Yatin Kumar Study Abroad Content Specialist

Study Abroad Content Specialist

The United Kingdom remains a top choice for Indian students due to its world-class education, cultural diversity, and vibrant job market. However, the cost of living is a critical factor to consider. In 2025, Indian students can expect average monthly expenses ranging between £900 to £1,400, depending on location and lifestyle. Key costs include accommodation in UK, which varies widely by city; food and groceries; healthcare insurance; and public transport. With opportunities for part-time work, a range of scholarships, and numerous student discounts, careful budgeting can make UK living manageable.

What is the Cost of Living in the UK Per Month?

Indian students in the UK should expect monthly costs that vary by city, housing, and lifestyle. Cost of Living in London is notably higher, with essential expenses covering accommodation, food, transportation, utilities, and other personal needs.

| Expense Category | Monthly Cost in London (£) | Monthly Cost in Other Cities (£) | Monthly Cost in London (INR) | Monthly Cost in Other Cities (INR) |

|---|---|---|---|---|

| Accommodation | £800 - £1,200 | £600 - £800 | ₹87,288 - ₹1,30,932 | ₹65,466 - ₹87,288 |

| Food & Groceries | £150 - £200 | £100 - £150 | ₹16,366 - ₹21,821 | ₹10,911 - ₹16,366 |

| Transportation | £65 | £45 | ₹7,092 | ₹4,910 |

| Utilities | £40 - £60 | £30 - £50 | ₹4,364 - ₹6,546 | ₹3,273 - ₹5,455 |

| Miscellaneous | £100 - £150 | £80 - £120 | ₹10,911 - ₹16,366 | ₹8,729 - ₹13,093 |

| Total | £1,155 - £1,665 | £855 - £1,165 | ₹1,26,931 - ₹1,81,452 | ₹93,378 - ₹1,26,931 |

Note: Costs will vary based on individual lifestyle choices and location.

Monthly Living Expenses in UK

Here’s a breakdown of the essential monthly expenses in London versus other cities in the UK, covering student housing in UK options, food, transportation, and miscellaneous needs.

| Expense Type | London (£) | Other Cities (£) | London (INR) | Other Cities (INR) |

|---|---|---|---|---|

| Accommodation | £800 - £1,200 | £600 - £800 | ₹87,288 - ₹1,30,932 | ₹65,466 - ₹87,288 |

| Food | £150 - £200 | £100 - £150 | ₹16,366 - ₹21,821 | ₹10,911 - ₹16,366 |

| Transportation | £65 | £45 | ₹7,092 | ₹4,910 |

| Utilities | £40 - £60 | £30 - £50 | ₹4,364 - ₹6,546 | ₹3,273 - ₹5,455 |

| Miscellaneous | £100 - £150 | £80 - £120 | ₹10,911 - ₹16,366 | ₹8,729 - ₹13,093 |

Accommodation Costs in UK

Accommodation in UK cities varies widely, with student accommodation in London city being the priciest. The following options range from university residences to shared apartments, offering flexibility based on budget.

| Accommodation Type | London (£) | Other Cities (£) | London (INR) | Other Cities (INR) |

|---|---|---|---|---|

| University Residence | £800 - £1,200 | £600 - £800 | ₹87,288 - ₹1,30,932 | ₹65,466 - ₹87,288 |

| Private Housing | £710 - £1,800 | £420 - £900 | ₹77,464 - ₹1,96,398 | ₹45,826 - ₹98,199 |

| Shared Apartment | £400 - £600 | £300 - £500 | ₹43,644 - ₹65,466 | ₹32,733 - ₹54,555 |

Tip: Shared accommodation is the most affordable. Explore options with student housing UK providers to save on costs.

Food Expenses in UK

Essential grocery items, especially when bought in bulk at discount stores like Aldi or Lidl, can help students manage their monthly food expenses. Here’s an average cost of common grocery items.

| Grocery Item | Average Cost (£) | Average Cost (INR) |

|---|---|---|

| Milk (1 liter) | £1.23 | ₹134 |

| Eggs (12) | £2.93 | ₹319 |

| Bread (500g) | £1.22 | ₹133 |

| Chicken (1kg) | £6.55 | ₹715 |

Tip: Buy in bulk, cook at home, and shop at budget-friendly stores like Aldi or Lidl.

