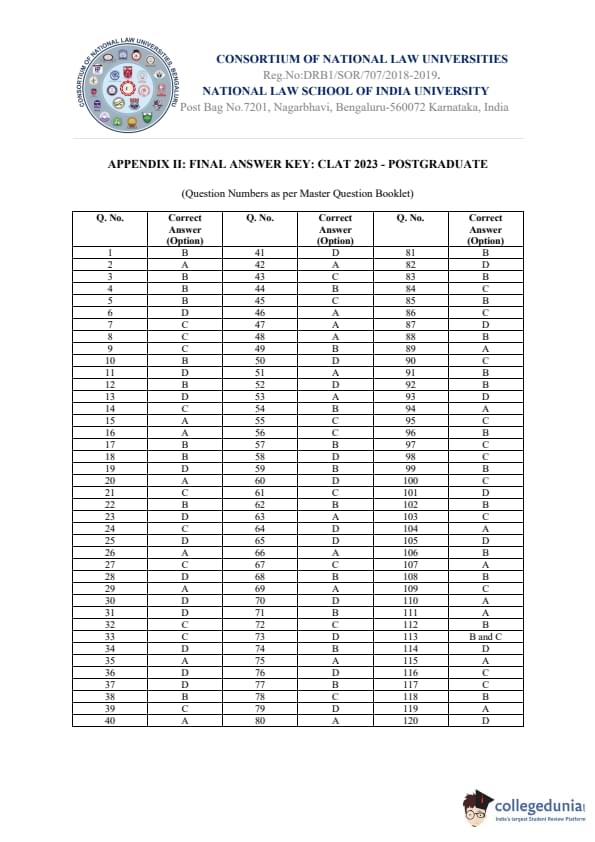

CLAT PG 2023 Question Paper PDF with answer key is available for download. The exam was successfully organized by the Consortium of NLUs on December 18, 2022, from 2:00 PM to 4:00 PM. According to experts, CLAT PG 2023 Question Paper was reported as moderate in terms of overall difficulty. Candidates had to answer a total of 120 questions covering two major sections- Constitutional Law and Other Law Subjects.

CLAT PG 2023 Question Paper with Solution PDF

CLAT PG 2023 Question Paper with Solutions

Our society is governed by the Constitution. The values of constitutional morality are a non-derogable entitlement. Notions of “purity and pollution”, which stigmatise individuals, can have no place in a constitutional regime. Regarding menstruation as polluting or impure, and worse still, imposing exclusionary disabilities on the basis of menstrual status, is against the dignity of women which is guaranteed by the Constitution. Practices which legitimise menstrual taboos, due to notions of “purity and pollution”, limit the ability of menstruating women to attain the freedom of movement, the right to education and the right of entry to places of worship and, eventually, their access to the public sphere. Women have a right to control their own bodies. The menstrual status of a woman is an attribute of her privacy and person. Women have a constitutional entitlement that their biological processes must be free from social and religious practices, which enforce segregation and exclusion. These practices result in humiliation and a violation of dignity. Article 17 prohibits the practice of “untouchability”, which is based on notions of purity and impurity, “in any form”. Article 17 certainly applies to untouchability practices in relation to lower castes, but it will also apply to the systemic humiliation, exclusion and subjugation faced by women. Prejudice against women based on notions of impurity and pollution associated with menstruation is a symbol of exclusion. The social exclusion of women, based on menstrual status, is but a form of untouchability which is an anathema to constitutional values. As an expression of the anti-exclusion principle, Article 17 cannot be read to exclude women against whom social exclusion of the worst kind has been practised and legitimised on notions of purity and pollution. Article 17 cannot be read in a restricted manner. But even if Article 17 were to be read to reflect a particular form of untouchability, that Article will not exhaust the guarantee against other forms of social exclusion. The guarantee against social exclusion would emanate from other provisions of Part III, including Articles 15(2) and 21. Exclusion of women between the age group of ten and fifty, based on their menstrual status, from entering the temple in Sabarimala can have no place in a constitutional order founded on liberty and dignity.

