Company Secretary (CS) is a 3-year professional course that trains students to handle the legal aspects of a firm including tax returns and record keeping. A Company Secretary is directly involved in a company’s strategy and ensures that all the activities comply with legal and regulatory requirements.

The Institute of Company Secretaries of India (ICSI) trains and regulates Company Secretaries in India under the Company Secretaries Act, of 1980. More than 65,000 members and around 2,50,000 students are on the ICSI roll. As per the new UGC guidelines, the CS Exam is equivalent to a postgraduate degree. Students have the option to pursue higher studies in the field of research.

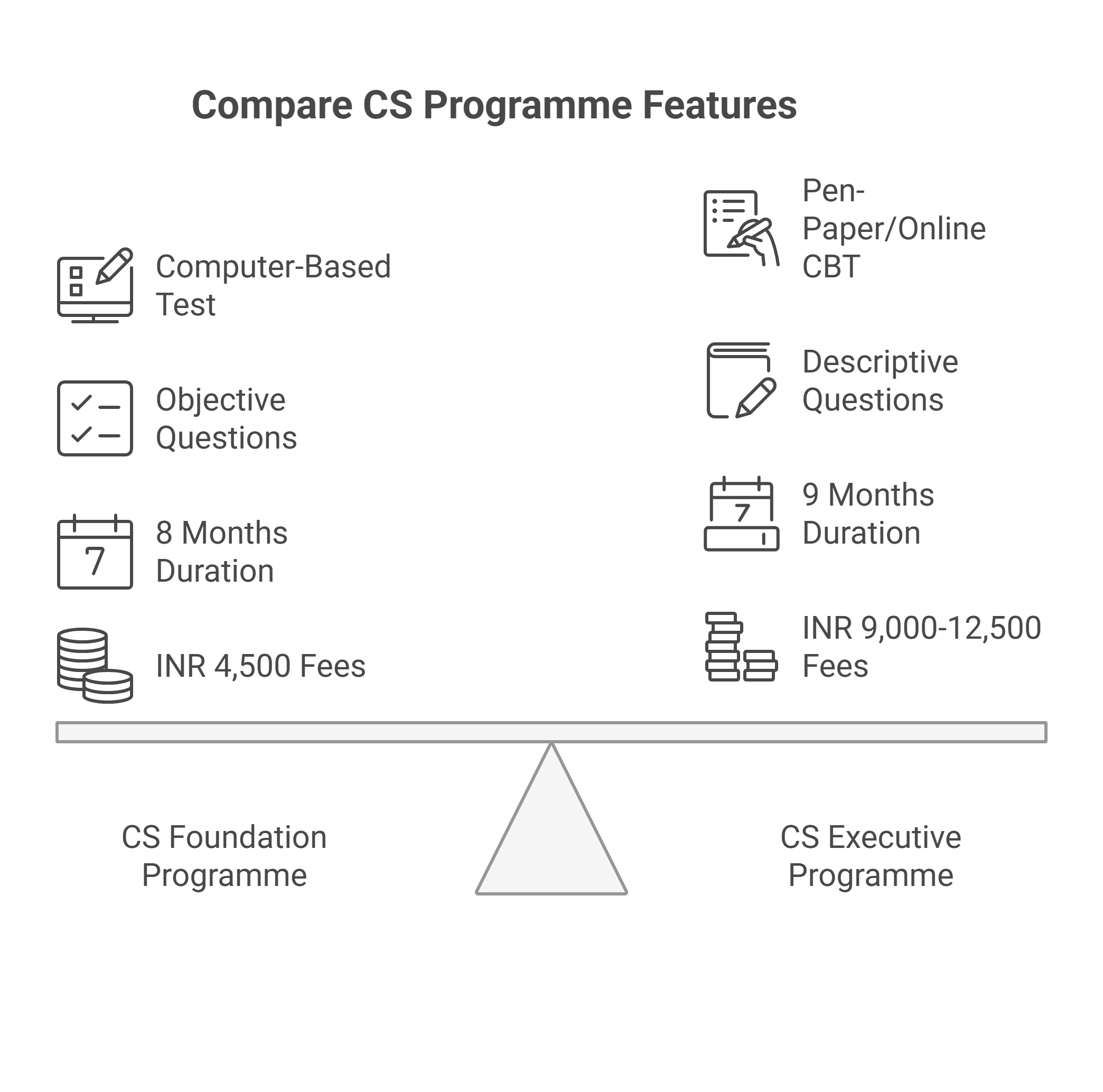

The CS Exam Fee is INR 4,500 for the CS Foundation, INR 8,500 to 12,500 for the CS Executive, and INR 12,000 for the CS Professional Course. CS Course duration is 8 months for CS Foundation, 9 months for CS Executive, and 15 months for CS Professional. The CS Foundation exam has been replaced by the CSEET exam. Students who wish to pursue the Company Secretary Course after graduation are exempted from passing the CSEET.

- Company Secretary Highlights

- What is Company Secretary (CS)?