Transportation Costs in UK

The public transportation cost in UK cities varies, with London being the most expensive. Monthly passes and fuel costs are crucial for students who rely on transport to navigate city life.

| Transport Option | London (£) | Other Cities (£) | London (INR) | Other Cities (INR) |

|---|---|---|---|---|

| Monthly Public Pass | £65 | £45 | ₹7,092 | ₹4,910 |

| Taxi (1 km) | £1.24 | £1.24 | ₹135 | ₹135 |

| Petrol (1 liter) | £1.56 | £1.56 | ₹170 | ₹170 |

Also Check: Student Guide to Study in UK

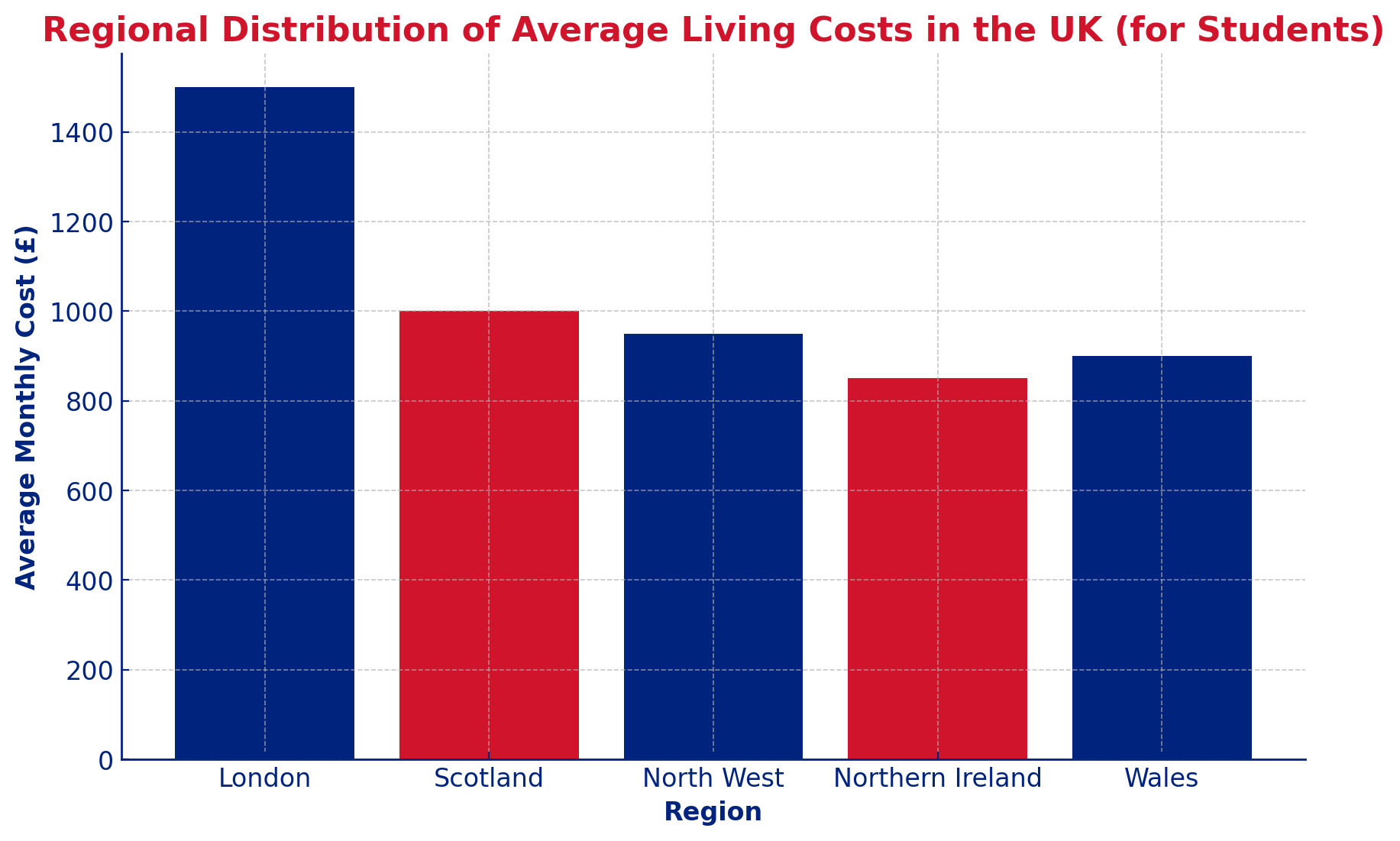

Regional Cost Variations in UK

Living costs vary widely, with London at the high end. Moving to one of the cheapest city in UK like Cardiff or Birmingham can save students significantly on monthly expenses.