[Extracted from Indian Young Lawyers Association v. State of Kerala, (2019) 11 SCC 1]

Question 1:

In IYLA, the Supreme Court held that the worshippers of Lord Ayyappa:

- (A) are not a religious denomination because they have not registered themselves as such

- (B) are not a religious denomination because they do not have a distinct name, a common set of beliefs, and a common organisational structure

- (C) are a religious denomination because they have been recognised as such by the state

- (D) are a religious denomination because they have consistently been treated as such by themselves as well as by society in general

Correct Answer: (B) are not a religious denomination because they do not have a distinct name, a common set of beliefs, and a common organisational structure

View Solution

Question 2:

The Supreme Court determined whether a religious practice falls within Article 25 using the:

- (A) Essential Religious Practice Test

- (B) Sincerity of Belief Test

- (C) Proportionality Test

- (D) Constitutional Morality Test

Correct Answer: (A) Essential Religious Practice Test

View Solution

Question 3:

Parliament gave effect to Article 17 by enacting:

- (A) The Abolition of Untouchability Act, 1951

- (B) The Protection of Civil Rights Act, 1955

- (C) The Constitutional Offences Act, 1951

- (D) The Untouchability Offences (Prohibition, Protection, and Remedies) Act, 1950

Correct Answer: (B) The Protection of Civil Rights Act, 1955

View Solution

Question 4:

Justice D.Y. Chandrachud’s reliance on Constituent Assembly Debates to determine the scope of Article 17 is best explained by this method of constitutional interpretation:

- (A) Living Constitutionalism

- (B) Originalism

- (C) Structuralism

- (D) Textualism

Question 5:

In IYLA, Justice D.Y. Chandrachud held that Article 17 has:

- (A) Vertical application

- (B) Horizontal application

- (C) Indirect horizontal application

- (D) None of the above

Question 6:

In the review petition against this judgment, the Supreme Court has framed which of the following questions for determination by a 9-judge bench?

- (A) Scope of “public order, morality and health” in Article 25(1)

- (B) Scope of expression “section of Hindus” in Article 25(2)(b)

- (C) Scope of “judicial recognition” to PILs filed by people not belonging to a religious denomination to contest a religious practice

- (D) All the above

- (A) The meaning of “public order, morality and health” in Art. 25(1).

- (B) Who qualifies as a “section of Hindus” under Art. 25(2)(b).

Question 7:

Which judge on the bench in IYLA disagreed with Justice Chandrachud on the application of Article 17?

- (A) Justice R.F. Nariman

- (B) Justice Dipak Misra

- (C) Justice Indu Malhotra

- (D) None of the above

Question 8:

In reaching his conclusion on the scope of Article 17, Justice D.Y. Chandrachud cited which of the following works of Dr. B.R. Ambedkar?

- (A) Coming out as Dalit

- (B) Goolami

- (C) Annihilation of Caste

- (D) All the above

Question 9:

In the passage above, what does the term “non-derogable” mean?

- (A) Cannot be extracted under any circumstances

- (B) Cannot be precisely determined

- (C) Cannot be infringed under any circumstances

- (D) None of the above

- (A) “Cannot be extracted” is meaningless in rights discourse.

- (B) “Cannot be precisely determined” talks about epistemic uncertainty, not legal inviolability.

Correct Answer: (C) Cannot be infringed under any circumstances

View Solution

Question 10:

The petition filed by the Indian Young Lawyers Association in this case was a:

- (A) Special Leave Petition from the decision of the Kerala High Court

- (B) Public Interest Litigation

- (C) Writ Appeal from a petition filed under Article 226

- (D) None of the above

An Ordinance which is promulgated by the Governor has (as clause 2 of Article 213 provides) the same force and effect as an Act of the legislature of the State if assented to by the Governor. However - and this is a matter of crucial importance - clause 2 goes on to stipulate in the same vein significant constitutional conditions. These conditions have to be fulfilled before the ‘force and effect’ fiction comes into being. These conditions are prefaced by the expression “but every such Ordinance” which means that the constitutional fiction is subject to what is stipulated in sub-clauses (a) and (b). Sub-clause (a) provides that the Ordinance “shall be laid before the legislative assembly of the state” or before both the Houses in the case of a bi-cameral legislature. Is the requirement of laying an Ordinance before the state legislature mandatory? There can be no manner of doubt that it is. The expression “shall be laid” is a positive mandate which brooks no exceptions. That the word ‘shall’ in sub-clause (a) of clause 2 of Article 213 is mandatory, emerges from reading the provision in its entirety. As we have noted earlier, an Ordinance can be promulgated only when the legislature is not in session. Upon the completion of six weeks of the reassembling of the legislature, an Ordinance “shall cease to operate”.

Article 213(2)(a) postulates that an ordinance would cease to operate upon the expiry of a period of six weeks of the reassembly of the legislature. The Oxford English dictionary defines the expression “cease” as : “to stop, give over, discontinue, desist; to come to the end.” P Ramanatha Aiyar’s, The Major Law Lexicon defines the expression “cease” to mean “discontinue or put an end to”. Justice C K Thakker’s Encyclopaedic Law Lexicon defines the word “cease” as meaning: “to put an end to; to stop, to terminate or to discontinue”. The expression has been defined in similar terms in Black’s Law Dictionary.