- CS Foundation

- CS Executive Course

- CS Professional Course

- Company Secretary Training

- CS vs CA

- CS vs CMA

- Duty of a Company Secretary

- Company Secretary Jobs and Salary

- Top Colleges Supporting CS Course in India

- Top Coaching Institutes for CS in India

- Company Secretary FAQs

Company Secretary Highlights

Here are the key highlights of the Company Secretary Course:

| Particulars | Details |

|---|---|

| Course Name | Company Secretary (CS) |

| Regulating Authority | Institute of Company Secretaries of India (ICSI) |

| Type of Course | Professional Certification |

| Course Levels | Foundation Programme, Executive Programme, Professional Programme |

| Entry Eligibility | 10+2 for Foundation; Graduation (excluding Fine Arts) for Executive |

| Direct Entry Route | Available for Graduates/Postgraduates (excluding Fine Arts) |

| Medium of Instruction | English |

| Mode of Study | Distance Learning + Optional Online/Offline Coaching |

| Course Duration | 3 to 5 years (based on entry level and completion time) |

| Examination Frequency | Twice a year (June and December) |

| Registration Open | Throughout the year |

| Exam Mode | Offline/Online (as per ICSI policy) |

| Subjects in Foundation | 4 subjects |

| Subjects in Executive | 8 subjects (2 modules) |

| Subjects in Professional | 9 subjects (3 modules + open book elective) |

| Elective Options (Professional) | 8 subjects including Forensic Audit, IPR, Banking, Insurance, Insolvency, etc. |

| Recognition | Equivalent to a postgraduate degree (as per UGC notification) |

| Course Fees | INR 4,500 (Foundation), INR 8,500–INR 12,500 (Executive), INR 12,000 (Professional) |

| Exam Fees | INR 1,200 per module |

| Admission Deadlines | Mar 31/Sep 30 (Foundation); Feb 28/May 31/Aug 31/Nov 30 (Executive) |

| Last Date for Exam Forms | Mar 25 & Sep 25 (Late fee till Apr 9 & Oct 10) |

| Training Requirements | 1–3 years internship based on course stage, plus 15-day MSOP |

| Internship Mode | With specified entities (law firms, corporates, CS in practice) |

| Qualifying Marks | Minimum 40% in each paper and 50% aggregate |

| Language Options for Exam | English and Hindi (except Business Communication in Foundation) |

| Job Roles | Company Secretary, Compliance Officer, Legal Advisor, Risk Manager |

| Average Starting Salary | INR 2.5 LPA to INR 5 LPA |

| Experienced Salary Range | INR 6 LPA to INR 12 LPA or more |

| Top Recruiters | TCS, Infosys, Reliance, L&T, Aditya Birla Group, PSUs, Regulatory Bodies |

| Employment Areas | Corporates, Law Firms, Government, PSUs, MNCs, Academic Institutions |

| Global Opportunities | Recognised in Commonwealth countries; additional qualifications may be required abroad |

| Advancement Option | Eligible for PhD, Fellow CS (FCS) after experience |

| Official Website | www.icsi.edu |

What is Company Secretary (CS)?

The CS course or Company Secretary course is specially designed for students coming from a commerce background. However, students from any field, completing their 12 standards, have access to this course. The Institute of Company Secretary of India offers the course to become a Company Secretary (CS). The course is available via distance learning, and with the setup of this course, the profession of being a Company Secretary (CS) came.

Candidates aspiring to seek admission to this program, in this institute, need to crack the CSEET or the Company Secretary Executive Entrance test. The exam is conducted on a national level. There are overall four Company Secretary Course programs, which the candidates can pursue to be a secretary of a company, namely, the Foundation Programme, Executive Programme, Professional Programme, and Management Training.

Review of the Video: Company Secretary (CS) Course Described | Indian Roles, Pay, and Scope

This video contains the entire process of becoming a Company Secretary (CS) in India. It describes which students should take the course, how it operates, the kind of jobs that can be obtained, and the cost. It's especially useful for students interested in law and corporate work, but who don’t want to go into court practice.

Key Highlights:

- What is CS? A Company Secretary handles a company’s legal tasks, ensures compliance with laws, and advises top management.

- Course Provider: The course is run by ICSI (Institute of Company Secretaries of India), not by any college.

- Course Levels:

- CSEET (Executive Entrance Test)

- Executive Program

- Professional Program

- Training Needed: Just like doctors or lawyers, CS students must do internships (called articleship) under a qualified CS professional.

- Who Should Pick Company Secretary? Perfect for students who want to study business and law but don't want to work in a courtroom. Acts such as Income Tax, GST, Company Law, Labour Law, and others are dealt with by CS.

- Career Options: A Company Secretary can work at a company as a legal/compliance specialist, OR They can start their own CS practice (like a law firm)

- Job Demand: Any company with more than INR 10 crore paid-up capital must have a CS, making demand high and steady.

- A CS is regarded as a Key Managerial Person (KMP) in an organisation, and they frequently answer directly to CEOs and MDs as well as other top executives.

- The full company secretary course can be completed in three to four years for approximately INR 5 to 7 lakh, including all expenses.

- Tip: Law + CS as a dual qualification is very powerful for career growth in corporate law and compliance.

This video gives a real, practical look at the CS profession. It’s a great starting point for anyone thinking about this legal-corporate career path!