| City | Average Monthly Cost (GBP) | Average Monthly Cost (INR) |

|---|---|---|

| London | £1,200 - £1,500 | ₹1,30,932 - ₹1,63,665 |

| Manchester | £800 - £1,000 | ₹87,288 - ₹1,09,110 |

| Birmingham | £750 - £900 | ₹81,832 - ₹98,199 |

| Cardiff | £700 - £850 | ₹76,377 - ₹92,743 |

Note: Living outside London can save students up to 30% on rent and monthly expenses. Cities like Manchester, Cardiff, and Birmingham are popular for their affordable living costs.

Education Costs in UK

Tuition fees vary by program type, and students can apply for scholarships like Chevening Scholarships or GREAT to help reduce the cost. Here’s an overview of tuition costs across different study levels.

| Education Level | Average Tuition Fee (£) | Average Tuition Fee (INR) |

|---|---|---|

| Undergraduate | £11,400 - £38,000 | ₹12,44,874 - ₹41,46,180 |

| Postgraduate | £9,000 - £30,000 | ₹9,81,990 - ₹32,73,300 |

| Doctoral | £18,000 - £35,000 | ₹19,63,980 - ₹38,18,850 |

Tip: Apply for scholarships like Chevening, Commonwealth Scholarships, and GREAT Scholarships to reduce education costs.

