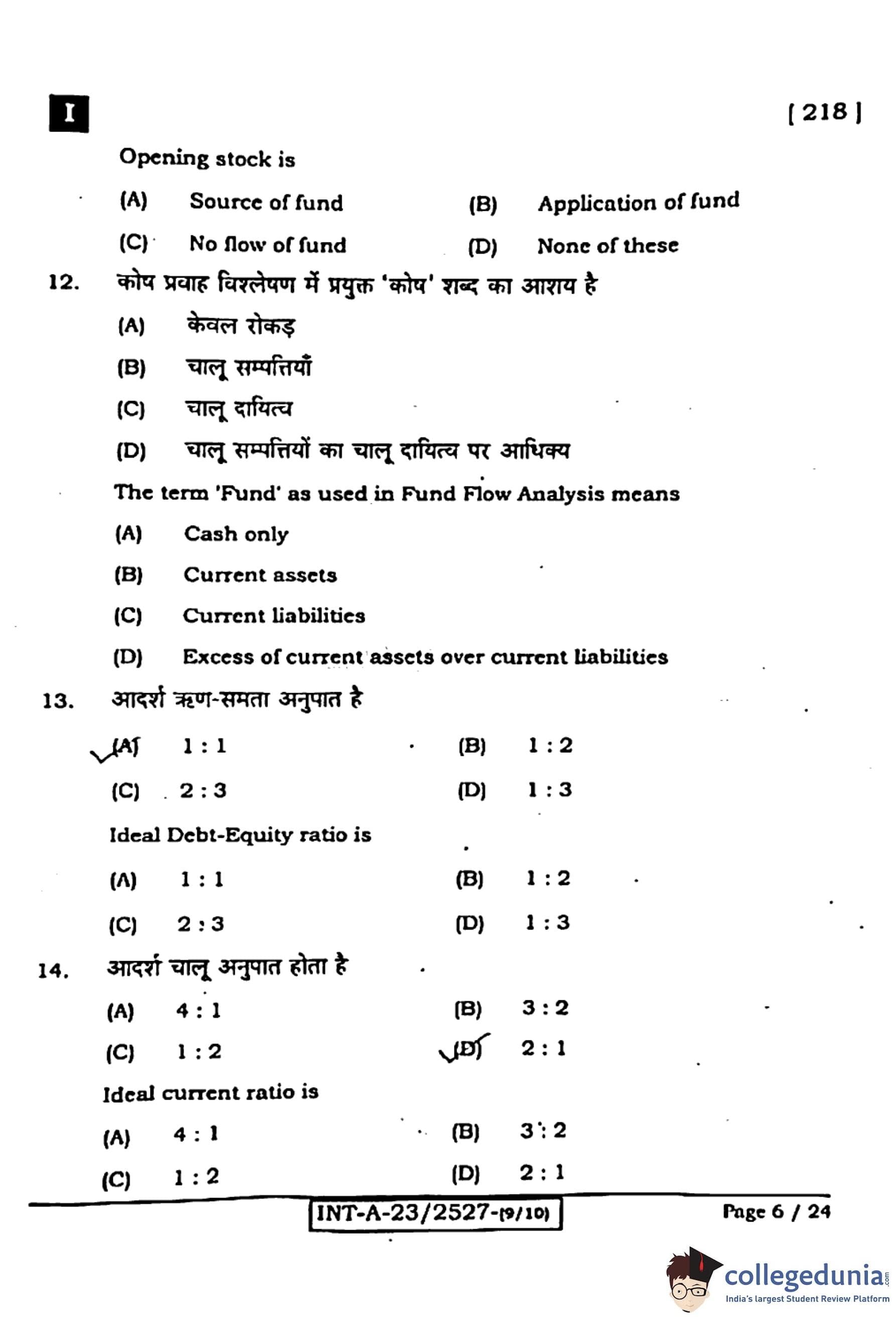

Increase in fixed assets due to cash purchase is

View Solution

Step 1: Understanding 'application of fund'.

An application of fund refers to the use or outflow of financial resources for various business purposes.

Whenever money is spent on acquiring assets, paying liabilities, or meeting expenses, it is considered an application of funds.

Step 2: Nature of the transaction.

When a business purchases fixed assets such as machinery, equipment, or land by paying cash, the transaction results in an increase in assets.

At the same time, there is a reduction in cash balance, which means money has been utilized or applied.

Step 3: Explanation with example.

For example, if a company buys machinery worth ₹2,00,000 in cash, then:

- Fixed assets increase by ₹2,00,000.

- Cash (a current asset) decreases by ₹2,00,000.

This represents a movement of funds from one form to another — from liquid assets (cash) to fixed assets.

Step 4: Reasoning.

Since cash has been used to acquire the fixed asset, it is treated as an application of fund.

It indicates a decrease in working capital because current assets (cash) have reduced while non-current assets have increased.

Step 5: Analysis of options.

- (1) Application of fund: Correct — cash used for purchasing assets is an outflow of funds.

- (2) Source of fund: Incorrect — it would mean generation of cash.

- (3) Inflow of fund: Incorrect — no inflow occurs here.

- (4) None of these: Incorrect.

Step 6: Conclusion.

Thus, an increase in fixed assets due to a cash purchase is an application of fund.

Quick Tip: Whenever cash is used to buy long-term assets, it’s recorded as an application of fund because working capital decreases.

Opening stock is

View Solution

Step 1: Understanding opening stock.

Opening stock represents the value of goods or materials that a business holds at the beginning of an accounting period.

It is the leftover inventory from the previous year, carried forward to the new financial year.

Step 2: Accounting impact.

In the preparation of fund flow statements, opening stock is treated as an application of fund.

This is because funds have already been invested in purchasing or producing this stock in the previous period, and those funds remain tied up in inventory.

Step 3: Conceptual explanation.

Even though opening stock does not involve a new cash transaction during the current year, it represents the utilization of resources in earlier operations.

Hence, the funds locked in the opening stock are considered as applied funds.

Step 4: Example.

If a business starts the year with ₹50,000 worth of stock, that amount signifies funds already spent and invested in inventory.

Thus, it is recorded as an application of fund since the capital is used and remains blocked in stock form.

Step 5: Analysis of options.

- (1) Source of fund: Incorrect — no new cash inflow arises from opening stock.

- (2) Application of fund: Correct — it represents resources tied up in inventory.

- (3) No flow of fund: Incorrect — it shows utilization from the past.

- (4) None of these: Incorrect.

Step 6: Conclusion.

Therefore, opening stock is classified as an application of fund in financial analysis.

Quick Tip: Opening stock shows funds already utilized in previous periods — hence it is treated as an application of fund, not as a new cash flow.

The term ‘Fund’ as used in Fund Flow Analysis means

View Solution

Step 1: Understanding the meaning of ‘Fund’.

In the context of Fund Flow Analysis, the term ‘Fund’ does not refer merely to cash or money.

Instead, it denotes the Net Working Capital (NWC), which represents the excess of current assets over current liabilities.

This concept helps in identifying the flow of funds — whether the working capital has increased (inflow) or decreased (outflow).

Step 2: Relationship between fund and working capital.

Working capital = Current Assets – Current Liabilities.

If current assets increase or current liabilities decrease, it results in an inflow of funds.

Conversely, if current assets decrease or current liabilities increase, it indicates an outflow of funds.

Step 3: Importance in Fund Flow Analysis.

Fund Flow Analysis focuses on understanding how resources are generated and used within an organization over a given period.

By analyzing the changes in working capital, businesses can evaluate their short-term financial health and liquidity position.

Step 4: Analysis of options.

- (1) Cash only: Incorrect — fund means more than just cash.

- (2) Current assets: Incomplete — fund is not equal to all current assets alone.

- (3) Current liabilities: Incorrect — liabilities represent obligations, not fund.

- (4) Excess of current assets over current liabilities: Correct — this is the actual definition of fund in Fund Flow Analysis.

Step 5: Conclusion.

Thus, in Fund Flow Analysis, the term ‘Fund’ refers to the excess of current assets over current liabilities.

Quick Tip: In Fund Flow Analysis, always remember: Fund = Net Working Capital = Current Assets – Current Liabilities.

Ideal Debt-Equity ratio is

View Solution

Step 1: Understanding Debt-Equity Ratio.

The Debt-Equity Ratio measures the relationship between the company’s borrowed funds (debt) and its shareholders’ funds (equity).

It helps in evaluating the financial structure and the risk level of a company in terms of its reliance on external versus internal capital.

Step 2: Formula.

\[ Debt-Equity Ratio = \frac{Long-term Debt}{Shareholders’ Equity} \]

This ratio reflects the extent to which a company is using borrowed funds to finance its assets relative to the funds invested by the owners.

Step 3: Significance of an ideal ratio.

An ideal Debt-Equity Ratio of 1:1 indicates a balanced capital structure — the company has equal proportions of debt and equity.

It ensures financial stability, moderate risk, and an optimal cost of capital.

If the ratio is higher (e.g., 2:1), it means more dependence on debt, which increases financial risk.

If it is lower (e.g., 0.5:1), it means excessive reliance on equity, which may reduce profitability for shareholders.

Step 4: Analysis of options.

- (1) 1 : 1 — Correct, considered the ideal balance between borrowed and owned funds.

- (2) 1 : 2 — Implies excessive equity; conservative structure.

- (3) 2 : 3 — Not standard; rarely used.

- (4) 1 : 3 — Implies high equity with little debt, not ideal for maximizing return.

Step 5: Conclusion.

Hence, the ideal Debt-Equity Ratio is 1:1.

Quick Tip: An ideal Debt-Equity ratio of 1:1 ensures financial balance — neither too risky (debt-heavy) nor too conservative (equity-heavy).

Ideal current ratio is

View Solution

Step 1: Understanding the current ratio.

The Current Ratio is a liquidity ratio that measures a company’s ability to meet its short-term obligations using its current assets.

It indicates whether the company has enough resources to pay off its immediate debts within a year.

Step 2: Formula.

\[ Current Ratio = \frac{Current Assets}{Current Liabilities} \]

This ratio shows how many times the current assets cover the current liabilities.

Step 3: Meaning of the ideal ratio.

An ideal current ratio is generally considered to be 2:1, which means that for every ₹1 of current liability, the company has ₹2 in current assets.

This ensures sufficient liquidity and safety for meeting short-term obligations without facing a cash crunch.

Step 4: Significance of 2:1.

A ratio higher than 2:1 may indicate excessive idle current assets or poor utilization of resources.

A ratio lower than 2:1 may suggest liquidity problems or over-dependence on short-term financing.

Hence, 2:1 provides a balanced level of safety and efficiency.

Step 5: Analysis of options.

- (1) 4 : 1 — Too high, indicates over-capitalization or inefficient asset use.

- (2) 3 : 2 — Low and risky for creditors.

- (3) 1 : 2 — Illogical; liabilities exceed assets.

- (4) 2 : 1 — Correct, ideal balance between liquidity and efficiency.

Step 6: Conclusion.

Therefore, the ideal Current Ratio is 2:1, signifying sound short-term financial health.

Quick Tip: A 2:1 current ratio means the company has twice as many current assets as liabilities — a safe liquidity position without underutilizing resources.