The expression “cease to operate” in Article 213(2)(a) is attracted in two situations. The first is where a period of six weeks has expired since the reassembling of the legislature. The second situation is where a resolution has been passed by the legislature disapproving of an ordinance. Apart from these two situations that are contemplated by sub-clause (a), sub-clause (b) contemplates that an ordinance may be withdrawn at any time by the Governor. Upon its withdrawal the ordinance would cease to operate as well.

[Extracts from the judgment of majority judgment in Krishna Kumar Singh v. State of Bihar, Civil Appeal No. 5875 of 1994, decided on January 2, 2017 hereafter ‘KK Singh’]

Question 11:

The power to promulgate an ordinance is an instance of the:

- (A) Executive power of the Governor

- (B) Delegated power of the Governor

- (C) Sovereign prerogative power of the Governor

- (D) None of the above

- (B) Delegated power — not correct; this is a constitutional power, not delegated by legislature.

Correct Answer: (A) Executive power of the Governor

View Solution

Question 12:

The Constitution Bench in D.C. Wadhwa v. State of Bihar (1987) 1 SCC 378 held that re-promulgation of an Ordinance was a ‘fraud on the Constitution’ because:

- (A) Legislative power is vested in the legislatures by the Constitution of India

- (B) It is a colourable exercise of power under the Constitution of India

- (C) The role of the Executive is to implement a law, not make it

- (D) None of the above

- (B) “Colourable exercise of power” is a possible characterisation but the primary doctrinal basis used was that legislative power rests with legislatures.

Correct Answer: (A) Legislative power is vested in the legislatures by the Constitution of India

View Solution

Question 13:

In States which are bicameral, the Governor can promulgate an Ordinance only when:

- (A) Both Houses are not in session

- (B) When a Proclamation of Emergency is in operation

- (C) When the state has been placed under President’s rule

- (D) None of the above

- (B) Emergency is irrelevant; ordinance power is independent of emergency provisions.

Question 14:

Under Article 213, an Ordinance once promulgated by the Governor can remain effective for a maximum period of:

- (A) Six weeks

- (B) Six months

- (C) Six-and-a-half months

- (D) One year

Question 15:

KK Singh overruled two 5-Judge decisions of the Supreme Court, to hold:

- (A) An Ordinance which is not laid before the Legislature in the manner prescribed by Article 213 shall not have any legal effect and consequences.

- (B) An Ordinance which is not laid before the Legislature in the manner prescribed by Article 213 shall be void from the date that it should have obtained approval.

- (C) An Ordinance which is not laid before the Legislature in the manner prescribed by Article 213 shall be void from the date the ordinance is replaced by a law made by the Legislature to replace the Ordinance.

- (D) An Ordinance which is not laid before the Legislature in the manner prescribed by Article 213 shall be considered as a temporary statute.

Correct Answer: (A) An Ordinance which is not laid before the Legislature in the manner prescribed by Article 213 shall not have any legal effect and consequences.

View Solution

Question 16:

An Ordinance promulgated by the Governor:

i. Shall be treated to be ‘law’ for the purposes of Article 13 of the Constitution of India.

ii. Shall in all cases require the prior approval of the President.

iii. Shall not be constrained by the subject-matter requirements of Article 246 read with the Seventh Schedule of the Constitution of India.

- (A) i alone is correct

- (B) i and ii are correct

- (C) i, ii and iii are correct

- (D) None of the above

Question 17:

Article 213 requires the Governor to reserve an Ordinance for the consideration of the President:

i. In all cases when the state is placed under President’s Rule under Article 356.

ii. When the Ordinance pertains to the proviso to Article 304(b) and seeks to impose reasonable restrictions in the public interest on the freedom of trade, commerce or intercourse with or within that state.

iii. When the Ordinance is on a matter enumerated in the Concurrent List (of the Seventh Schedule) and which is repugnant to a law made by Parliament.

- (A) i, ii and iii are correct

- (B) i and iii are correct

- (C) i and ii are correct

- (D) None is correct

Question 18:

The power of the Governor to promulgate an Ordinance is subject to the Governor being satisfied that “circumstances exist which render it necessary for him to take immediate action.” The 7-judge bench in KK Singh held that the satisfaction of the Governor:

- (A) Is not subject to judicial review since it is a political question

- (B) Is subject to judicial review with regard to the relevancy of the material on which such satisfaction is based

- (C) Is subject to judicial review with regard to the adequacy of materials on which such satisfaction is based

- (D) None of the above

- (A) is incorrect — satisfaction is justiciable.

- (C) is incorrect — adequacy is non-justiciable.