When to Study the Company Secretary Course?

- Candidates completing their 12 standards and looking to get into a good commerce field can apply for the Company Secretary (CS).

- Also, candidates should be above 17 years of age in the year of admission to the Company Secretary course.

- Candidates appearing for their 12th board exam can also apply for the Company Secretary (CS).

Who should study Company Secretary Course?

- Students coming from a commerce background and aspiring to choose a renowned field in this area should go for the Company Secretary (CS).

- Candidates having good mental strength and strong convincing power can apply for the Company Secretary course, as these two things are highly required in the profession of a Company Secretary.

- There are also some desirable skill sets that the candidates must possess to pursue this course. Among these are strong communication skills, time management, multitasking, being an expert in company law, working as a meticulous planner, and having a good command of spoken and written English.

How to Become a Company Secretary?

Candidates aspiring to become a Company Secretary (CS) need to appear for the CSET exam. Students who have completed their 10+2 are eligible to pursue this course. There are three course levels in this exam, namely the foundation course, executive course, and professional course.

Candidates have to first enrol in the Foundation course, which is course level one. After passing, students have to register themselves for the Executive course, and then the Professional program. There is a final management training round after completing the Professional level. Accomplishing that, candidates will be officially certified as a Company Secretary (C.S.) graduate. The Company Secretary's salary in India is 6 lakhs per year.

Company Secretary: Course Levels

The Company Secretary has 3-course levels, namely, Foundation Programme, Executive Programme, and Professional Programme.

| Course Level | Mode of Exam & Duration per Paper | Type of Questions | Duration | Fees (INR) |

|---|---|---|---|---|

| CS Foundation Programme | Computer-Based Test & 90 minutes | Objective (MCQs) | 8 Months | 4,500 |

| CS Executive Programme | Pen-Paper/Online CBT & 3 hours | Descriptive (with MCQs in select papers) | 9 Months |

9000/- (for Commerce Graduates) |

| CS Professional Programme | Pen-Paper/Online & 3 hours | Descriptive (Open Book for Elective) | 10 Months | 12,000 |

Video Review: How to Become a Company Secretary (CS) in India | Course Details & Salary

This video from Quick Support explains everything you need to know about becoming a Company Secretary (CS) in India. It covers the full process from entrance exams to training and job roles. If you're thinking about a legal and corporate career, this video is perfect for you!

Key Highlights:

- What is a Company Secretary? A CS handles a company’s legal work, tax filing, records, and advises the board to ensure the business runs by legal rules.

- Course Authority: The Institute of Company Secretaries of India (ICSI) runs the CS course and exams.

- Course Stages:

- CSEET (CS Executive Entrance Test) – mandatory for all

- Executive Program

- Professional Program

- CSEET Exam Details:

- Conducted online

- Covers subjects like business law, economics, reasoning, and communication

- No negative marking

- Course Fees:

- CSEET fee: INR 1,000 (concessions available)

- Executive & Professional course fee: INR 10,600 to INR 15,600 depending on qualifications

- Exam Validity: CSEET result is valid for 8 years; course registration is valid for 5 years

- Training Required: 1-month soft skill training + 21-month industry training

- Job Roles After CS:

- Legal Advisor

- Company Registrar

- Corporate Planner

- Administrative Secretary

- Assistant to the Board of Directors

- Top Recruiters: ONGC, Oil India, Deloitte, PNB, HCL Technologies, and more

- Salary Insight:

- Freshers: INR 28,000 – INR 40,000 per month

- Experienced CS professionals can earn up to INR 1,00,000+ monthly

This video is a complete guide for anyone dreaming of a career as a Company Secretary in India. It’s detailed, easy to follow, and super informative for students and job seekers!

CS Foundation

The CS foundation course trains students in various areas, including entrepreneurship, management, business environment, ethics, accounting, and economics. Check out the eligibility, course duration, course fee, syllabus, and entrance exams for the foundation course for the Company Secretary.

CS Foundation: Eligibility

Students must meet the CS Foundation Eligibility to sit for the CS Foundation Exam. The eligibility criteria are mentioned below:

- Candidates aspiring to take up the foundation course under the Company Secretary Course must pass their 10+2 entrance exams.

- Candidates should successfully pass their 12th exams from a recognised educational institute or equivalent, with a minimum of 50% aggregate marks.

CS Foundation: Duration

The Company Secretary course duration is 3 years, which is parallel to a postgraduate degree. The first level of the Company Secretary course, i.e., the foundation program, is 8 months long.

CS Foundation: Fee Structure

Candidates pursuing the CS foundation program need to pay both the admission and tuition fees. The total course fee for this course is INR 4500.

| Description | Fees (INR) |

|---|---|

| Examination Fee | 1200 |

| Total Fee | 4500 |

CS Foundation Syllabus

The CS Foundation syllabus is as follows:

| Paper Code | Subject Name | Description |

|---|---|---|

| Paper 1 | Business Communication | Covers business laws, Indian contract act, and basic legal frameworks |

| Paper 2 | Legal Aptitude & Logical Reasoning | Focuses on management principles, business ethics, and entrepreneurial skills |

| Paper 3 | Economic & Business Environment | Explains micro and macroeconomic principles, market dynamics, and national income |

| Paper 4 | Current Affairs & Quantitative Aptitude | Introduces accounting basics and auditing procedures used in corporate setups |

CS Foundation Exam Dates

For the CS Foundation course, there is a CS Foundation entrance exam, where there will be 4 papers, based on the syllabus mentioned above. Each paper will have 100 marks, for a total of 400. The total number of questions for the test will be 250 MCQs, which the candidates need to complete in 90 minutes. It is a CBT exam.