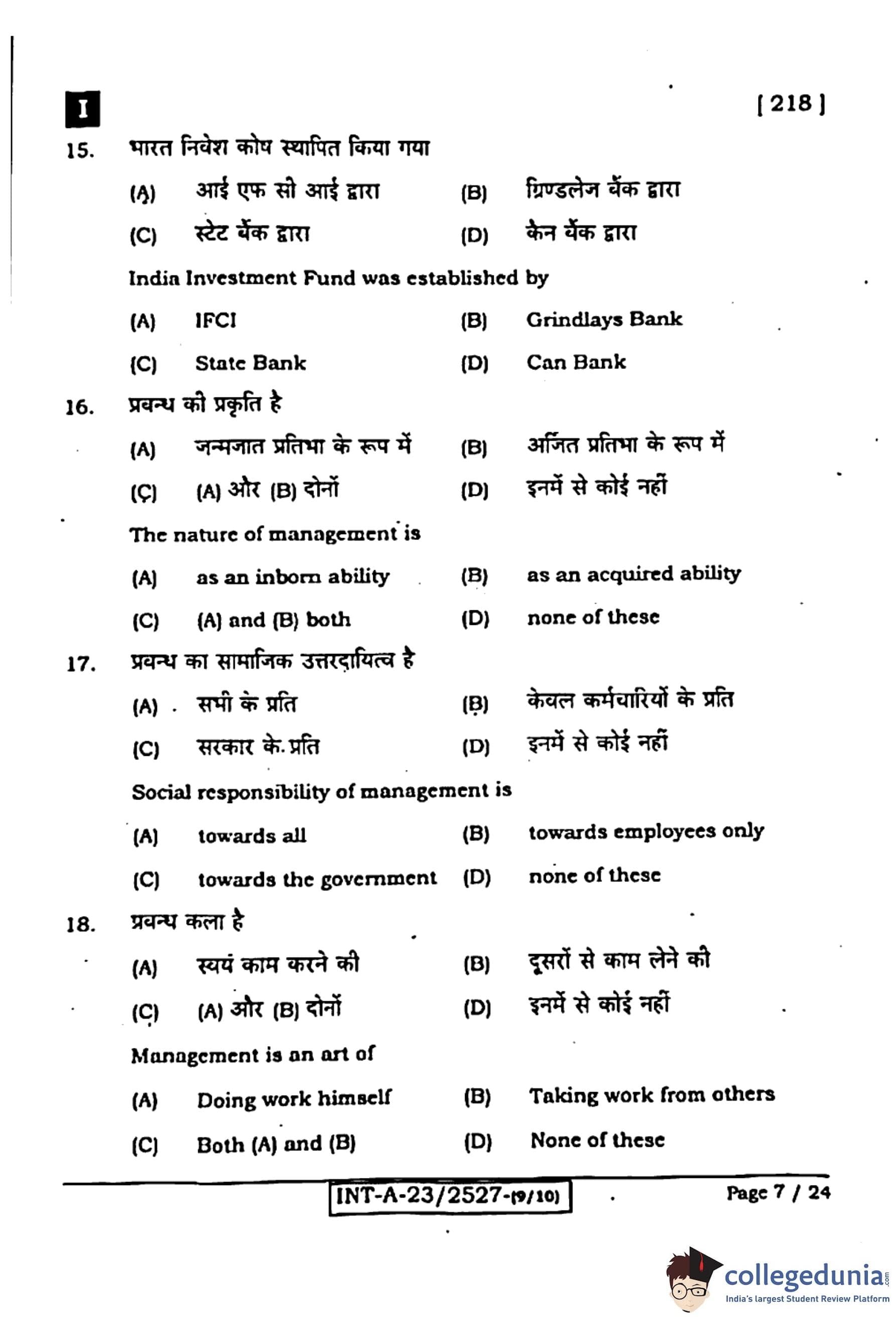

India Investment Fund was established by

View Solution

Step 1: Understanding the India Investment Fund.

The India Investment Fund was established as a financial initiative to promote investment opportunities and industrial development in India.

The fund aimed to attract both domestic and foreign investors by providing structured investment opportunities and promoting the Indian economy’s growth potential.

Step 2: Establishing authority.

The India Investment Fund was established by the Canara Bank (Can Bank) through its financial subsidiaries.

Can Bank is a major public sector bank in India that has been instrumental in setting up various financial institutions and investment funds to support industrial and infrastructure growth.

Step 3: Role of Can Bank.

Can Bank’s role was crucial in promoting capital formation, supporting industrial expansion, and fostering financial inclusion through long-term investments.

Step 4: Analysis of options.

- (1) IFCI: Focuses mainly on industrial finance, not on the India Investment Fund.

- (2) Grindlays Bank: A foreign bank, not involved in establishing this fund.

- (3) State Bank: A leading public bank but not associated with this specific fund.

- (4) Can Bank: Correct — India Investment Fund was established by Canara Bank.

Step 5: Conclusion.

Hence, the India Investment Fund was established by Can Bank.

Quick Tip: Canara Bank (Can Bank) has promoted several financial institutions like Canbank Mutual Fund and India Investment Fund to enhance industrial finance in India.

The nature of management is

View Solution

Step 1: Understanding management.

Management is both a science and an art — it involves planning, organizing, leading, and controlling an organization’s resources to achieve specific goals efficiently.

Step 2: Inborn ability aspect.

Some individuals possess natural leadership and managerial qualities, such as communication, decision-making, and coordination skills.

This reflects the inborn ability component of management — certain traits are innate.

Step 3: Acquired ability aspect.

At the same time, management requires formal education, training, and experience to understand theories, strategies, and techniques of administration.

This indicates the acquired ability component.

Step 4: Combination of both.

Successful managers combine both — natural talent and acquired knowledge — to adapt to changing organizational needs and environments.

Step 5: Analysis of options.

- (1) As an inborn ability: Partially correct.

- (2) As an acquired ability: Also true but incomplete.

- (3) Both (A) and (B): Correct — management is both natural and learned.

- (4) None of these: Incorrect.

Step 6: Conclusion.

Thus, the nature of management is both inborn and acquired ability.

Quick Tip: Effective management combines natural leadership traits with acquired professional knowledge and practical experience.

Social responsibility of management is

View Solution

Step 1: Understanding social responsibility.

Social responsibility refers to the ethical obligation of management to act in the interest of society and various stakeholders — not just the organization.

It involves ensuring fairness, sustainability, and positive contributions to the community.

Step 2: Scope of responsibility.

The management’s responsibility extends towards:

- Employees: Ensuring fair wages, safe working conditions, and career growth.

- Customers: Providing quality products and services.

- Government: Adhering to laws and paying taxes.

- Environment: Preventing pollution and promoting eco-friendly practices.

- Society at large: Supporting education, health, and social welfare.

Step 3: Why it is towards all.

Management must balance the interests of all stakeholders for sustainable growth and public trust.

Focusing only on one group, such as employees or government, limits ethical responsibility.

Step 4: Analysis of options.

- (1) Towards all: Correct — includes employees, government, customers, and society.

- (2) Towards employees only: Incorrect — too narrow.

- (3) Towards the government: Partial, but not complete.

- (4) None of these: Incorrect.

Step 5: Conclusion.

Thus, the social responsibility of management is towards all.

Quick Tip: Social responsibility in management means maintaining a balance between economic objectives and social welfare for all stakeholders.

Management is an art of

View Solution

Step 1: Understanding the concept of management as an art.

Management is often described as an art because it requires creativity, experience, and skill to achieve organizational objectives effectively through others.

The essence of management lies in achieving desired results by directing and motivating people.

Step 2: Manager’s role.

A manager’s primary responsibility is not to perform all tasks personally but to get the work done efficiently through proper coordination and supervision.

This involves delegation, communication, motivation, and leadership.

Step 3: Why not ‘doing work himself’.

While a manager must understand the nature of work, direct performance of all tasks is impractical in large organizations.

Hence, the real art of management lies in achieving goals through others.

Step 4: Analysis of options.

- (1) Doing work himself: Incorrect — a manager’s role is supervisory.

- (2) Taking work from others: Correct — reflects true managerial skill.

- (3) Both (A) and (B): Not accurate — management emphasizes coordination, not self-execution.

- (4) None of these: Incorrect.

Step 5: Conclusion.

Thus, management is the art of getting work done through others.

Quick Tip: True management lies in achieving goals by effectively directing, coordinating, and motivating others — not by doing every task personally.

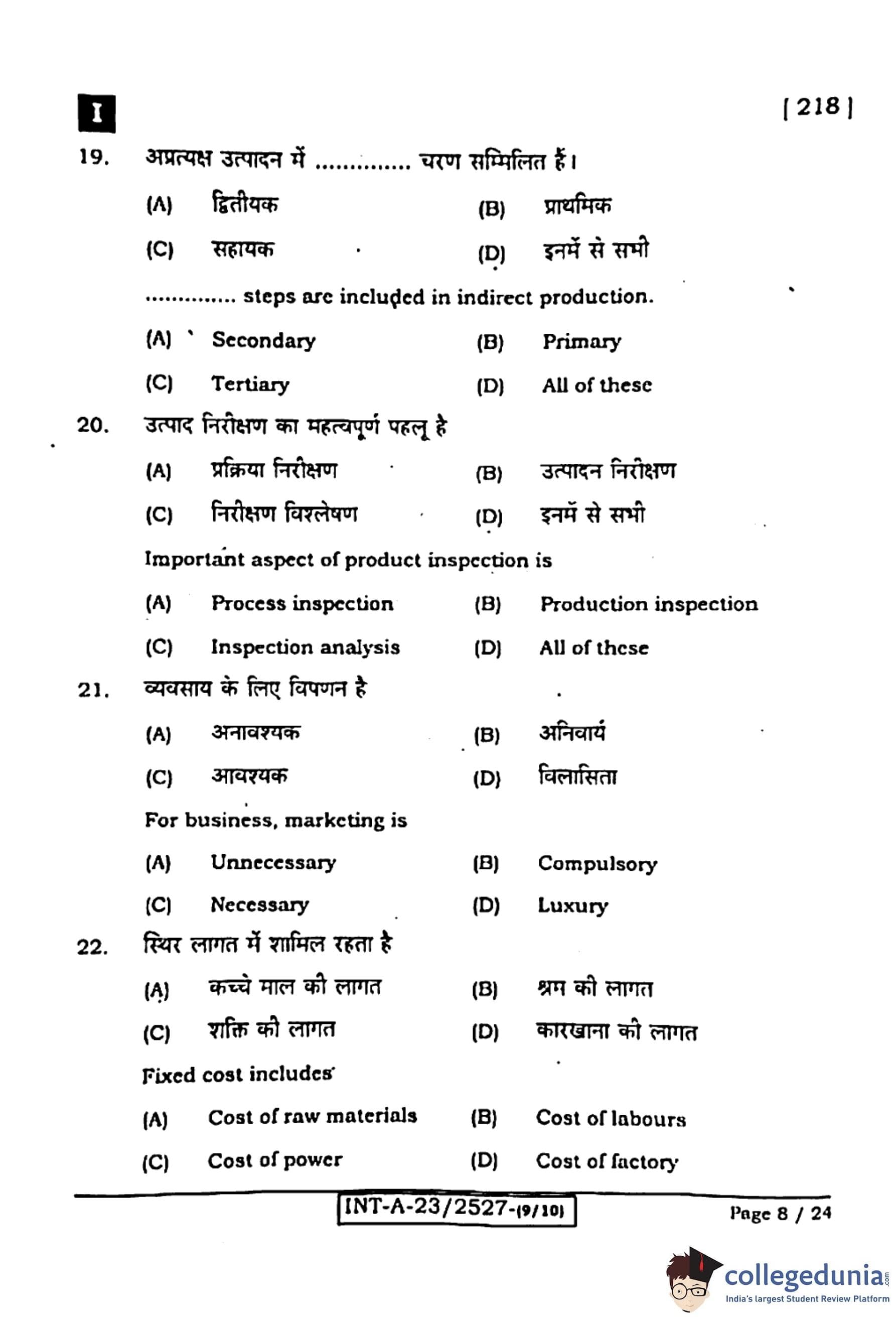

............... steps are included in indirect production.

