Content Curator

A wire transfer is also known as money transfer in electronic form. International students may find wire transfer to be important as it allows speedy money transfer between their home country and current country. Through online wire transfer you can send and receive funds quickly and securely. International students can perform transactions in large amounts to cover study abroad expenses such as university tuition fee and accommodation charges.

If you intend to initiate international money transfer via wire transfer, you are required to provide the bank with certain details, including the recipient's name and their bank account information, along with specifying the amount you wish to transfer. A physical form may be necessary, but many banks facilitate an online completion process. Alternatively, if you are the recipient of funds through a wire transfer, you must share your bank account details with the sender.

The transactions through wire transfer are preferred over bank transactions as it may take only minutes to transfer the money. There are two kinds of wire transfers: domestic and international. Domestic transfers usually take a day and cost about 15 to 25 USD (1,200-2,000 INR). For international money transfer, where you send money to another country, each transaction can cost around 45 USD (3,700 INR).

|

Table of Contents |

SWIFT Wire Transfer

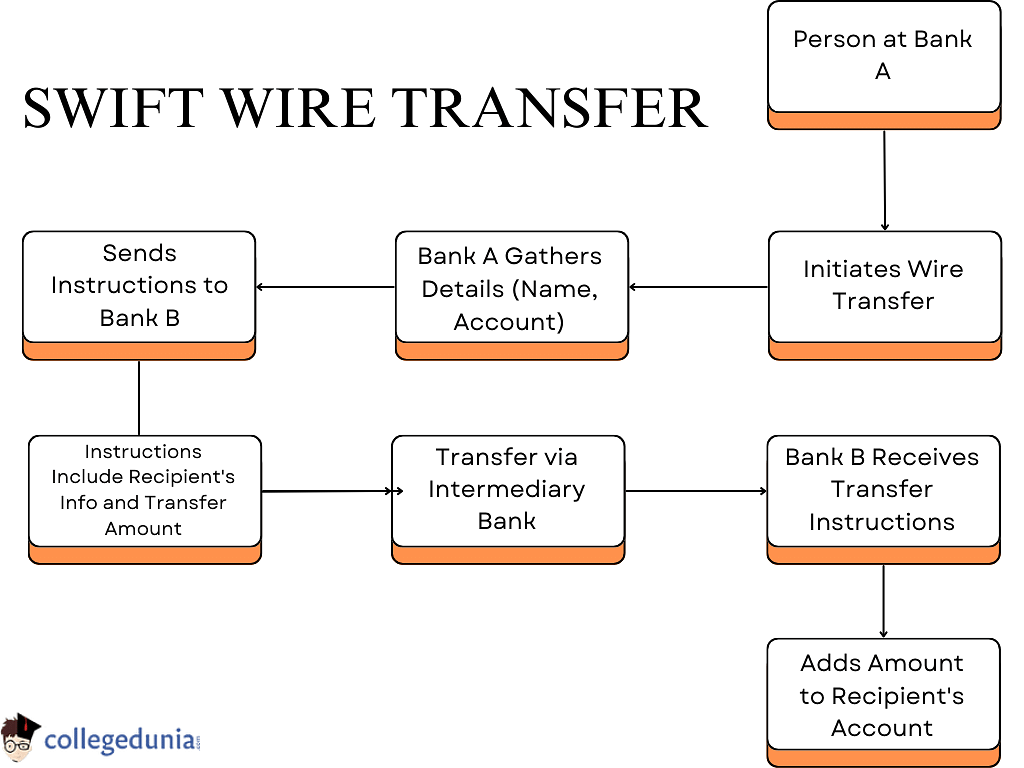

The most common method for wire funds transfer is through the SWIFT (Society for Worldwide Interbank Financial Telecommunication) network. This network, functioning as a messaging protocol, has a membership of over 11,000 banks across 200+ countries. Its primary purpose is to facilitate the exchange of information and provide instructions for wire transfers between participating banks.

It's important to know that there isn't an actual movement of money in a wire transfer. Instead, the money is deducted from the sender's bank account and then placed into the recipient's bank account. That's the basic idea behind how wire transfers operate.

Methods for Wire Transfers

Apart from traditional bank transfer or e-wallet, there are other methods for the international students to do transactions which do not involve banks such as: -

TransferWise

TransferWise, now officially known as Wise, is a US based online money transfer website service which helps cut down the cost up to 8 times. It is one of the most effective methods of money transfer. This technique basically shows two local transfers instead of one international transfer.

If you wish to send money from India to USA, you can do so by sending the INR amount to TransferWise's India-based account. Subsequently, an equivalent amount of money will be transferred from TransferWise's USA account to the intended recipient. Wise’s smart technology links local bank accounts in countries all over the world.