Correct Answer: (B) Is subject to judicial review with regard to the relevancy of the material on which such satisfaction is based

View Solution

Question 19:

Section 6 of the General Clauses Act, 1897 protects rights, privileges, obligations and liabilities in cases of repeal of an enactment. The majority in KK Singh held that:

i. An Ordinance that ‘ceases to operate’ is distinct from a law that is void.

ii. An Ordinance that ‘ceases to operate’ is distinct from a temporary statute.

iii. An Ordinance that ‘ceases to operate’ is distinct from a repealed statute.

iv. An Ordinance that ‘ceases to operate’ is not ‘saved’ in the absence of any ‘savings clause’ in Article 213.

- (A) i, ii, and iii are correct

- (B) ii and iii are correct

- (C) i and iii are correct

- (D) All the above are correct

Question 20:

A resolution by the Legislature disapproving an Ordinance promulgated under Article 213 by the Governor is:

- (A) Statutory in nature and has binding effect upon the Government

- (B) A mere expression of the opinion of the House

- (C) A decision of the House relating to the control of its proceedings

- (D) An exercise of delegated legislation

- (B) is incorrect — it’s more than an opinion.

- (C) is incorrect — control of proceedings is irrelevant; effect is constitutional.

Correct Answer: (A) Statutory in nature and has binding effect upon the Government

View Solution

The other material which prompted the High Court to reach the conclusion that the subsoil/minerals vest in the State is . . . recitals of a patta which . . . .. states that if minerals are found in the property covered by the patta and if the pattadar exploits those minerals, the pattadar is liable for a separate tax in addition to the tax shown in the patta and . . . . certain standing orders of the Collector of Malabar which provided for collection of seigniorage fee in the event of the mining operation being carried on. We are of the clear opinion that the recitals in the patta or the Collector’s standing order that the exploitation of mineral wealth in the patta land would attract additional tax, in our opinion, cannot in any way indicate the ownership of the State in the minerals. The power to tax is a necessary incident of sovereign authority (imperium) but not an incident of proprietary rights (dominium). Proprietary right is a compendium of rights consisting of various constituent, rights. If a person has only a share in the produce of some property, it can never be said that such property vests in such a person. In the instant case, the State asserted its ‘right’ to demand a share in the ‘produce of the minerals worked’ though the expression employed is right – it is in fact the Sovereign authority which is asserted. From the language of the BSO No.10 it is clear that such right to demand the share could be exercised only when the pattadar or somebody claiming through the pattadar, extracts/works the minerals – the authority of the State to collect money on the happening of an event – such a demand is more in the nature of an excise duty/a tax. The assertion of authority to collect a duty or tax is in the realm of the sovereign authority, but not a proprietary right.

The only other submission which we are required to deal with before we part with this matter is the argument of the learned counsel for the State that in view of the scheme of the Mines and Minerals (Development and Regulation) Act, 1957 (hereafter ‘MMDRA’) which prohibits under Section 4 the carrying on of any mining activity in this country except in accordance with the permit, licence or mining lease as the case may be, granted under the Act, the appellants cannot claim any proprietary right in the sub-soil.

[Extract from the judgment in Thressiamma Jacob v. Dept. of Mining & Geology, (2013) 9 SCC 725] (hereafter ‘T Jacob’)

Question 21:

The MMDRA enacted by Parliament grants the Union Government the:

- (A) Right to obtain ownership of land containing mineral wealth

- (B) Power to exclude the State Government from ownership rights of land containing mineral wealth

- (C) Right to regulate the grant of mining rights

- (D) Right to impose taxes on all mining activities

- (A) No provision in MMDRA vests ownership of land/minerals in the Union.

- (B) The Act does not oust States from proprietary rights; it only regulates.

Correct Answer: (C) Right to regulate the grant of mining rights

View Solution

Question 22:

T Jacob dealt with traditional proprietary rights in subsoil/minerals and held that:

i. Sub-soil rights are treated as ‘commons’ and are held by the State in public trust.

ii. There is nothing in the law which declares that all mineral wealth/subsoil rights vest in the State.

iii. The owner of the land can be deprived of sub-soil rights by law.

- (A) i is correct

- (B) ii and iii are correct

- (C) i and iii are correct

- (D) None of the above is correct

Question 23:

The power to impose a tax on the produce of some land should be treated as:

- (A) Assertion that land is partly owned by government

- (B) Power of eminent domain

- (C) Assertion of a proprietary right

- (D) Assertion of a sovereign right

Question 24:

In common law, the owner of a piece of land is entitled to:

i. Work on the surface of the land.

ii. Everything beneath the surface down to the centre of the earth.

iii. Everything below the surface except those minerals included under the MMDRA.