View Solution

Step 1: Understanding indirect production.

Indirect production refers to all the activities that are not directly involved in producing goods but are essential for making production possible and efficient.

It involves processes such as services, transportation, communication, marketing, and other supporting functions that assist the actual production process.

Step 2: Classification of production stages.

Production can be classified into three broad types:

- Primary production: Activities that extract raw materials directly from nature — like agriculture, fishing, and mining.

- Secondary production: Activities that process raw materials into finished or semi-finished goods — like manufacturing and construction.

- Tertiary production: Activities that provide services supporting both primary and secondary production — like transport, banking, and marketing.

Step 3: Indirect production involvement.

Indirect production includes all these steps because they collectively contribute to the creation, movement, and distribution of goods.

Without the combined effort of all three sectors, the overall production cycle would remain incomplete.

Step 4: Analysis of options.

- (1) Secondary: Partly true — it supports production directly.

- (2) Primary: Also part of the chain, providing essential materials.

- (3) Tertiary: Provides services essential for production flow.

- (4) All of these: Correct — indirect production includes activities from all three sectors.

Step 5: Conclusion.

Hence, all three — primary, secondary, and tertiary — are included in indirect production.

Quick Tip: Indirect production includes every stage that supports or facilitates the creation and delivery of goods — from raw material extraction to marketing.

Important aspect of product inspection is

View Solution

Step 1: Understanding product inspection.

Product inspection is the process of examining goods during and after production to ensure they meet quality standards and customer expectations.

It helps in detecting defects, preventing wastage, and maintaining product reliability.

Step 2: Key aspects of product inspection.

Product inspection involves three important aspects:

- Process inspection: Examining the production process to identify errors in machinery, materials, or workflow.

- Production inspection: Checking products during various stages of manufacturing to ensure accuracy and consistency.

- Inspection analysis: Studying inspection data to evaluate performance and identify recurring defects for continuous improvement.

Step 3: Why all are important.

These three aspects are interlinked — process inspection ensures production quality, production inspection validates product accuracy, and analysis provides feedback for further quality enhancement.

Step 4: Analysis of options.

- (1) Process inspection: True, but partial.

- (2) Production inspection: True, but limited.

- (3) Inspection analysis: True, but supportive.

- (4) All of these: Correct — all are vital components of effective product inspection.

Step 5: Conclusion.

Therefore, all the given aspects together constitute the important elements of product inspection.

Quick Tip: Quality control requires process, production, and analytical inspections working together to maintain consistent standards.

For business, marketing is

View Solution

Step 1: Understanding the role of marketing.

Marketing is the process of identifying consumer needs, developing products to meet those needs, and promoting them effectively to maximize sales and satisfaction.

It is an essential part of every business, connecting the producer and the consumer.

Step 2: Importance in modern business.

In today’s competitive world, marketing is vital for survival and growth because it helps in:

- Creating awareness about products and services.

- Building brand identity and loyalty.

- Increasing sales and revenue.

- Adapting products to meet changing consumer demands.

Step 3: Marketing as a necessity.

Without marketing, even the best products may fail to reach customers.

Therefore, marketing is not a luxury or an optional activity — it is a core necessity for every business to sustain and grow.

Step 4: Analysis of options.

- (1) Unnecessary: Incorrect — business cannot survive without marketing.

- (2) Compulsory: Not wrong, but the better economic term is ‘necessary’.

- (3) Necessary: Correct — marketing ensures connection between production and consumption.

- (4) Luxury: Incorrect — it is essential, not extravagant.

Step 5: Conclusion.

Thus, marketing is a necessary function for every business.

Quick Tip: Marketing bridges the gap between production and consumption — making it an indispensable element of business success.

Fixed cost includes

View Solution

Step 1: Understanding fixed cost.

Fixed costs are expenses that do not change with the level of production or sales.

They remain constant over a certain period, irrespective of output levels.

Examples include rent, insurance, salaries of permanent staff, and depreciation of buildings.

Step 2: Distinguishing between fixed and variable cost.

- Fixed cost: Remains constant — e.g., factory rent or depreciation.

- Variable cost: Changes with production — e.g., raw materials, wages, power consumption.

Step 3: Factory cost explanation.

The cost of factory facilities (such as rent, insurance, and maintenance) remains unchanged within a production range.

Hence, it is classified under fixed costs because it does not fluctuate with production volume.

Step 4: Analysis of options.

- (1) Cost of raw materials: Variable, changes with output.

- (2) Cost of labours: Partly variable depending on production.

- (3) Cost of power: Varies with machinery use.

- (4) Cost of factory: Correct — a fixed expense that remains stable regardless of production levels.

Step 5: Conclusion.

Hence, the cost of factory is included under fixed cost.

Quick Tip: Fixed costs remain constant — like factory rent or insurance — while variable costs change with production, like materials and labor.

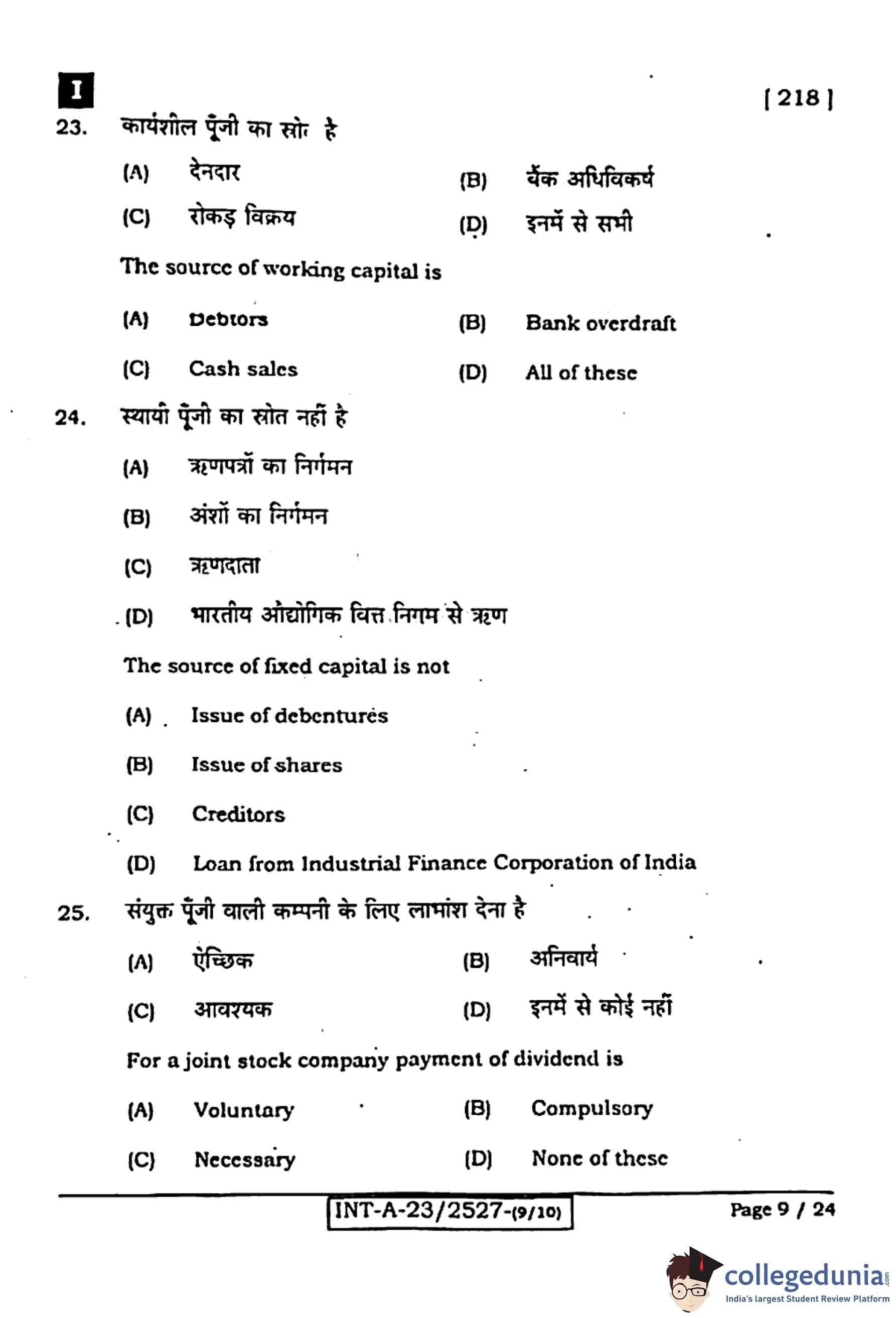

The source of working capital is

View Solution

Step 1: Understanding working capital.

Working capital refers to the amount of capital that a business requires to run its daily operations.

It is calculated as the difference between current assets and current liabilities.

\[ Working Capital = Current Assets - Current Liabilities \]

A company needs working capital to finance its short-term obligations, pay wages, purchase materials, and meet operational expenses.

Step 2: Sources of working capital.

The main sources of working capital include:

- Debtors: When a company sells goods on credit, debtors represent money to be received — a current asset, thus a source of working capital.

- Bank overdraft: This is a short-term borrowing facility provided by banks to meet immediate cash needs, which serves as a temporary source of working capital.

- Cash sales: Cash sales generate immediate inflow of funds, increasing liquidity and providing working capital.

Step 3: Importance of multiple sources.

In practice, a combination of these sources is used to maintain a steady flow of working capital and ensure business continuity.

Proper management of working capital ensures smooth operations and financial stability.

Step 4: Analysis of options.

- (1) Debtors: Correct, provides short-term capital inflow.

- (2) Bank overdraft: Correct, provides temporary financing.

- (3) Cash sales: Correct, increases liquidity instantly.

- (4) All of these: Correct — all the above are valid sources of working capital.

Step 5: Conclusion.

Hence, the source of working capital is All of these.

Quick Tip: Working capital ensures operational efficiency — manage debtors, cash, and short-term loans wisely for smooth daily functioning.

The source of fixed capital is not

View Solution

Step 1: Understanding fixed capital.

Fixed capital refers to the funds invested in long-term assets such as land, buildings, plant, machinery, and equipment.

These assets are not intended for sale; rather, they are used continuously in the production process to generate income.

Step 2: Common sources of fixed capital.

Fixed capital is usually raised from long-term financial sources such as:

- Issue of shares: Capital obtained from shareholders represents long-term equity funding.

- Issue of debentures: Funds borrowed through debentures are repayable over a long period, suitable for fixed asset investments.

- Loans from financial institutions: Organizations like the Industrial Finance Corporation of India (IFCI) provide long-term loans for setting up industries and purchasing machinery.

Step 3: Why creditors are not a source.

Creditors are individuals or entities to whom the business owes short-term obligations — generally payable within a year.

Since creditors represent short-term liabilities, they cannot be considered a source of fixed capital, which is meant for long-term investment.

Step 4: Analysis of options.

- (1) Issue of debentures: Long-term source — correct for fixed capital.

- (2) Issue of shares: Long-term equity — correct.

- (3) Creditors: Incorrect for fixed capital — a short-term liability.

- (4) Loan from IFCI: Long-term institutional source — correct.

Step 5: Conclusion.

Hence, the source of fixed capital is not creditors.

Quick Tip: Fixed capital is always raised from long-term sources like shares, debentures, and institutional loans — not from short-term liabilities like creditors.

For a joint stock company, payment of dividend is

View Solution

Step 1: Understanding dividend.

A dividend is the portion of profits distributed by a joint stock company to its shareholders as a reward for their investment.

It is declared by the company’s Board of Directors and approved by shareholders during the annual general meeting (AGM).

Step 2: Legal nature of dividend payment.