Also Check: UK Visa Sponsorship Requirements

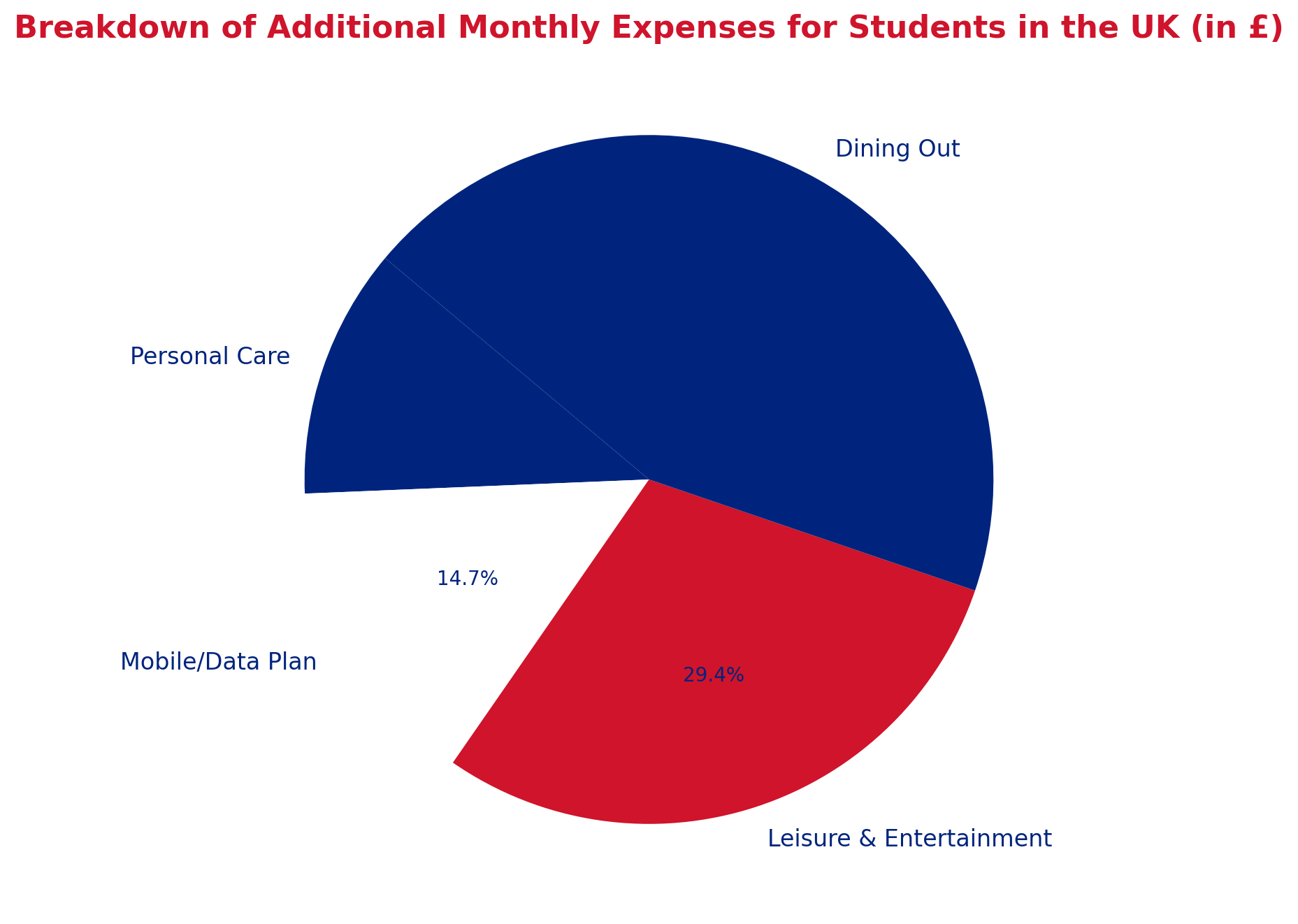

Miscellaneous Expenses in UK

Monthly miscellaneous expenses can include personal care, entertainment, and mobile data. Many retailers offer UK student discounts on essentials, helping students save on these costs.

| Miscellaneous Item | Average Monthly Cost (£) | Average Monthly Cost (INR) |

|---|---|---|

| Personal Care | £10 - £20 | ₹1,091 - ₹2,182 |

| Entertainment | £50 - £100 | ₹5,456 - ₹10,911 |

| Clothing | £50 - £100 | ₹5,456 - ₹10,911 |

| Mobile Data & Internet | £25 - £35 | ₹2,728 - ₹3,819 |

Tip: Utilize UK student discounts on essentials and entertainment to save monthly.

Tips to Save Money While Living in the UK

Considering the following tips, you can save money while living in UK.

- Accommodation: Opt for shared or off-campus housing; student accommodation in London city options often have shared rooms for lower rent.

- Transportation: Use a student travel card for discounted public transport or bike around campus.

- Food: Shop smartly at budget stores and cook at home.

- Budgeting: Track expenses using budgeting apps and set monthly limits for non-essential items.

- Open a Bank Account: Learn how to open a UK bank account to avoid international transaction fees.

Living as a student in the UK is manageable with effective budgeting. Choose affordable housing, make the most of student discounts, and keep track of monthly expenses to enjoy a financially stable experience. With careful planning, you can focus more on academics and make the most of your UK experience.

FAQs

Ques. What are the average upfront costs when moving to the UK as an international student?

Ans. Apart from tuition and visa fees, students may need £500-£1,000 for initial expenses like housing deposits, groceries, and setting up utilities.