- (A) All are correct

- (B) Only i is correct

- (C) Only i and ii are correct

- (D) Only i and iii are correct

Question 25:

Under the Constitution of India, all property and assets which vested in the British Crown for the purposes of the Government of the Dominion of India and Governor’s Provinces, stood:

- (A) Confiscated without payment

- (B) Repatriated back to the Crown

- (C) Vested in the Union of India

- (D) Vested in the Union of India and the States

Correct Answer: (D) Vested in the Union of India and the States

View Solution

Question 26:

The Constitution of India vests all lands, minerals, and other things of value under the ocean floor within the territorial waters:

- (A) In the Union of India

- (B) In the respective States having a shoreline

- (C) In the Union and all States in the Union

- (D) Are treated as ‘res commune’

- (B) Incorrect — States do not own offshore minerals.

- (C) Incorrect — vesting is exclusively in Union, not concurrent.

Question 27:

The Supreme Court in State of Meghalaya v. All Dimasa Students Union Hasao (2019) held that in the Sixth Schedule State of Meghalaya, where most lands are either privately or community-owned:

[i.]

- (A) Landowners of privately owned/community-owned lands can lease their lands for mining.

- (B) The State Government alone can grant a lease for mining in privately/community-owned lands.

- (C) Landowners of privately owned/community-owned lands can lease their lands for mining after obtaining previous approval of the Central Government through the State Government.

- (A) iv is correct

- (B) ii and iii are correct

- (C) i and iii are correct

- (D) None of the above is correct

Question 28:

Section 105 of the Transfer of Property Act, 1882 states that a lease of immovable property is a transfer of a right to enjoy such property under certain conditions.

The right to ‘enjoy such property’:

- (A) Includes the right to carry on mining operation in the surface of the land

- (B) Includes the right to carry on mining operation in the sub-soil of the land

- (C) Includes the right to extract the specified quantity of the minerals found therein, to remove and appropriate that mineral

- (D) All the above

Question 29:

The need for environmental clearance under the Environment Protection Act, 1986 is required for a project of coal mining:

- (A) In all lands whether privately, community, or publicly owned

- (B) Only in lands owned by the Union Government

- (C) Only in lands owned by the State Government

- (D) Only where sustainability is threatened

Correct Answer: (A) In all lands whether privately, community, or publicly owned

View Solution

Question 30:

The Constitution of India provides that all properties within the territory of India that do not have a lawful heir, successor or rightful owner, accrue to the Union or State where it is situate through:

- (A) Escheat

- (B) Lapse

- (C) Bona vacantia

- (D) All the above

A nationwide lockdown was declared by the Central Government from 24 March 2020 to prevent the spread of the CoVID-19 pandemic. Economic activity came to a grinding halt. The lockdown was extended on several occasions, among them for the second time on 14 April 2020. On 17 April 2020, the Labour and Employment Department of the State of Gujarat issued a notification under Section 5 of the Factories Act to exempt all factories registered under the Act “from various provisions relating to weekly hours, daily hours, intervals for rest etc. for adult workers” under Sections 51, 54, 55 and 56. The stated aim of the notification was to provide “certain relaxations for industrial and commercial activities” from 20 April 2020 till 19 July 2020.

Section 5 of the Factories Act provides that in a public emergency, the State Government can exempt any factory or class or description of factories from all or any of the provisions of the Act, except Section 67. Section 5 is extracted below: “5. Power to exempt during public emergency. — In any case of public emergency the State Government may, by notification in the Official Gazette, exempt any factory or class or description of factories from all or any of the provisions of this Act except section 67 for such period and subject to such conditions as it may think fit: Provided that no such notification shall be made for a period exceeding three months at a time. Explanation.—For the purposes of this section ‘public emergency’ means a grave emergency whereby the security of India or of any part of the territory thereof is threatened, whether by war or external aggression or internal disturbance.” (emphasis supplied)

The notification in its relevant part is extracted below:

“... NOW, THEREFORE, in exercise of the powers conferred by Section 5 of the Factories Act, 1948, the ‘Factories Act’ PART B Government of Gujarat hereby directs that all the factories registered under the Factories Act, 1948 shall be exempted from various provisions relating to weekly hours, daily hours, intervals for rest etc. of adult workers under section 51, section 54, and section 55 and section 56 with the following conditions from 20th April till 19th July 2020, —

1. No adult worker shall be allowed or required to work in a factory for more than twelve hours in any day and Seventy Two hours in any week.

2. The Periods of work of adult workers in a factory each day shall be so fixed that no period shall exceed six hours and that no worker shall work for more than six hours before he has had an interval of rest of at least half an hour.

3. No Female workers shall be allowed or required to work in a factory between 7:00 PM to 6:00 AM.

4. Wages shall be in a proportion of the existing wages (e.g. If wages for eight hours are 80 Rupees, then the proportionate wages for twelve hours will be 120 Rupees).