Payment of dividends is not a legal obligation.

A company may choose to reinvest its profits in business expansion, debt repayment, or other uses.

Only when the Board declares a dividend does it become payable to shareholders.

Step 3: Voluntary nature.

The payment depends on factors like profit availability, liquidity, expansion plans, and dividend policy.

Hence, it is a voluntary decision based on management discretion rather than a compulsory act.

Step 4: Analysis of options.

- (1) Voluntary: Correct — depends on company policy and financial performance.

- (2) Compulsory: Incorrect — no law mandates compulsory dividend payment.

- (3) Necessary: Incorrect — may not always be appropriate.

- (4) None of these: Incorrect.

Step 5: Conclusion.

Thus, for a joint stock company, payment of dividend is voluntary.

Quick Tip: Dividend payments are discretionary — companies may retain profits for growth or declare dividends depending on financial health and strategy.

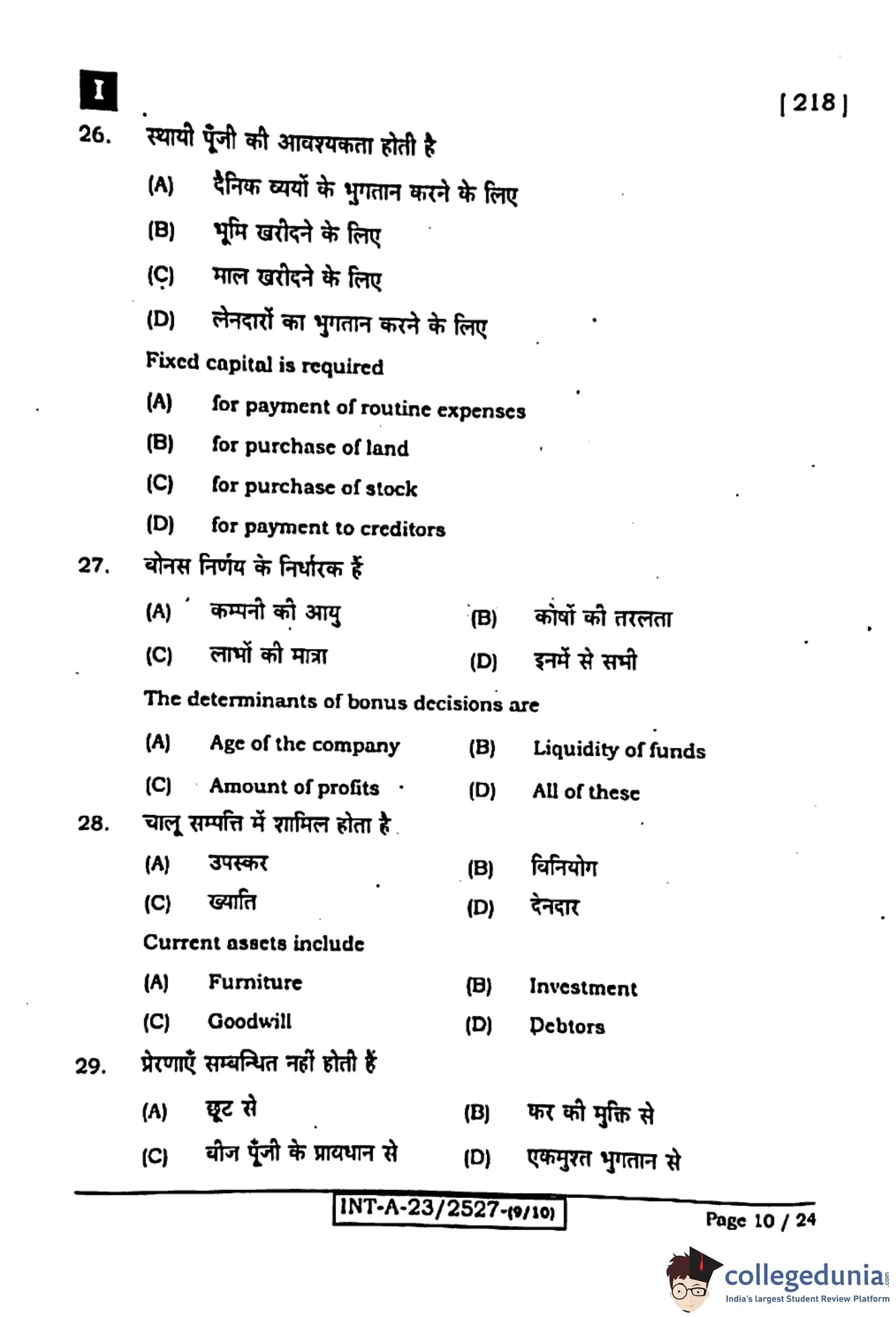

Fixed capital is required

View Solution

Step 1: Understanding fixed capital.

Fixed capital refers to the funds that are invested in long-term assets of a business.

These assets are not intended for immediate resale but are used over several years to generate income.

Examples include land, buildings, machinery, vehicles, and equipment.

Step 2: Purpose of fixed capital.

Fixed capital is required for the purchase, installation, and maintenance of long-term assets that help in the production of goods and services.

It is essential for establishing and expanding the infrastructure of an organization.

Step 3: Why land purchase is part of fixed capital.

Land is a long-term asset that provides the physical foundation for business operations such as factories, offices, and warehouses.

The expenditure on land is non-recurring and remains fixed regardless of the level of production.

Step 4: Analysis of options.

- (1) For payment of routine expenses: Incorrect — these are short-term and come under working capital.

- (2) For purchase of land: Correct — land is a long-term investment and requires fixed capital.

- (3) For purchase of stock: Incorrect — this is a current asset funded through working capital.

- (4) For payment to creditors: Incorrect — involves current liabilities, not fixed assets.

Step 5: Conclusion.

Hence, fixed capital is required for the purchase of land.

Quick Tip: Fixed capital is invested in long-term assets like land, buildings, and machinery, while working capital meets short-term operational needs.

The determinants of bonus decisions are

View Solution

Step 1: Understanding bonus decisions.

A bonus is an additional payment made by an employer to employees as a reward for their contribution to the organization’s success.

Bonus decisions depend on multiple financial and organizational factors that determine how much and when bonuses are distributed.

Step 2: Major determinants of bonus decisions.

- Age of the company: Older companies with stable finances and established markets are often in a better position to pay bonuses than new firms.

- Liquidity of funds: The availability of cash or liquid assets plays a crucial role — even profitable firms may delay bonuses if liquidity is low.

- Amount of profits: The company’s profitability directly affects its capacity to distribute bonuses, as bonuses are usually paid out of profit reserves.

Step 3: Interrelation of factors.

Each of these determinants interacts — for instance, a profitable but cash-strapped company might postpone bonuses, while a financially stable firm may pay consistently.

Step 4: Analysis of options.

- (1) Age of the company: Correct but not sole factor.

- (2) Liquidity of funds: Correct, determines ability to pay.

- (3) Amount of profits: Correct, source of bonus distribution.

- (4) All of these: Correct — all three factors jointly determine bonus policies.

Step 5: Conclusion.

Thus, the determinants of bonus decisions include the company’s age, liquidity, and profitability — hence, All of these.

Quick Tip: Bonus distribution depends on a firm’s financial strength, liquidity, and profitability — not on a single factor alone.

Current assets include

View Solution

Step 1: Understanding current assets.

Current assets are short-term assets that can be easily converted into cash within one year.

They are used in day-to-day operations and help maintain liquidity in a business.

Examples include cash, debtors, bills receivable, and stock.

Step 2: Role of debtors.

Debtors are individuals or firms who owe money to the business after purchasing goods or services on credit.

Since this amount is expected to be received soon, it is treated as a current asset.

Step 3: Comparison with other options.

- Furniture: Considered a fixed asset as it has long-term utility.

- Investment: May be current or non-current, but generally long-term in nature.

- Goodwill: An intangible fixed asset, not a current one.

- Debtors: Represent short-term receivables, hence a current asset.

Step 4: Importance of debtors as current assets.

Debtors contribute to a firm’s liquidity position and form a vital part of working capital management.

Efficient management of debtors ensures timely inflows and stable cash cycles.

Step 5: Conclusion.

Therefore, among the given options, Debtors are classified as current assets.

Quick Tip: Debtors are part of current assets as they can be converted into cash quickly — unlike furniture or goodwill, which are fixed assets.

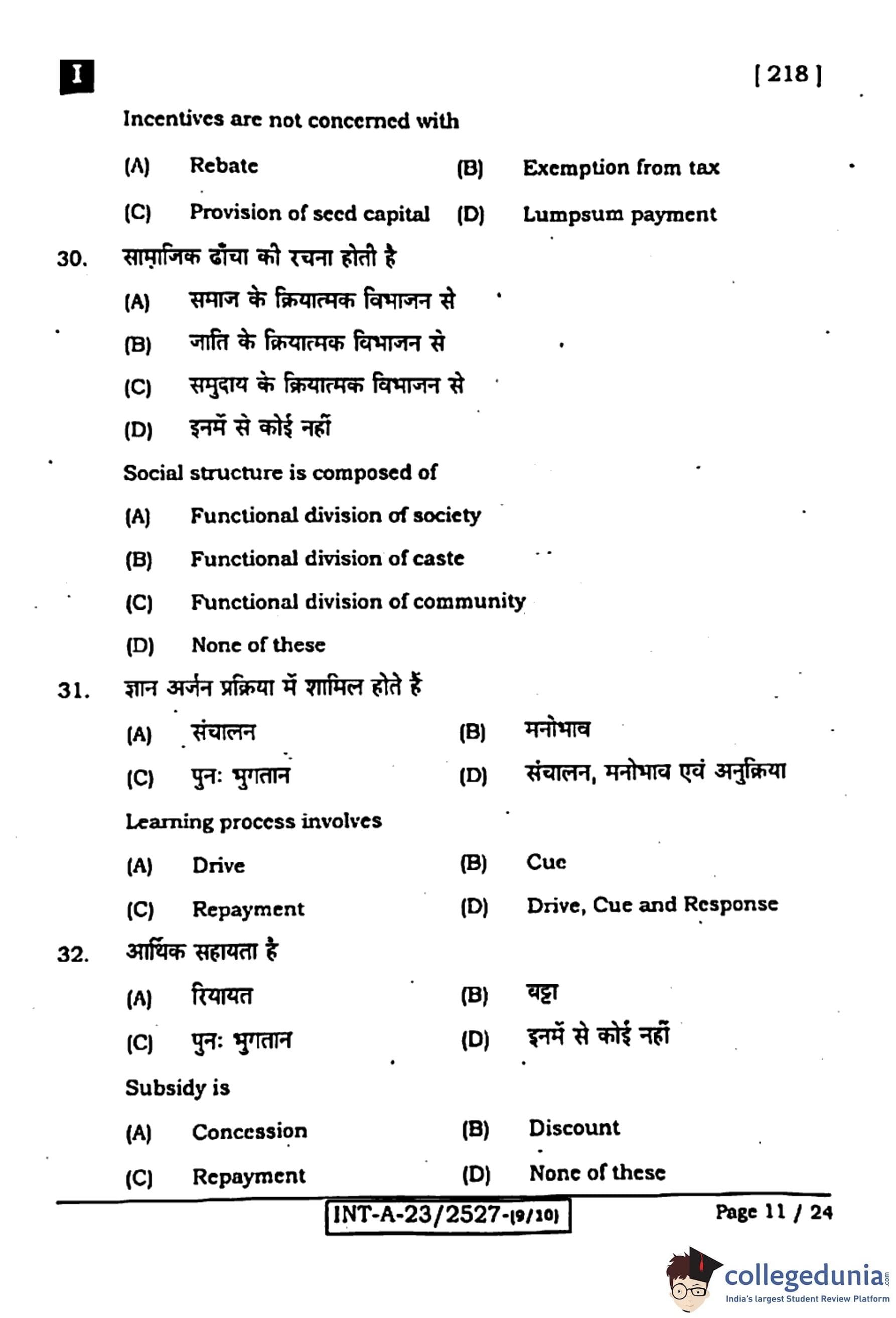

Incentives are not concerned with

View Solution

Step 1: Understanding incentives.