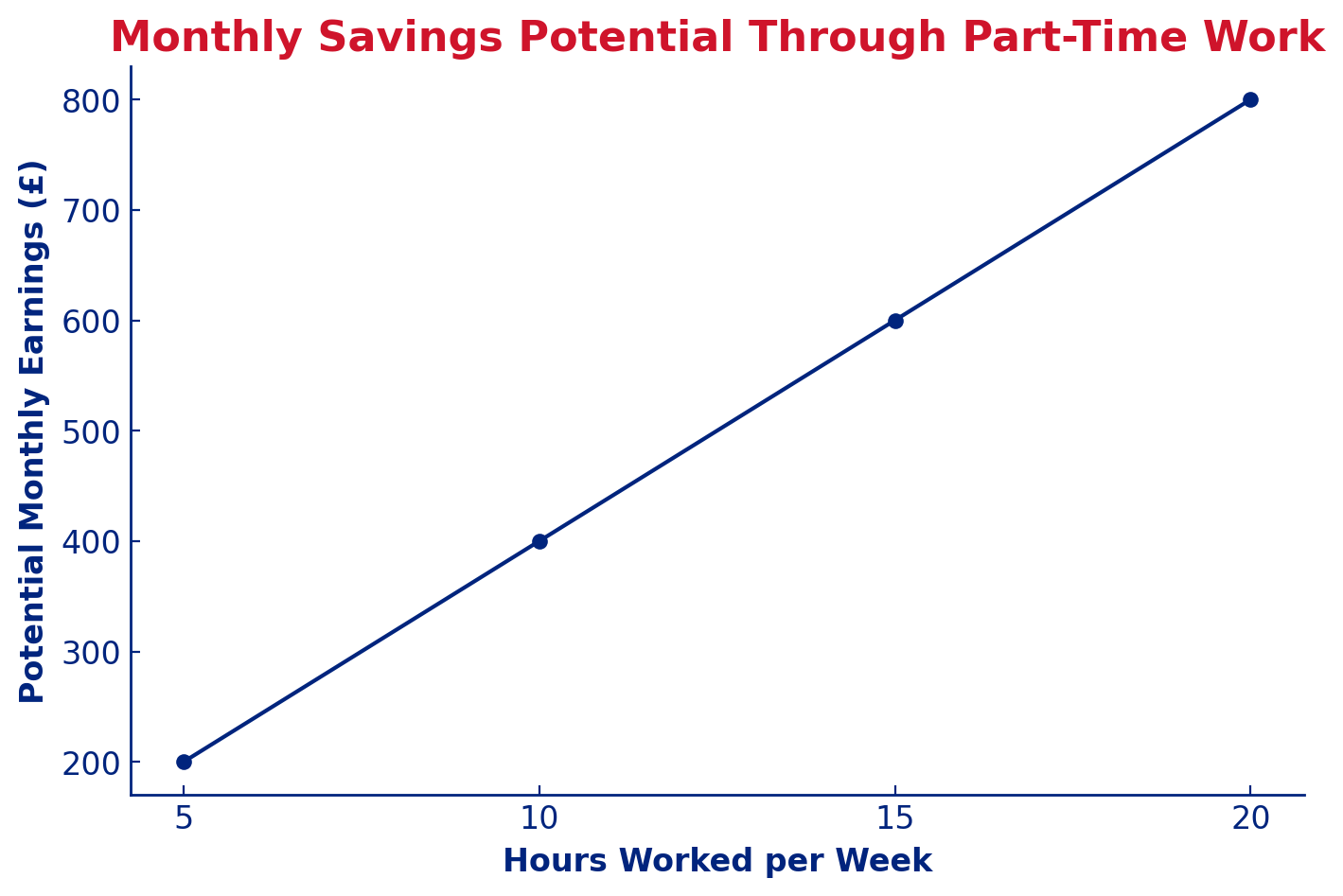

Ques. Can Indian students work part-time in the UK to cover living expenses?

Ans. Yes, on a Tier 4 student visa, Indian students can work up to 20 hours per week during term time and full-time during vacations, which can significantly help with living costs.

Ques. Is it necessary to buy health insurance for international students in the UK?

Ans. Indian students pay the Immigration Health Surcharge (IHS) as part of their visa, which provides access to the UK’s NHS. Additional private insurance can be bought for specific needs, like dental.

Ques. How can I find affordable accommodation as an international student?

Ans. Use platforms like UniAcco, Student.com, and university housing offices for vetted listings. Shared housing or student halls are generally the most affordable options.

Ques. Are there specific grocery stores or markets in the UK known for budget shopping?

Ans. Yes, discount stores like Aldi, Lidl, and Asda are popular for affordable groceries, and some cities have Indian grocery stores offering familiar food items at lower prices.

Ques. What documents are required to open a UK bank account as a student?

Ans. Typically, students need a valid passport, visa, a proof of address in the UK, and a letter from their university. Banks like HSBC, Barclays, and Santander are student-friendly.

Ques. How do living costs in smaller UK towns compare to major cities?

Ans. Smaller towns are generally 20-30% cheaper in terms of rent and utilities than major cities like London, making them ideal for students looking to save.

Comments