Check out the important entrance exam dates for the 2025 CS foundation exam below.

| Paper | June 2025 Date & Time (Tentative) | December 2025 Date & Time (Tentative) |

|---|---|---|

| Paper-1: Business Environment and Law | June 8, 2025 – 9:30 AM to 11:00 AM | December 7, 2025 – 9:30 AM to 11:00 AM |

| Paper 2: Business Management, Ethics, and Entrepreneurship | June 8, 2025 – 12:00 PM to 1:30 PM | December 7, 2025 – 12:00 PM to 1:30 PM |

| Paper-3: Business Economics | June 9, 2025 – 9:30 AM to 11:00 AM | December 8, 2025 – 9:30 AM to 11:00 AM |

| Paper-4: Fundamentals of Accounting and Auditing | June 9, 2025 – 12:00 PM to 1:30 PM | December 8, 2025 – 12:00 PM to 1:30 PM |

CS Executive Course

The CS executive course involves various areas, mainly regarding the law. This includes commercial law, company law, general law, tax law, accounts and audit practice, and securities law. Know the eligibility, course duration, course fee, syllabus, and entrance exams for the executive program in the Company Secretary course.

CS Executive: Eligibility

CS Executive Eligibility criteria must be met to sit for this examination. The CS Executive Eligibility criteria are mentioned below:

- The CSEET Exam is a mandatory qualifying test for all categories of students for registration to the Executive Programme, except for a few exempted categories.

- Candidates must have completed Class 12 to be eligible for CSEET.

- Also, the age bar of the candidates should be above 17.

The following categories of students are exempted from qualifying for CSEET and can seek registration directly to the Executive Programme:

| Eligible Category | Total Fee | Remarks |

|---|---|---|

| Commerce Graduates | INR 9,000 | For B.Com or similar graduates |

| CPT passed (ICAI) / Foundation passed (ICAI-CMA) | INR 12,500 | Must provide valid proof from ICAI or ICMAI |

| Non-Commerce Graduates | INR 10,000 | For BA, B.Sc. (excluding Fine Arts), etc. |

| CS Foundation Passed Students | INR 8,500 | For those who cleared CS Foundation under ICSI |

CS Executive: Duration

Company Secretary course duration for the Executive program lasts for 9 months. ICSI CS Executive program registration is open throughout the year for the exam conducted in June and December.

CS Executive: Fee Structure

The fee structure for the CS executive program differs from the earlier one, and the total course fee is higher in this instance. The registration fee for the CS executive course is INR 1500, while there is another fee for the foundation examination exemption, which is INR 500. The tuition fee for this course is INR 5000, and the total course fee stands at INR 7000.

| Description | Fees (INR) |

|---|---|

| Registration | 1500 |

| Tuition Fee | 5000 |

| Examination Form fee | 1800 |

| Examination Fee | 500 |

| Total | 8,800 |

CS Executive: Syllabus

In the CS executive course syllabus, there will be two modules, namely I and II. In each module, there will be 4 papers. In module I, there will be the topics of Interpretation, Jurisprudence, and General laws in paper I, company law in paper II, setting up of business entities, and closure and tax laws in the last two papers.

On the other hand, in Module II, Paper I will consist of corporate and management accounting, and Paper II will consist of securities laws and capital markets. In the last two papers, there will be Business, Economics and Commercial Law, and financial and strategic management, respectively.

| Paper No | Group | Subject Name |

|---|---|---|

| 1 | Group 1 | Jurisprudence, Interpretation & General Laws |

| 2 | Company Law & Practice | |

| 3 | Setting Up of Business, Industrial & Labour Laws | |

| 4 | Corporate Accounting and Financial Management | |

| 5 | Group 2 | Capital Market & Securities Laws |

| 6 | Economic, Commercial and Intellectual Property Laws | |

| 7 | Tax Laws & Practice |

CS Executive Exams Dates

To be eligible for the CS executive course, candidates must pass the CSEET exam, i.e., the CS Executive Entrance Test. Candidates with a UG or PG degree can apply for this entrance.

| Event | June 2025 Session | December 2025 Session |

|---|---|---|

| Last Date for Registration (Both Modules) | February 28, 2025 | August 31, 2025 |

| Last Date for Registration (Single Module) | May 31, 2025 | November 30, 2025 |

| Last Date for Exam Form (Without Late Fee) | March 25, 2025 | September 25, 2025 |

| Last Date for Exam Form (With Late Fee INR 250) | April 9, 2025 | October 10, 2025 |

| Admit Card Release | May 25, 2025 (Expected) | November 25, 2025 (Expected) |

| Exam Dates | June 1 to June 10, 2025 (Tentative) | December 20 to December 30, 2025 (Tentative) |

| Result Declaration | August 2025 | February 2026 |

CS Professional Course

The CS professional course is the final level of the CS program. Find the eligibility, duration, course fee, syllabus, and entrance exams below:

CS Professional Eligibility

For candidates seeking admission to the CS Professional course, they must come through the CS executive program successfully.