Incentives are benefits, rewards, or concessions given by the government or organizations to encourage certain economic or business activities.

They are designed to motivate entrepreneurs, industries, and employees to improve performance, productivity, or investment.

Step 2: Common forms of incentives.

Incentives may include:

- Rebate: Reduction or refund on taxes or duties.

- Exemption from tax: Relief from paying certain taxes for a specific period.

- Provision of seed capital: Providing initial financial assistance to start a new venture.

Step 3: Nature of lump-sum payment.

A lump-sum payment is a one-time financial transaction or settlement not directly linked to performance or motivation.

It is generally considered a compensation or settlement, not an incentive.

Step 4: Analysis of options.

- (1) Rebate: Related to incentives.

- (2) Exemption from tax: An important type of incentive.

- (3) Provision of seed capital: Encourages entrepreneurship.

- (4) Lumpsum payment: Not an incentive; it is a fixed payment unrelated to motivation or promotion.

Step 5: Conclusion.

Hence, incentives are not concerned with lump-sum payment.

Quick Tip: Incentives are benefits aimed at motivation or growth — not one-time financial settlements like lump-sum payments.

Social structure is composed of

View Solution

Step 1: Understanding social structure.

The term ‘social structure’ refers to the organized pattern of relationships and institutions that make up a society.

It defines how different groups and individuals interact within a social framework and how social order is maintained.

Step 2: Functional division concept.

Social structure is based on the functional division of society, meaning different members or groups perform specific roles that contribute to the smooth working of society.

For example, teachers educate, farmers produce food, and administrators manage governance — all of which are essential functions.

Step 3: Why not caste or community.

While caste or community can influence structure in traditional societies, the broader concept of social structure encompasses the overall role and function of individuals in the entire society.

Step 4: Analysis of options.

- (1) Functional division of society: Correct — it forms the base of social structure.

- (2) Functional division of caste: Incorrect — caste is a sub-aspect, not the whole.

- (3) Functional division of community: Limited view, not comprehensive.

- (4) None of these: Incorrect.

Step 5: Conclusion.

Hence, social structure is composed of the functional division of society.

Quick Tip: Social structure organizes society through division of roles and responsibilities ensuring stability and cooperation among individuals.

Learning process involves

View Solution

Step 1: Understanding learning.

Learning is a process through which experience or practice results in a relatively permanent change in behavior.

It involves motivation, action, and feedback that help individuals acquire new knowledge or skills.

Step 2: Components of learning process.

According to the behavioral theory of learning, the process includes:

- Drive: The internal motivation or desire to act (e.g., hunger motivating food-seeking).

- Cue: The stimulus or signal that directs behavior (e.g., seeing food).

- Response: The reaction or behavior resulting from the cue (e.g., eating the food).

Reinforcement then strengthens the learning connection between cue and response.

Step 3: Explanation.

A combination of drive, cue, and response explains how habits and learned behaviors develop through repetition and reward.

Step 4: Analysis of options.

- (1) Drive: Important but incomplete alone.

- (2) Cue: Essential but not sufficient.

- (3) Repayment: Irrelevant — not part of learning process.

- (4) Drive, Cue and Response: Correct — all three form the basis of learning behavior.

Step 5: Conclusion.

Hence, the learning process involves Drive, Cue, and Response.

Quick Tip: Learning is a behavioral change resulting from Drive (motivation), Cue (stimulus), and Response (action) — reinforced through experience.

Subsidy is

View Solution

Step 1: Understanding the term “Subsidy.”

A subsidy is a form of financial assistance granted by the government or an institution to individuals or businesses.

It is intended to promote certain economic activities or to make essential goods and services affordable.

Subsidies may take various forms such as direct cash payments, tax reductions, or price support mechanisms.

Step 2: Meaning of “Concession.”

A concession refers to a reduction in the price, tax, or cost of something as a form of financial relief.

In economics, it aligns closely with the idea of subsidy — both represent financial assistance or relaxation in costs.

Step 3: Analysis of options.

- (1) Concession: Correct — a subsidy acts as a financial concession provided by the government.

- (2) Discount: Incorrect — a discount is a price reduction given by a seller to promote sales, not a government grant.

- (3) Repayment: Incorrect — repayment involves returning borrowed money; it’s the opposite of a subsidy.

- (4) None of these: Incorrect — as “concession” accurately represents a subsidy.

Step 4: Conclusion.

Therefore, a subsidy is best described as a concession.

Quick Tip: A subsidy is financial aid or concession, not a commercial discount. Governments use subsidies to support industries, farmers, and public welfare schemes.

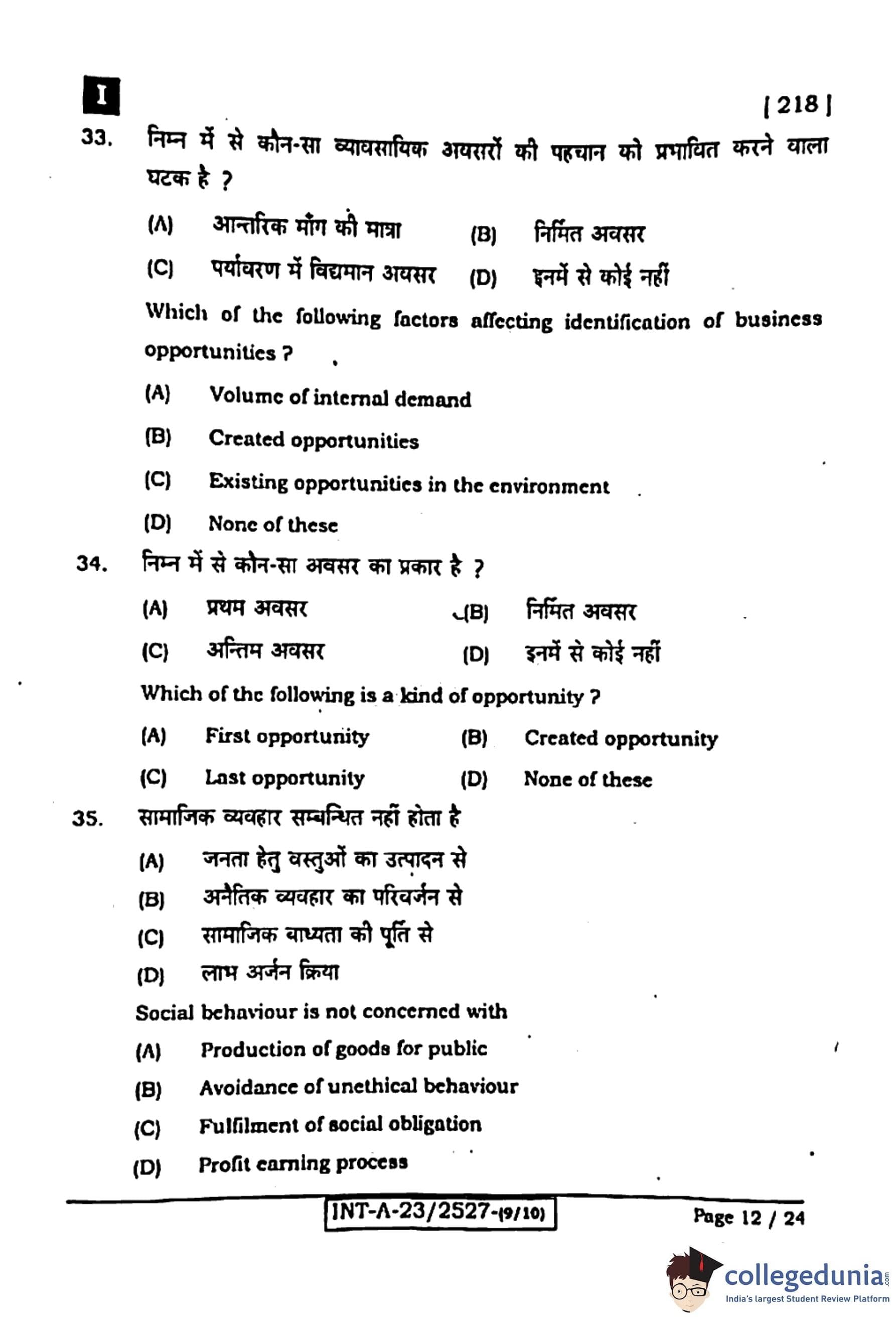

Which of the following factors affect the identification of business opportunities?

View Solution

Step 1: Understanding Business Opportunity Identification.

The process of identifying a business opportunity involves observing and analyzing the external environment to locate gaps or unmet needs in the market.

Entrepreneurs and organizations continuously scan their surroundings to find viable opportunities that can be converted into profitable ventures.

Step 2: Factors Influencing Identification.

One of the key factors influencing opportunity identification is the presence of existing opportunities in the environment.

These opportunities often arise due to technological changes, policy reforms, social trends, or consumer behavior shifts.

Step 3: Analysis of options.

- (1) Volume of internal demand: This affects production decisions, not the identification of new opportunities.

- (2) Created opportunities: These result after identifying opportunities, not before.

- (3) Existing opportunities in the environment: Correct — these help identify new ventures and business ideas.

- (4) None of these: Incorrect — option (3) correctly matches the influencing factor.

Step 4: Conclusion.

Hence, the factor affecting identification of business opportunities is the existing opportunities in the environment.

Quick Tip: Always observe market trends, consumer needs, and technological advancements — these existing opportunities often lead to successful business ideas.

Which of the following is a kind of opportunity?

View Solution

Step 1: Understanding the term “Opportunity.”

In the field of business and entrepreneurship, an opportunity refers to a favorable situation or condition that allows an entrepreneur to start or expand a business.

It arises from changing market conditions, technological innovations, or shifts in consumer behavior.

Step 2: Types of Opportunities.

Opportunities can be classified into different types: natural (or existing) opportunities and created opportunities.

A created opportunity is one that an entrepreneur identifies and develops through innovation, research, or creative effort, rather than waiting for it to naturally exist in the environment.

Step 3: Analysis of options.

- (1) First opportunity: Incorrect — this is not a recognized type of business opportunity.

- (2) Created opportunity: Correct — because it refers to an opportunity generated by entrepreneurial effort or innovation.

- (3) Last opportunity: Incorrect — not a standard classification in business studies.

- (4) None of these: Incorrect — as “created opportunity” is indeed a valid type.

Step 4: Conclusion.

Therefore, among the given options, the correct answer is Created opportunity.

Quick Tip: Entrepreneurs often create opportunities through innovation and market insight rather than waiting for them to appear naturally.

Social behaviour is not concerned with

View Solution

Step 1: Understanding Social Behaviour.

Social behaviour refers to the actions and conduct of individuals or groups guided by societal norms, ethics, and moral values.

It involves behaving responsibly and ethically toward society and ensuring actions contribute to the welfare of others.

Step 2: Role of Social Behaviour in Business.

In the context of business, social behaviour includes:

- Producing goods and services for public welfare.

- Avoiding unethical and exploitative practices.

- Fulfilling social obligations such as environmental protection and employee welfare.

However, earning profit is a business objective, not a social one. Profit-making is necessary for business survival but is not classified as part of social behaviour.

Step 3: Analysis of options.

- (1) Production of goods for public: This is part of social responsibility — hence related to social behaviour.