This shows that money was never transferred overseas and the conversion of the currency was made on the basis of real mid-market exchange rate. This saves the customers from paying the hidden charges on the currency exchange. Mid-market price is decided as the median at which the customers are ready to ‘buy’ or ‘sell’ a specific currency. This concept is a fair deal for the exchange rate.

Moneygram or Western Union Wire Transfer (U.S.)

You can save your dollars by not going to the bank or e-wallet. If students are US locals, they may transfer money domestically or internationally in a fast and reliable way. The charges are decided on the basis of speed of transfer, location, and amount of money for the transfer. In the case of international money transfers, you have to pay an exchange rate, though they are not competitive rates but may incur hidden charges. Technically, Moneygram is faster and is ready to transfer within 10 minutes. Online transfers are faster than most of the competitors.

ExTravel Money (India)

Looking for a secure way of online money transfer? ExTravelMoney.com, an online outward remittance and currency exchange marketplace startup in India, allows students who are planning to study in the US or are already pursuing their education abroad to transfer and receive money through wire transfer. With more than 6000 partner branches across India, they make it easy for students to pay their tuition fees for US universities without any hassle.

Online money transfer through ExTravelMoney may take a maximum of 48 hours as soon as the KYC details of the student’s bank are verified. The document requirement for fees transfer through ExTravelMoney is minimal, these include:

- University letter depicting the amount that is being transferred

- Copy of passport

- PAN card

- ID proof (Voter ID card/Adhaar card/Driving license).

Wire Transfer vs Bank Transfer

| Feature | Wire Transfer | Bank Transfer |

|---|---|---|

| Speed | Usually faster, often within the same day | Can take a few days to complete |

| Method | Direct electronic transfer of funds | Transfer through banking system |

| Accessibility | Widely available, can be done online or in-person at a bank | Commonly available through online banking and branches |

| International | Commonly used for international transactions | Can be used for both domestic and international transactions |

| Information Needed | Recipient's bank details (SWIFT/BIC code, account number) | Recipient's bank details (account number, routing number) |

| Confirmation | Immediate confirmation of transfer by SWIFT system | Confirmation may take some time depending on the banks involved |

| Convenience | Quick and convenient for urgent transfers | Reliable but may take longer for processing |

Wire Transfer U.S. Bank Fee

Mentioned are the charges for incoming and outgoing money through wire transfer. International students may pay the fee accordingly.

| Bank | International Incoming Fee (USD) | International Outgoing Fee (USD) |

|---|---|---|

| Ally Bank | 0 | Not available |

| Bank of America | 15 | 0 (if sent in foreign currency) or 45 (if sent in USD) |

| Chase | 15 (0 with Chase) | 5 (if sent in foreign currency, or 0 for 5,000 USD or more) or 40 (if sent in USD, or 50 with banker assistance) |

| Wells Fargo | 15 | Varies; inquire with bank representative |

| Alliant Credit Union | 0 | 50 |

| Capital One 360 | 0 | Only available in-branch |

| Discover | 0 | 30 |

| PNC Bank | 15 | 40 |

Factors involved while assessing International Wire Transfer Rates

The most common aspects to consider while calculating the fee for wire transfer are as follows:

- Location of the receiver.

- Incoming or Outgoing money: Incoming is comparatively cheaper.

- Domestic or International transaction: As the domestic services are simple as compared to international wire transfer, domestic facility is cheaper.

- Initiation fee: For conducting a transaction other than wire transfer method.

- Exchange Rate: Students can get the exchange rates from the banks. However, banks add their profit to the rate. Contact the banks to know about the current exchange rate.

- Tracer Fee: For tracing services for a previous wire transfer.

Ways to reduce Wire Transfer Fee

- The fees for wire transfers can vary depending on how you start the process. Doing it online by yourself is usually the most affordable option. If you ask for the transfer in person or over the phone, it could add 10 USD or more to your fee. For example, with Chase, setting up a domestic wire transfer with the help of a banker costs 35 USD, but it's 25 USD if you do it online.

- Sending money in the foreign currency is cheaper than sending it in US dollars.

- Recurring wire transfers can be a bit cheaper too. Some banks, like Comerica, may charge a few dollars less for each recurring transfer.

Wire Transfer Requirements

Sending an international wire transfer involves some specific requirements to ensure the money reaches your recipient smoothly. Given below is the list of information needed for international wire transfer:

| Sending Funds to US Account | Sending Funds to an International Account |

|---|---|

| Name and address of the account holder | Name and address of the account holder |

| Name and Address of the Bank or Credit Union | Name and Address of the Bank |

| Routing Number | SWIFT Code or BIC of Bank |

| Account Number | IBAN Number or Account number |

For specific details and procedures regarding international money transfer, it's best to consult your bank or chosen money transfer service directly. They can guide you through their specific requirements and processes.

1691402920.png?tr=w-305,h-145,c-force?h=40&w=40&mode=crop)

1641992784.jpg?tr=w-305,h-145,c-force?h=175&w=350&mode=crop)

Comments