CS Professional: Duration

The final course in the CS program is the professional course. The Company Secretary Course lasts for three years, where the first two courses combine for 15 months. The CS professional course is equal to the duration of the first two, i.e. 15 months.

CS Professional: Fee Structure

The course fee for the CS professional course is the highest and certainly bigger than the first two. The registration fee for the same is INR 1500. Candidates must pay the fee for both exemptions from the foundation and the exemption from the executive program exam, which is INR 500 for both. Lastly, the tuition fee for this course is INR 9500, and combining all these, the total course fee stands at INR 12,000.

| Description | Fees (INR) |

|---|---|

| Examination Form Fee | 2250 |

| Registration Fee | 1500 |

| Tuition Fee | 9500 |

| Total | 13,250 |

CS Professional: Syllabus

In the CS Professional course, there will be three modules, and each module will consist of three papers.

| Paper No. | Subject Name | Total Marks |

|---|---|---|

| 1 | Environmental, Social & Governance (ESG) | 100 |

| 2 | Drafting, Pleadings & Appearances | 100 |

| 3 | Compliance Management, Audit & Due Diligence | 100 |

| 4 | Elective 1 (Choose 1 from ICSI Electives) | 100 |

| 5 | Strategic Management & Corporate Finance | 100 |

| 6 | Corporate Restructuring, Valuation & Insolvency | 100 |

| 7 | Elective 2 (Choose 1 from ICSI Electives) | 100 |

| Elective 1 (Choose One) | ||

|---|---|---|

| Paper No. | Subject | Marks Distribution |

| 4.1 | CSR & Social Governance | Part I: CSR (50) Part II: Social Governance (50) |

| 4.2 | Internal and Forensic Audit | Part I: Internal Audit (60) Part II: Forensic Audit (40) |

| 4.3 | Intellectual Property Rights – Law & Practice | 100 Marks |

| 4.4 | AI, Data Analytics & Cyber Security – Laws & Practice | 100 Marks |

| 4.5 | Advanced Direct Tax Laws & Practice | 100 Marks |

| Elective 2 (Choose One) | ||

|---|---|---|

| Paper No. | Subject | Marks Distribution |

| 7.1 | Arbitration, Mediation & Conciliation | Part I: Arbitration & Conciliation (70) Part II: Mediation (30) |

| 7.2 | GST & Corporate Tax Planning | Part I: GST (70) Part II: Corporate Tax Planning (30) |

| 7.3 | Labour Laws & Practice | 100 Marks |

| 7.4 | Banking & Insurance – Laws & Practice | Part I: Banking Laws (50) Part II: Insurance Laws (50) |

| 7.5 | Insolvency and Bankruptcy – Law & Practice | 100 Marks |

CS Professional Exam Dates

CS Professional exams take place twice a year. This takes place mostly in June and December. The CS Professional Exam Results are released after 1 month of the exam.

| Event | June 2025 Session | December 2025 Session |

|---|---|---|

| Last Date for Registration (Both Modules) |

February 28, 2025 | August 31, 2025 |

| Last Date for Registration (Single Module) |

May 31, 2025 | November 30, 2025 |

| Last Date for Exam Form (Without Late Fee) |

March 25, 2025 | September 25, 2025 |

| Last Date for Exam Form (With Late Fee INR 250) |

April 9, 2025 | October 10, 2025 |

| Admit Card Release (Expected) |

May 25, 2025 | November 25, 2025 |

| Examination Period | June 1 to June 10, 2025 (Tentative) | December 20 to December 30, 2025 (Tentative) |

| Result Declaration | August 2025 | February 2026 |

Company Secretary Training

Company Secretary (CS) Training is an important component of the CS Course. The training structure includes several phases, such as the One Day Orientation Programme (ODOP), Executive Development Programme (EDP), 21-month Practical Training, and the Management Skills Orientation Programme (MSOP). Check these in detail below.

| Training Component | Duration | Stage of Completion | Remarks |

|---|---|---|---|

| Three Days Orientation Programme (TDOP) | 3 days | After registration to Executive Programme | Mandatory before starting any training |

| Executive Development Programme (EDP) | 30 days | After passing Executive Programme | Can be completed online or offline |

| Practical Training / Internship | 21 months | After passing Executive Programme | To be completed under a Practicing Company Secretary or in specified entities |

| Corporate Leadership Development Programme (CLDP) | 30 days | After passing Professional Programme and completing training | Mandatory before applying for Associate Membership (ACS) |

| Pre-Examination Test | N/A (Online) | Before appearing for Executive and Professional exams | Mandatory for eligibility to sit for main exams |