- (2) Avoidance of unethical behaviour: This is directly part of ethical social conduct.

- (3) Fulfilment of social obligation: Again, an essential component of social behaviour.

- (4) Profit earning process: Correct — as it is an economic activity, not a social one.

Step 4: Conclusion.

Therefore, social behaviour is not concerned with the profit earning process.

Quick Tip: Remember: Social behaviour in business emphasizes ethics, social responsibility, and welfare — not profit-making motives.

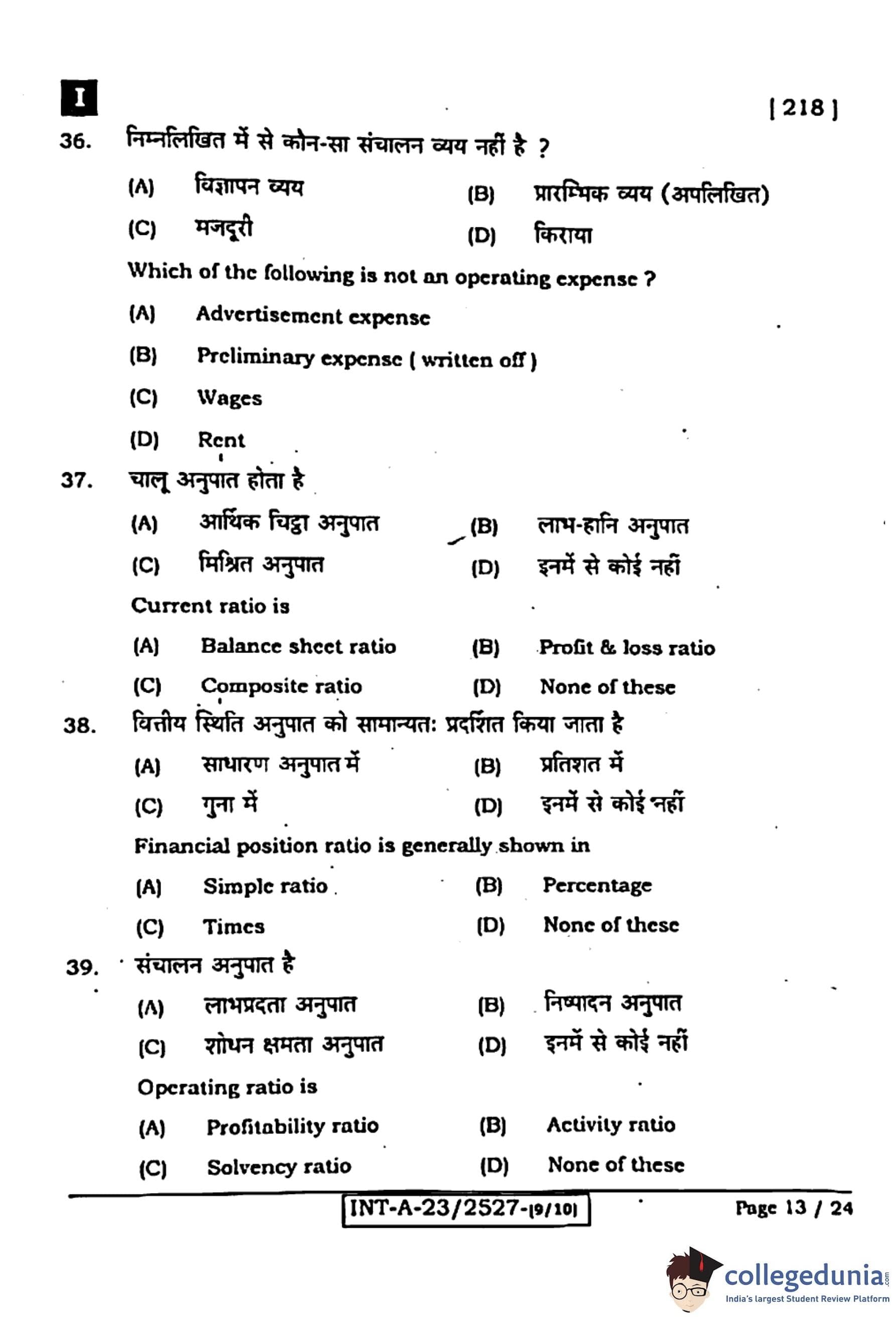

Which of the following is not an operating expense?

View Solution

Step 1: Understanding Operating Expenses.

Operating expenses are the day-to-day costs incurred by a business during its normal operations.

These include salaries, rent, advertisement, utilities, and other regular business expenses.

They are directly related to running the business and maintaining operations.

Step 2: Non-operating expenses.

Non-operating expenses are costs that are not directly linked to daily operations, such as interest, depreciation, and preliminary expenses written off.

Preliminary expenses are incurred before a business starts operating (like registration fees, promotion costs), and their write-off is a non-operational cost.

Step 3: Analysis of options.

- (1) Advertisement expense: Operating expense — incurred regularly to promote business.

- (2) Preliminary expense (written off): Non-operating — not part of regular operations.

- (3) Wages: Operating expense — part of daily business operations.

- (4) Rent: Operating expense — recurring business cost.

Step 4: Conclusion.

Hence, Preliminary expense (written off) is not an operating expense.

Quick Tip: Operating expenses occur regularly during business activities, while preliminary expenses are incurred before operations begin.

Current ratio is

View Solution

Step 1: Meaning of Current Ratio.

The current ratio measures a company’s ability to pay short-term obligations with its short-term assets.

It is calculated as:

\[ Current Ratio = \frac{Current Assets}{Current Liabilities} \]

Step 2: Classification of Ratios.

Accounting ratios are generally divided into:

- Balance Sheet Ratios (derived from Balance Sheet items).

- Income Statement Ratios (from Profit & Loss accounts).

- Composite Ratios (from both Balance Sheet and P&L items).

Since the current ratio uses only Balance Sheet items (current assets and current liabilities), it is a Balance Sheet Ratio.

Step 3: Analysis of options.

- (1) Balance sheet ratio: Correct — both numerator and denominator come from the Balance Sheet.

- (2) Profit & loss ratio: Incorrect — it involves income or expenditure accounts.

- (3) Composite ratio: Incorrect — not a mix of P&L and Balance Sheet items here.

- (4) None of these: Incorrect — option (1) fits correctly.

Step 4: Conclusion.

Hence, the Current ratio is a Balance Sheet Ratio.

Quick Tip: The Current Ratio helps assess liquidity; a ratio of 2:1 is generally considered ideal.

Financial position ratio is generally shown in

View Solution

Step 1: Understanding Financial Position Ratios.

Financial position ratios are used to measure a company’s liquidity, solvency, and stability based on its financial statements.

Examples include current ratio, debt-equity ratio, and proprietary ratio.

Step 2: Expression of these ratios.

These ratios are generally expressed in simple ratio form (like 2:1, 1:1), rather than in percentages or times.

This simple ratio format helps compare the relationship between two financial statement items easily.

Step 3: Analysis of options.

- (1) Simple ratio: Correct — expresses relation like 2:1, 3:2, etc.

- (2) Percentage: Incorrect — used mainly in profitability ratios.

- (3) Times: Incorrect — used in turnover or activity ratios.

- (4) None of these: Incorrect — option (1) is correct.

Step 4: Conclusion.

Thus, the Financial position ratio is generally shown in Simple ratio form.

Quick Tip: Liquidity and solvency ratios (like current or debt-equity) are best shown in simple ratio form for clarity.

Operating ratio is

View Solution

Step 1: Understanding Operating Ratio.

The operating ratio measures the relationship between operating expenses and net sales.

It indicates the efficiency of business operations and how much of the total revenue is used to cover operational costs.

The formula is:

\[ Operating Ratio = \frac{Operating Cost}{Net Sales} \times 100 \]

Step 2: Relation to Profitability.

A lower operating ratio indicates higher profitability, as it shows that a smaller portion of revenue is spent on operations.

Therefore, it is a type of Profitability Ratio, since it helps assess operational efficiency and profit control.

Step 3: Analysis of options.

- (1) Profitability ratio: Correct — measures how efficiently expenses are managed to generate profit.

- (2) Activity ratio: Incorrect — measures asset utilization, not profitability.

- (3) Solvency ratio: Incorrect — measures long-term financial stability.

- (4) None of these: Incorrect — as (1) fits best.

Step 4: Conclusion.

Thus, the Operating Ratio is a Profitability Ratio.

Quick Tip: The lower the operating ratio, the higher the business efficiency — an ideal ratio is around 70–75%.

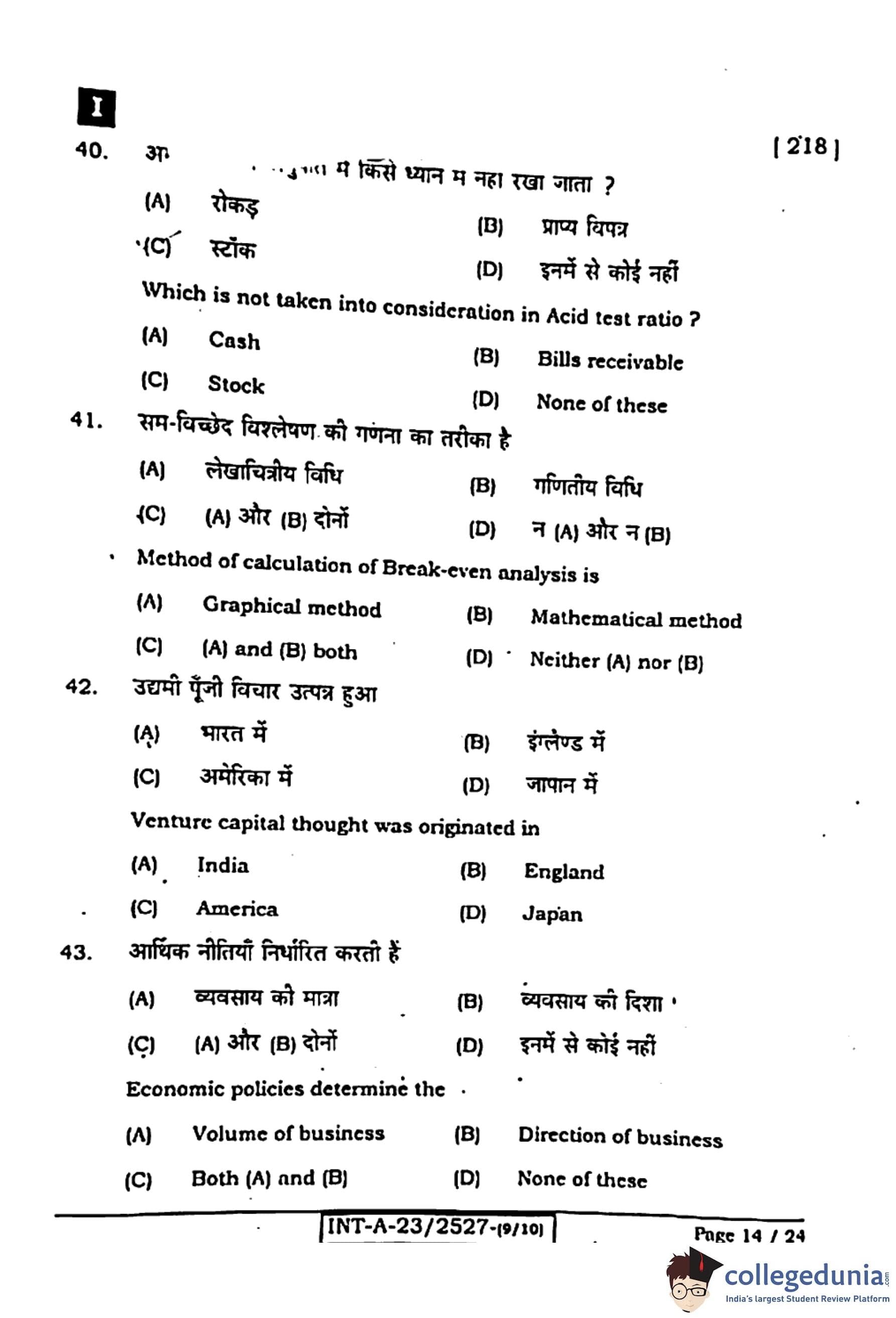

Which is not taken into consideration in Acid Test Ratio?