[Extract from judgment of the Supreme Court in Gujarat Mazdoor Sabha v. The State of Gujarat decided on 1 October, 2020, (hereafter ‘GMS’)]

Question 31:

Section 5 of the Factories Act, 1948 provides for the power of exemption from certain provisions of the Act due to the occurrence of a public emergency. In GMS, the Supreme Court held that:

i. Situations of grave emergency require an actual threat to the security of the state.

ii. Emergency powers can be used to avert the threat posed by war, external aggression or internal disturbance.

iii. Emergency powers must not be used for any other purpose.

- (A) Only i and iii are correct

- (B) Only ii is correct

- (C) Only i and ii are correct

- (D) All the above statements are correct

Correct Answer: (D) All the above statements are correct

View Solution

Question 32:

In order for a Proclamation of Emergency to be made under Article 352 of the Constitution of India, the President must be satisfied that a grave emergency exists whereby the security of India or of any part of the territory thereof is threatened:

- (A) By war or external aggression or internal disturbance

- (B) By war or external aggression or financial instability

- (C) By war or external aggression or armed rebellion

- (D) By war or armed rebellion or internal disturbance

Correct Answer: (C) By war or external aggression or armed rebellion

View Solution

Question 33:

Following the Constitution (Forty-fourth Amendment) Act, 1978, in order for a Proclamation of Emergency to be issued, such decision has:

- (A) To be taken by the Prime Minister and conveyed to the President

- (B) To be taken by the Council of Ministers of Cabinet rank and approved by both Houses of Parliament

- (C) To be taken by the Council of Ministers of Cabinet rank and communicated to the President in writing

- (D) To be taken by the Council of Ministers of Cabinet rank and approved by at least half the State Legislatures

Correct Answer: (C) To be taken by the Council of Ministers of Cabinet rank and communicated to the President in writing

View Solution

Question 34:

Article 355 casts a duty on the Union to protect every State against, inter alia, internal disturbance. The Supreme Court noted that the Sarkaria Commission recognised a range of situations that could amount to internal disturbance, including:

- (A) Situations of financial exigencies

- (B) Breaches of public peace

- (C) Inefficient administration

- (D) None of the above

Question 35:

The Supreme Court in Sarbananda Sonowal v. Union of India, AIR 2005 SC 2920, held that the duty of the Union to protect every state against external aggression and internal disturbance extends to:

- (A) Situations where there are large-scale cases of illegal migrants from other countries

- (B) Situations where there are large-scale cases of migration from other parts of India

- (C) Cases of external aggression which are similar to ‘war’

- (D) None of the above

Correct Answer: (A) Situations where there are large-scale cases of illegal migrants from other countries

View Solution

Question 36:

In deciding whether the CoVID-19 pandemic and the ensuing lockdown imposed by the Central Government to contain the spread of the pandemic have created a public emergency as defined by the explanation to Section 5 of the Factories Act, 1948, the Supreme Court in GMS held:

i. The economic slowdown caused by the pandemic constitutes a public emergency.

ii. The situation created by the CoVID-19 pandemic was similar to a national emergency caused by external aggression or war.

iii. The economic slowdown created by the CoVID-19 pandemic qualifies as an internal disturbance threatening the security of the state.

- (A) Only i and iii are correct

- (B) Only ii and iii are correct

- (C) Only i and ii are correct

- (D) None of the above statements are correct

Correct Answer: (D) None of the above statements are correct

View Solution

Question 37:

The Supreme Court in Ram Manohar Lohia v. State of Bihar, AIR 1966 SC 740, Arun Ghosh v. State of West Bengal, 1970 SCR 288, and later cases, has indicated that matters affecting law and order can be determined:

- (A) Not by the nature of the act alone e.g., a case of stabbing of one person by another

- (B) The degree to which public tranquillity is disturbed

- (C) Whether the even tempo of life of a community continues undisturbed or not

- (D) All the above

Question 38:

The Supreme Court has indicated that matters that affect public order are to be determined:

i. By looking at the nature of the act, how violent it is irrespective of its context.

ii. The degree and effect any action has on the life of the community.

iii. By consideration of factors related to the maintenance of law and order.

- (A) Only i and iii are correct

- (B) Only ii is correct

- (C) Only i and ii are correct

- (D) All the above statements are correct

Correct Answer: (D) All the above statements are correct

View Solution

Question 39:

The Factories Act, 1948 stipulates the maximum number of hours that can be worked per week and also that overtime wages need to be double the normal wage rate. In GMS the exemption relied upon by State government to extend the working hours to 12 hours a day and at the usual wage rate without payment of overtime across all factories was deemed to be:

i. Justified in view of the grave emergency cause by the CoVID-19 pandemic.

ii. Violative of the rule of law.

iii. Violative of just and humane conditions of work.