CS vs CA

The choice between becoming a Company Secretary (CS) or a Chartered Accountant (CA) is often difficult for students who wish to work in corporate governance, finance, or law. CS focuses primarily on legal compliance, corporate law, and company governance, while CA emphasises accounting, taxation, and auditing. The company secretary course and the chartered accounting course are compared in detail below:

| Feature | Company Secretary (CS) | Chartered Accountant (CA) |

|---|---|---|

| Governing Body | ICSI (Institute of Company Secretaries of India) | ICAI (Institute of Chartered Accountants of India) |

| Focus Area | Corporate laws, compliance, secretarial audit | Accounting, auditing, taxation, financial reporting |

| Eligibility | 10+2 or Graduation | 10+2 or Graduation |

| Entry Exam | CSEET (for 10+2) | CA Foundation (for 10+2) |

| Course Levels | Executive, Professional | Intermediate, Final |

| Course Duration | 3–5 years | 4.5–5 years |

| Articleship Duration | 1–3 years (based on stage) | 3 years |

| Fees | INR 25,000–INR 30,000 (approx.) | INR 50,000–INR 80,000 (approx.) |

| Subjects | Law, Governance, Tax, Ethics | Accounting, Audit, Tax, Law, Finance |

| Exam Frequency | Twice a year | Twice a year |

| Job Roles | Company Secretary, Compliance Officer | Auditor, CA, Tax Consultant, Financial Analyst |

| Average Salary (Fresher) | INR 3–8 LPA | INR 6–10 LPA |

CS vs CMA

Company Secretary (CS) and Cost and Management Accountant (CMA) are two top professional courses in the finance sector. CS is particularly suitable for those who are aiming for legal and administrative roles within organisations, as it focuses on corporate law, governance, regulatory frameworks, and secretarial practices. On the other hand, CMA is appropriate for positions in internal financial management, pricing strategy, cost control, and budgeting because it concentrates on cost accounting, budgeting, performance management, and strategic financial planning. A detailed comparison of CS vs CMA is provided below:

| Feature | Company Secretary (CS) | Cost and Management Accountant (CMA) |

|---|---|---|

| Governing Body | ICSI | ICMAI (Institute of Cost Accountants of India) |

| Focus Area | Corporate law, compliance, governance | Cost accounting, budgeting, strategic finance |

| Eligibility | 10+2 or Graduation | 10+2 or Graduation |

| Entry Exam | CSEET (for 10+2) | CMA Foundation (for 10+2) |

| Course Levels | Executive, Professional | Intermediate, Final |

| Course Duration | 3–5 years | 3–4 years |

| Training Duration | 1–3 years | 6 months (minimum) |

| Fees | INR 25,000–INR 30,000 | INR 50,000–INR 60,000 |

| Subjects | Law, Taxation, Secretarial Practices | Costing, Financial Reporting, Strategic Management |

| Job Roles | Corporate Secretary, Legal Advisor | Cost Accountant, Financial Controller, MIS Analyst |

| Average Salary (Fresher) | INR 3–8 LPA | INR 4–7 LPA |

Duty of a Company Secretary

The roles and responsibilities of a company secretary are as follows -

- Company secretaries serve as compliance officers and provide guidance as in-house legal experts.

- They act as the board of directors’ chief advisers on corporate governance matters.

- A company secretary is an expert in corporate law, capital markets, and securities law.

- They are responsible for ensuring the organisation’s regulatory compliance.

- Company secretaries also play a significant role in corporate planning and act as strategic managers.

Company Secretary Jobs and Salary

After completing the Company Secretary (CS) course, there are many job opportunities available both in India and abroad. Some of the most popular CS job roles are listed in the table below, along with important details like their job description (JD) and average salary. Below the table, we have also shared information about the types of jobs freshers can get after CS, and how much salary they can expect in the beginning.

| Job Profile | Job Description | Average Salary Range |

|---|---|---|

| Business Consultant | Collaborate across departments to streamline operations, enhance compliance, and support strategic decisions. | INR 8 – INR 12 LPA |

| Operations Manager | Implement internal policies, ensure legal compliance, and enhance operational efficiency. | INR 6.5 – INR 10 LPA |

| Investment Banker | Assist in fundraising, IPOs, and mergers, handling financial structuring and legal filings. | INR 10 – INR 18 LPA |

| Finance Consultant | Offer financial planning advice, audit financial status, and ensure compliance with financial strategies. | INR 5 – INR 8 LPA |

| Legal Advisor | Provide legal services, specialise in specific legal areas, and ensure compliance to prevent legal issues. | INR 6 – INR 10 LPA |

| Stock Broker | Facilitate buying and selling of stocks, ensuring transactions follow SEBI regulations and disclosure norms. | INR 3.5 – INR 7.5 LPA |

CS Fresher Average Salary

The table below shows the types of job roles that freshers usually get after completing the CS course. It also includes important details like the average starting salary and other useful information about these job profiles.