View Solution

Step 1: Understanding Acid Test Ratio.

The Acid Test Ratio, also known as the Quick Ratio, measures a firm’s ability to meet its short-term liabilities with its most liquid assets.

The formula is:

\[ Acid Test Ratio = \frac{Current Assets - Inventory}{Current Liabilities} \]

This ratio excludes items that are not easily convertible into cash, such as stock or inventory.

Step 2: Reason for exclusion.

Stock or inventory is excluded because it may take time to sell, making it less liquid compared to other current assets like cash or receivables.

Step 3: Analysis of options.

- (1) Cash: Included — it is the most liquid asset.

- (2) Bills receivable: Included — can be quickly converted into cash.

- (3) Stock: Excluded — not easily liquidated, hence not part of the quick ratio.

- (4) None of these: Incorrect — stock is indeed excluded.

Step 4: Conclusion.

Hence, Stock is not taken into consideration while calculating the Acid Test Ratio.

Quick Tip: Remember: Quick Ratio = Current Assets – Inventory / Current Liabilities. Inventory is always excluded as it’s less liquid.

Method of calculation of Break-even analysis is

View Solution

Step 1: Understanding Break-even Analysis.

Break-even analysis determines the level of sales at which total revenue equals total cost — i.e., no profit, no loss.

It helps managers identify the minimum output or sales volume required to avoid losses.

Step 2: Methods of calculation.

Break-even analysis can be calculated using:

- Graphical Method: Represented visually where the total cost and total revenue curves intersect.

- Mathematical Method: Calculated using the formula:

\[ Break-even Point (in units) = \frac{Fixed Costs}{Selling Price per Unit – Variable Cost per Unit} \]

Hence, both graphical and mathematical methods are valid.

Step 3: Analysis of options.

- (1) Graphical method: Correct but not the only one.

- (2) Mathematical method: Also correct.

- (3) Both (A) and (B): Correct — both are recognized methods.

- (4) Neither (A) nor (B): Incorrect.

Step 4: Conclusion.

Therefore, Break-even analysis can be calculated by both the Graphical and Mathematical methods.

Quick Tip: Use Graphical Method for visual analysis and Mathematical Method for precise calculation of break-even points.

Venture capital thought was originated in

View Solution

Step 1: Understanding Venture Capital.

Venture capital refers to financing provided to start-ups and emerging firms that have high growth potential but also carry high risk.

It plays a crucial role in fostering innovation and entrepreneurship.

Step 2: Origin of Venture Capital.

The concept of venture capital originated in the United States of America after World War II.

The first formal venture capital firm, “American Research and Development Corporation (ARDC),” was founded in 1946 by Georges Doriot.

The success of venture capital in America later inspired its adoption in other countries.

Step 3: Analysis of options.

- (1) India: Incorrect — introduced later in the 1980s.

- (2) England: Incorrect — venture funding developed later here.

- (3) America: Correct — birthplace of venture capital.

- (4) Japan: Incorrect — adopted after the U.S. model.

Step 4: Conclusion.

Hence, the concept of Venture Capital originated in America.

Quick Tip: The first venture capital firm “ARDC” was established in the USA in 1946 — marking the beginning of modern venture financing.

Economic policies determine the

View Solution

Step 1: Understanding Economic Policies.

Economic policies are government strategies formulated to guide the functioning of the economy and the business environment.

These include fiscal policy, monetary policy, trade policy, and industrial policy.

Step 2: Role of Economic Policies in Business.

Economic policies directly influence both the volume (extent or scale of business activities) and the direction (nature and type of industries encouraged) of business operations.

For example, liberal trade policies increase business volume, while policies promoting green industries determine business direction.

Step 3: Analysis of options.

- (1) Volume of business: Correct — policies affect the scale of production and trade.

- (2) Direction of business: Correct — policies guide business priorities and sectors.

- (3) Both (A) and (B): Correct — covers both aspects accurately.

- (4) None of these: Incorrect.

Step 4: Conclusion.

Hence, Economic policies determine both the volume and direction of business.

Quick Tip: Economic policies influence both the size and type of industries that develop within a nation.

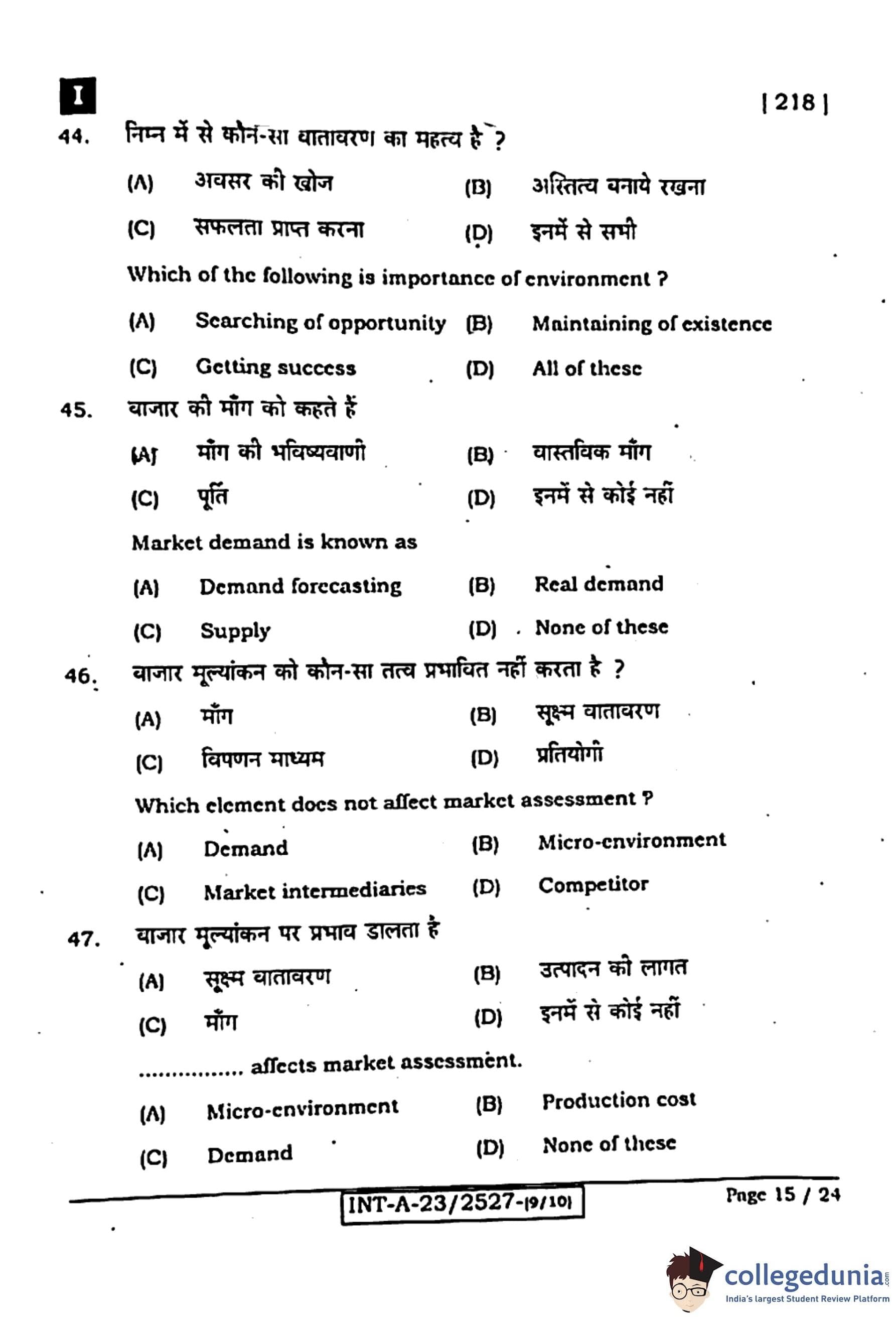

Which of the following is an importance of environment?

View Solution

Step 1: Understanding the Business Environment.

The business environment includes all external and internal factors that influence business operations such as economic, social, political, and technological forces.

Understanding the environment helps businesses adapt to changes, identify opportunities, and overcome threats.

Step 2: Importance of the Environment.

The business environment is important because:

- It helps in searching for new opportunities by analyzing market trends.

- It aids in maintaining existence by allowing firms to adapt to environmental changes.

- It ensures business success by helping organizations make strategic decisions.

Step 3: Analysis of options.

- (1) Searching of opportunity: Correct but partial.

- (2) Maintaining of existence: Also correct.

- (3) Getting success: True but not the only importance.

- (4) All of these: Correct — covers all aspects of business-environment importance.

Step 4: Conclusion.

Hence, the importance of business environment includes all of the above — searching opportunity, maintaining existence, and achieving success.

Quick Tip: A strong understanding of the business environment ensures long-term growth and adaptability to change.

Market demand is known as

View Solution

Step 1: Understanding Market Demand.

Market demand refers to the total quantity of a product that consumers in a market are willing and able to purchase at various prices during a specific period.

It represents the combined demand of all individual consumers in a market.

Step 2: Meaning of Demand Forecasting.

Demand forecasting is the process of estimating future demand for a product or service based on historical data, market trends, and analysis.

Thus, market demand is closely related to the concept of demand forecasting.

Step 3: Analysis of options.

- (1) Demand forecasting: Correct — market demand helps predict future sales trends.

- (2) Real demand: Refers to actual sales, not estimation.

- (3) Supply: Indicates availability of goods, not consumer demand.

- (4) None of these: Incorrect — option (1) is correct.

Step 4: Conclusion.

Therefore, market demand is known as demand forecasting.

Quick Tip: Demand forecasting helps in planning production, pricing, and inventory management effectively.

Which element does not affect market assessment?

View Solution

Step 1: Understanding Market Assessment.

Market assessment involves studying the various internal and external factors that influence a business’s market position.

It includes analyzing demand, competition, distribution channels, and pricing mechanisms.

Step 2: Role of Micro-environment.

The micro-environment includes factors such as customers, suppliers, intermediaries, and competitors that directly affect the company.

However, while these factors influence business decisions, the “micro-environment” itself is a broader category, not a single influencing element in market value determination.

Step 3: Analysis of options.

- (1) Demand: Strongly affects market conditions and pricing.

- (2) Micro-environment: Correct — it’s a broad category and not a direct element affecting market assessment.

- (3) Market intermediaries: Influence market distribution.

- (4) Competitor: Affects pricing and strategy decisions.

Step 4: Conclusion.

Hence, the Micro-environment does not directly affect market assessment as an individual factor.

Quick Tip: While micro-environment affects business operations broadly, specific factors like demand and competition have more direct market impact.

................. affects market assessment.

View Solution

Step 1: Understanding Market Assessment.

Market assessment refers to evaluating the factors that influence market trends, pricing, and business decisions.

Among these, demand plays a crucial role as it directly determines the level of sales, production, and pricing strategies.

Step 2: Role of Demand.

Demand determines how much of a product consumers are willing to buy at given prices.

A high level of demand leads to increased production and market growth, while low demand results in reduced business activity.