- (A) Only i and iii are correct

- (B) Only ii is correct

- (C) Only ii and iii are correct

- (D) All the above statements are correct

Question 40:

The rationale of the Factories Act, 1948 in providing double the wage rate for periods of overtime work is based on:

i. Compensating the worker for the extra strain on their health in doing overtime work.

ii. Enabling the worker to maintain proper standard of health and stamina.

iii. Protecting the worker against exploitation.

- (A) i, ii, and iii are correct

- (B) Only i and iii are correct

- (C) Only ii is correct

- (D) Only ii and iii are correct

Question 41:

In the concluding part of the judgment excerpted above, preliminary inquiries were permitted for which of the following class or classes of cases?

- (A) Offences related to matrimonial disputes

- (B) Allegations of corruption against public officers

- (C) Where the information was received after substantial delay, such as more than three months after the alleged incident

- (D) All the above

- <

Question 42:

In the recent judgment of the Supreme Court in Netaji Achyut Shinde (Patil) v. State of Maharashtra (2021), which principle relating to FIR did the Court reiterate?

- (A) That a cryptic phone call, without complete details and information about the commission of a cognizable offence cannot always be treated as a F.I.R.

- (B) That non-reading-over of the recorded complaint by the police to the informant will vitiate the recording of the F.I.R.

- (C) That F.I.R.s are substantive pieces of evidence at the trial and can be duly proved to establish the facts in issue at a trial.

- (D) That F.I.R.s are necessarily hearsay statements and cannot be relied upon to prove the truth of the matters asserted therein.

Correct Answer: (A) That a cryptic phone call, without complete details and information about the commission of a cognizable offence cannot always be treated as a F.I.R.

View Solution

Question 43:

A police officer, after receiving information about a cognizable offence, records it in the Station House Diary and begins investigation without registering a formal FIR. The FIR is registered only the next day. On which ground can the FIR be challenged?

- (A) That the police officer has not followed the mandatory procedure of sending a copy of the FIR to the jurisdictional magistrate upon registration.

- (B) That the statement recorded as the FIR is a hearsay statement made by the police officer himself and therefore cannot be admissible in evidence.

- (C) That the recorded FIR becomes a statement under Section 161, Code of Criminal Procedure, 1973, because the Station House Diary entry will be considered the FIR.

- (D) That the procedure set out in Section 190, Code of Criminal Procedure, 1973 has been violated by the police officer.

Correct Answer: (C) That the recorded FIR becomes a statement under Section 161, Code of Criminal Procedure, 1973, because the Station House Diary entry will be considered the FIR.

View Solution

Question 44:

In Aghnoo Nagesia v. State of Bihar (1966), the accused registered an FIR against himself without prior accusation. How would such an FIR be treated?

- (A) Violative of right against self-incrimination under Article 20(3) of the Constitution of India.

- (B) A statement that cannot be proved as a confession hit by Section 25, Indian Evidence Act, 1872.

- (C) A statement that can be used as substantive evidence against its maker, since there was no accusation against him at the time he made the statement.

- (D) A statement that can be retracted by the accused person at the time of trial, and thereafter the commission of the offence cannot be proved.

Correct Answer: (B) A statement that cannot be proved as a confession hit by Section 25, Indian Evidence Act, 1872.

View Solution

Question 45:

In Pakala Narayanaswami v. King Emperor (1939), the Privy Council held that a statement is a confession if:

- (A) Admitted the commission of the offence in the terms of the offence.

- (B) Admitted the commission of the ingredients for the commission of the offence.

- (C) Either (A) or (B)

- (D) Both (A) and (B)

Question 46:

In the excerpt above, the Supreme Court refers to the standard of ex facie. Such a standard in law can be explained as:

- (A) Refers to a standard where a document by its stated terms displays the sought fact.

- (B) Refers to a standard where a document by very simple perusal displays the sought fact.

- (C) Refers to a standard which calls for an application of mind by the finder of fact to infer a conclusion.

- (D) Refers to a standard which requires no consideration unless proved otherwise by the opposite side.

Correct Answer: (B) Refers to a standard where a document by very simple perusal displays the sought fact.

View Solution

Question 47:

In Lalita Kumari the Supreme Court provides a timeline for the completion of preliminary inquiries by the police prior to the registration of the F.I.R. As per the Court, such an inquiry should be concluded:

- (A) Within a period not exceeding fifteen days

- (B) Within a period not exceeding seven days

- (C) As expeditiously as possible but the Court did not specify a timeline

- (D) Within such time as may be permitted by the jurisdictional Magistrate

Correct Answer: (B) Within a period not exceeding seven days

View Solution

Question 48:

An F.I.R. is considered the first information of the commission of a cognizable offence. Where the information discloses the commission of both cognizable offences as well as non-cognizable offences as part of the same facts, how must this information be treated?