| Job Role | Details | Average Fresher Salary Range |

|---|---|---|

| Budget Analyst | Entry-level roles in corporations or government bodies | INR 3.5 – INR 5.5 LPA |

| Stock Broker | Commission-based income can increase with performance | INR 3 – INR 6 LPA |

| Marketing Manager | Fresher roles usually start as assistant/associate managers | INR 4 – INR 7 LPA |

| Investment Banker | High-paying but demanding, fresher roles in top firms require an MBA/CA | INR 8 – INR 12 LPA |

| Revenue Manager | Common in hospitality, airlines, and tech-based companies | INR 4 – INR 6.5 LPA |

| Audit Manager | Freshers typically start as audit associates; this role assumes experience | INR 6 – INR 9 LPA |

| Chief Financial Officer (CFO) | Generally not a fresher role; freshers in the CFO office may earn INR 6 – INR 9 LPA | INR 12 – INR 20 LPA (rare for freshers) |

CS Salary Country Wise

Below are the country-by-country salaries for the position of company secretary in various countries worldwide.

| Country | Average Salary Range (per annum in INR) | Remarks |

|---|---|---|

| India | INR 5.5 – INR 9 LPA | Varies by experience and company type (listed vs. private) |

| Canada | INR 10 – INR 15 LPA | CS professionals often need additional local certifications |

| United Kingdom | INR 50 – INR 75 LPA | Institute of Chartered Secretaries and Administrators (ICSA) is preferred |

| Australia | INR 9 – INR 13 LPA | Experience in governance and compliance is highly valued |

| United States | INR 22 – INR 35 LPA | Mostly work as Corporate Secretaries or Legal Compliance Officers |

CS Salary City Wise

The salary for the company secretary profession in various cities in India is provided below, organised by city.

| City | Average Salary | Remarks |

|---|---|---|

| Kolkata | INR 4.5 – INR 6 LPA | Salaries may vary based on company size; moderate demand in traditional firms |

| Mumbai | INR 7 – INR 9 LPA | Highest-paying city; hub for listed companies, MNCs, and financial firms |

| Bangalore | INR 6.5 – INR 8 LPA | High demand in tech and startup sectors, especially for compliance roles |

| Pune | INR 4.5 – INR 6 LPA | Decent pay in mid-sized firms and IT parks |

| Chennai | INR 7.5 – INR 8.5 LPA | Strong opportunities in manufacturing, shipping, and legal-heavy sectors |

| New Delhi | INR 5.5 – INR 7 LPA | Good scope with regulatory bodies, PSUs, and legal firms |

Top Colleges Supporting CS Course in India

Colleges themselves typically do not directly offer the Company Secretary (CS) course, as it is a professional course regulated by the Institute of Company Secretaries of India (ICSI) in India, or equivalent organisations in other countries.

However, some colleges and universities offer coaching or support for students pursuing CS alongside their degree (like B.Com or BBA). So, while the CS certification itself comes from ICSI, you can find college programs that support or complement CS studies. Some of the colleges that offer BCom with CS Course support are provided below.

| College Name | Location | Highlights |

|---|---|---|

| Narsee Monjee College of Commerce and Economics | Mumbai, Maharashtra | Integrated CS coaching in a top commerce college |

| Symbiosis College of Arts and Commerce | Pune, Maharashtra | Aligned with professional CS preparation |

| St. Joseph’s College of Commerce | Bangalore, Karnataka | Autonomous college with CS support |

| Christ University | Bangalore, Karnataka | Offers integrated support for CS alongside degrees |

| Loyola College | Chennai, Tamil Nadu | Top NAAC-rated college with strong commerce faculty |

| Shri Ram College of Commerce (SRCC) | Delhi | Premier commerce institution in India |

| Mount Carmel College | Bangalore, Karnataka | NAAC A+ accredited, women’s college |

| Sri Ramakrishna College of Arts and Science | Coimbatore, Tamil Nadu | Focused on CS-aligned curriculum |

| Jain Deemed-to-be University | Bangalore, Karnataka | UGC-approved, NAAC A++ accredited |

Top Coaching Institutes for CS in India

For dedicated CS exam preparation (i.e. from CS Foundation to Professional), several coaching institutes across India offer specialised training:

| Institute Name | Location | Highlights |

|---|---|---|

| iProledge Academy | Bangalore | Full coaching with study materials and online/offline options |

| ArivuPro Academy | All India (Online & Offline) | Structured learning with expert faculty |

| Yeshas Academy | Bangalore | Known for consistent CS exam success |

| SuccessEdge Academy | Bangalore | Focused on practical and exam-oriented training |

| BRICS Academy | Bangalore | Offers personalised coaching plans |

Company Secretary FAQs

Ques. What is the role of a Company Secretary?

Ans. A Company Secretary (CS) ensures a company complies with all legal and regulatory requirements. They handle corporate governance, maintain company records, and assist the board of directors in legal matters.

Ques. Is the CS course recognised as a degree?

Ans. Yes, as per UGC guidelines, the CS qualification is considered equivalent to a postgraduate degree, enabling CS professionals to pursue a PhD and academic opportunities.

Ques. Can a graduate skip the CSEET and directly join the CS Executive Programme?

Ans. Yes, graduates and postgraduates (except those in Fine Arts) are exempted from the CSEET and can directly enrol in the CS Executive Programme.

Ques. What are the job prospects after completing the CS course?

Ans. CS professionals can work in corporate compliance, legal advisory, finance, government roles, or start their own independent practice. There is also a growing demand for CS in multinational corporations.

Ques. How many attempts are allowed for each CS exam level?