Step 3: Analysis of options.

- (1) Micro-environment: Includes multiple factors, not a single determinant.

- (2) Production cost: Affects profitability, not market assessment directly.

- (3) Demand: Correct — it has a direct and strong influence on market trends and assessments.

- (4) None of these: Incorrect — as demand directly affects the market.

Step 4: Conclusion.

Thus, Demand is the most significant factor affecting market assessment.

Quick Tip: High market demand encourages production expansion, innovation, and competitive pricing strategies.

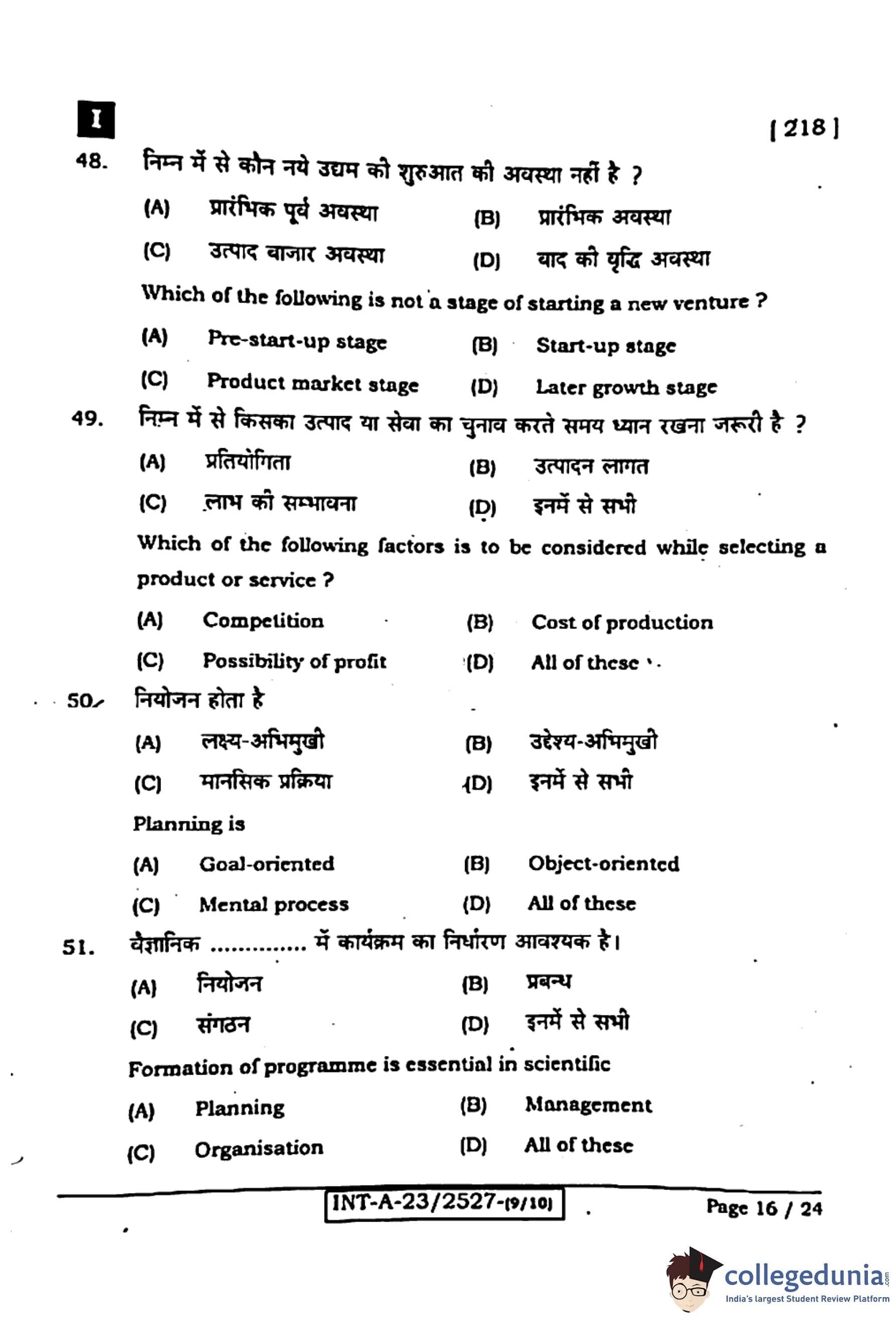

Which of the following is not a stage of starting a new venture?

View Solution

Step 1: Understanding stages of starting a new venture.

Starting a new business involves several key stages — each representing a different phase in the journey of entrepreneurship.

The major stages are:

1. Pre-start-up stage – Idea generation, feasibility analysis, and planning.

2. Start-up stage – Implementation of plans, setting up operations, and launching products.

3. Growth stage – Expanding operations, increasing sales, and entering new markets.

Step 2: Clarifying the incorrect option.

“Product market stage” is not a recognized stage in standard venture creation models. It refers to a marketing process rather than a business development phase.

Step 3: Analysis of options.

- (1) Pre-start-up stage: A recognized stage in venture initiation.

- (2) Start-up stage: A key phase where the business is launched.

- (3) Product market stage: Incorrect — not part of the recognized stages.

- (4) Later growth stage: Correctly represents business expansion.

Step 4: Conclusion.

Hence, the Product market stage is not a stage of starting a new venture.

Quick Tip: Entrepreneurial venture stages are Pre-start-up, Start-up, and Growth; “Product market” refers to marketing, not venture development.

Which of the following factors is to be considered while selecting a product or service?

View Solution

Step 1: Understanding product/service selection.

Selecting the right product or service is one of the most crucial decisions for an entrepreneur.

It determines the future success, profitability, and sustainability of the business.

Step 2: Factors influencing selection.

An entrepreneur must consider:

- Competition: The number and strength of competitors affect pricing and market share.

- Cost of production: Determines pricing strategy and profitability margin.

- Possibility of profit: Ensures the financial feasibility of the business idea.

Step 3: Analysis of options.

- (1) Competition: Important to assess market position.

- (2) Cost of production: Determines whether production is financially viable.

- (3) Possibility of profit: Core motive for business existence.

- (4) All of these: Correct — all these factors must be evaluated together.

Step 4: Conclusion.

Thus, all the listed factors — competition, cost of production, and profit potential — must be considered before finalizing a product or service.

Quick Tip: A successful entrepreneur always evaluates market demand, cost, and competition before launching a product.

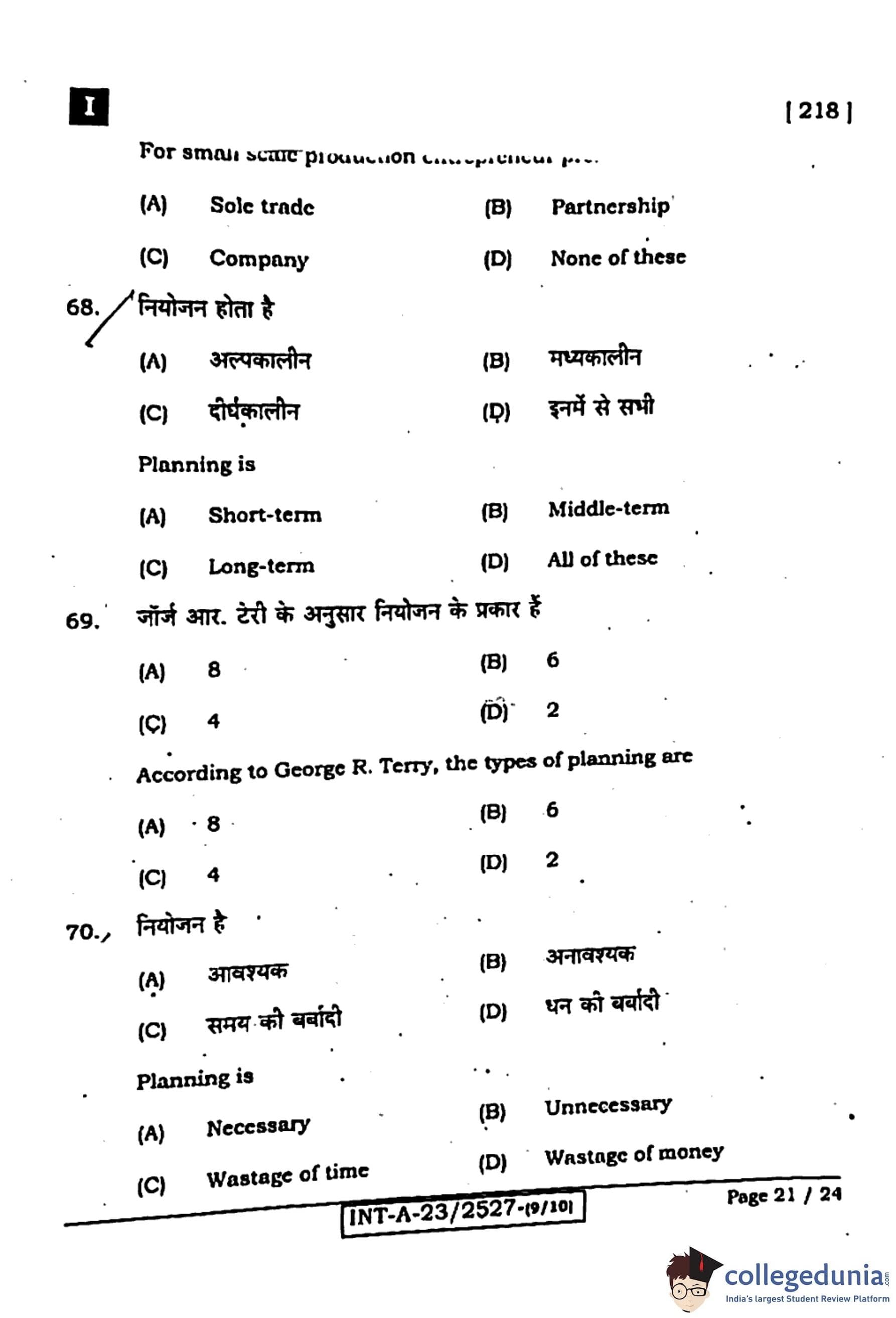

Planning is

View Solution

Step 1: Definition of Planning.

Planning is the process of deciding in advance what is to be done, how it is to be done, and who will do it.

It serves as the foundation of management and provides direction to all organizational activities.

Step 2: Characteristics of Planning.

- Goal-oriented: Planning always aims at achieving organizational objectives.

- Object-oriented: It aligns all activities towards the purpose or mission of the business.

- Mental process: It involves decision-making and problem-solving using logical reasoning.

Step 3: Analysis of options.

- (1) Goal-oriented: Correct — planning sets objectives.

- (2) Object-oriented: Correct — focuses on business aims.

- (3) Mental process: Correct — involves thinking before acting.

- (4) All of these: Correct — includes all above attributes.

Step 4: Conclusion.

Hence, planning is a goal-oriented, object-oriented, and mental process.

Quick Tip: Planning bridges the gap between where we are and where we want to be — it is the first function of management.

Formation of programme is essential in scientific

View Solution

Step 1: Understanding scientific planning.

Scientific planning is a systematic process of setting goals, developing policies, and formulating strategies to achieve organizational objectives efficiently.

It emphasizes logic, data analysis, and factual decision-making instead of guesswork.

Step 2: Role of programme formation.

Programme formation is a key step in planning as it involves setting a sequence of actions to achieve desired outcomes.

Without planning, programme implementation lacks structure and direction.

Step 3: Analysis of options.

- (1) Planning: Correct — programme formation is an integral part of planning.

- (2) Management: Incorrect — management is a broader function.

- (3) Organisation: Refers to resource arrangement, not programme formulation.