Ans. There is no restriction on the number of attempts for CS exams. However, registration is valid for five years, and students must clear exams within this period or renew their registration.

Ques: What is the expected salary of a company secretary?

Ans: Candidates can earn an average of INR 4.1 lakhs per annum as a fresher, being a company secretary of an organisation.

Ques: If I study company secretary in India, can I get a job abroad as a company secretary?

Ans: Yes. Anyone having a CS degree from ICSI, as well as having a minimum of 3 to 4 years of experience in this field, offers numerous opportunities abroad countries. Among these are Singapore, the UK, Hong Kong, Malaysia, etc.

Ques: Is the position of company secretary a good career GG?

Ans: The job of a CS is a high-level job in all administrative and organisational matters. This includes company law, securities markets, various corporate strategies, and cases. Apart from the roles and responsibilities of a company secretary, they can expect an average salary of INR 25,000 to 40,000 monthly in India.

Ques: What are some good online CS (company secretary) coaching classes?

Ans: Some of the best CS (company secretary) coaching classes in India are -

- Edu-Ex

- SuperProfs

- Vignan CA Institute

- ACE Tutorials

- Deep Gyan Classes

- GOLS CS Coaching

- Takshila Learning, etc.

Ques: How difficult is it to become a company secretary?

Ans: To become a CS, aspirants have to come through the Company Secretary program, which is certainly very difficult. It is recommended that students apply for the CS executive program and the CS professional program from a recognised university by the ICSI.

Ques: How does one become a company secretary?

Ans: Candidates must be eligible and apply for the CS course first. There are three course levels for the CS program, namely the foundation course, executive course, and professional course. Passing all three courses, a candidate will be officially certified as a company secretary.

Ques: What is the scope of a CS (company secretary) course in India?

Ans: The future scope of pursuing the CS course in India is numerous. Candidates can earn a handsome amount of compensation. The job roles which aspirants can look for by pursuing this course are Operations Manager, Business Consultant, Marketing Manager, Stock Broker, Investment Banker, Finance Consultant, etc.

Ques: What is the duration of the Company Secretary Course?

Ans: The CS program has 3-course levels, namely the foundation course, executive course, and professional course. The foundation course is 8 months, the executive course is 7 months, and the professional course is 15 months, combining a total course duration to be 3 years.

Ques: What qualifications do you need to be a Company Secretary?

Ans: To become a company secretary, you need to have a professional degree in law, business, accountancy, or public administration. Also, you need to have working experience in business areas such as credit control, accounts, pensions, personnel, etc.

Ques: What is the salary of a CS?

Ans: The average starting salary of a company secretary is INR 3 lakhs, and the salary of a senior-level experienced company secretary ranges from INR 9,00,000 – 12,00,000.

Ques: Is CS easier than CA?

Ans: The CS course is primarily much easier than the CA course. The chartered accountancy course is considered one of the toughest courses in India. The CS course is overall not that easy, but comparatively easier than the CA.

Ques: Which degree is best with CS?

Ans: There are multiple degrees that candidates can have along with the CS degree. Mentionable among these are -

- CS with CA

- CS with LLB

- CS with MBA in Finance, etc.

Ques: Who Earns More, CA or CS?

Ans: Individuals having a CA degree earn much more than individuals having a CS degree. The average salary of a company secretary is 6 lakhs in India, whereas the average salary of a CA in India is around 8 lakhs.

Ques: What is the maximum salary of a CS?

Ans: The highest salary of a company secretary in India has been reportedly INR 54 lakhs. Also, candidates having a significant amount of experience are able to earn more than INR 42 lakhs per year.

Ques: What is the salary of a CS fresher?

Ans: The salary of a CS fresher in India can range from INR 3 to 3.5 lakhs per annum. It can also be above 4.1 lakh per annum if the fresher candidate has good working skills.

Ques: Can an average student crack CS?

Ans: Yes. Cracking the CS is not a big deal. Candidates have to earn a total of 60% in the theoretical paper and 40% in the practical paper.

Ques: Can I delete CS on the first attempt?

Ans: Company secretary users can delete their CS first data or request which is an export of their data.

Ques: What is the CS syllabus?

Ans: The company secretary course is mainly based on law subjects. It has three different course levels, including foundation, executive, and professional courses. The CS program mainly deals with subjects including Corporate laws, company laws, business laws, risk management, and financial management.

Ques: Can I do self-study for CS?

Ans: Yes. Individuals can execute the study of CS programs themselves. This includes a few hours of self-study, following the books, and preparing the syllabus given by the ICSI. Also, attending classroom coaching, online video lectures, etc.

Ques: Can I clear CS without coaching?

Ans: Yes. It is possible to clear the CS course without taking coaching classes. However, in that case, it is necessary for you to put effort into your studies for at least 5 to 6 hours a day.

![Haldia Law College - [HLC]](https://image-static.collegedunia.com/public/college_data/images/appImage/8768_HLC_New.jpg?h=150&w=320&mode=stretch)

![Haldia Law College - [HLC]](https://image-static.collegedunia.com/public/college_data/images/logos/1561361827logo8.png?h=30&w=30&mode=stretch)

Comments