- (A) The entire information will be treated as disclosing cognizable offences and registered as an F.I.R.

- (B) The police officer will sever the parts disclosing non-cognizable offences and shall only register the parts disclosing cognizable offences.

- (C) The police officer shall refer the informant to the jurisdictional Magistrate for a direction to register the F.I.R., and thereafter, once such direction is received, register the F.I.R.

- (D) The F.I.R. registered, which contains information of non-cognizable offences, is subject to confirmation by a Magistrate under Sections 156 and 157 of Cr.P.C.

Correct Answer: (A) The entire information will be treated as disclosing cognizable offences and registered as an F.I.R.

View Solution

Question 49:

The power of the police to launch an investigation is provided for under Sections 154 and 157 of Cr.P.C. The threshold to be met for launching an investigation under Section 157, according to Lalita Kumari, is:

- (A) Cogent and reliable information disclosing the commission of a cognizable offence.

- (B) Higher than the requirement under Section 154 of Cr.P.C. as the Section uses the term “reason to suspect the commission of an offence”.

- (C) Precisely the same standard under Section 154 of Cr.P.C. and the police have no discretion in the matter.

- (D) At the same standard as for a non-cognizable complaint being scrutinised by a Judicial Magistrate.

Correct Answer: (B) Higher than the requirement under Section 154 of Cr.P.C. as the Section uses the term “reason to suspect the commission of an offence”.

View Solution

Question 50:

According to the decision of the Supreme Court in Lalita Kumari, the police may not consider the genuineness of information disclosing the commission of a cognisable offence at the time of registering an F.I.R. What does this mean?

- (A) That the informant must be believed for the purposes of registering the F.I.R.

- (B) That the information must be taken as true for the purposes of registering the F.I.R.

- (C) That the police cannot reject any information disclosing the commission of a cognisable offence on the basis of it being false.

- (D) All the above

Question 51:

The Supreme Court judgment held that compliance with Sections 65A and 65B of the Indian Evidence Act, 1872 for admitting secondary evidence of electronic records is:

- (A) Mandatory as held in the case of Anvar v. Basheer, (2014) 10 SCC 473

- (B) Discretionary upon the trial court judge to insist or waive the requirement

- (C) To be read together with the mode of proof of non-electronic documents under Sections 62–65, Indian Evidence Act, 1872

- (D) None of the above

Correct Answer: (A) Mandatory as held in the case of Anvar v. Basheer, (2014) 10 SCC 473

View Solution

Question 52:

In Indian evidence law, the proof of the contents of documents must necessarily follow a sequence of procedure; this sequence can be illustrated as:

- (A) Admitting the document, marking the document, authenticating the document

- (B) Authenticating the document, receiving evidence of its contents, marking the document

- (C) Proving the contents of the document, authenticating the document, marking the document

- (D) Marking the document, authenticating the document, receiving the document as evidence

Correct Answer: (A) Admitting the document, marking the document, authenticating the document

View Solution

Question 53:

Where the original document, such as the original computer device containing the electronic record, is produced before the court, Section 65B(4) certificate is not required. However, the owner of the device must testify that it belongs to them. This function by a witness is most appropriately understood as:

- (A) The act of authentication of a document

- (B) The act of proving contents of a document

- (C) The act of corroborating the evidence of a document

- (D) The act of solving the problem of hearsay associated with documents

Correct Answer: (A) The act of authentication of a document

View Solution

Question 54:

Under the Indian Evidence Act, 1872, oral evidence as to the contents of documents:

- (A) Cannot be admitted

- (B) Generally cannot be admitted except when accepted as admissible secondary evidence under Section 65, Indian Evidence Act, 1872

- (C) Generally can be admitted except when barred by the rule against hearsay

- (D) Generally can be admitted except when considered unreliable due to impeachment of the witness

Correct Answer: (B) Generally cannot be admitted except when accepted as admissible secondary evidence under Section 65, Indian Evidence Act, 1872

View Solution

Question 55:

Where primary evidence of an electronic record cannot be produced, and the secondary evidence is not accompanied by a Section 65B(4) certificate, the court may:

- (A) Never admit such evidence

- (B) May only admit such evidence where it is satisfied that procuring such a certificate would result in unfair prejudice, and where the document is crucial evidence

- (C) May admit such evidence if satisfied that the party adducing such evidence was unable to procure the certificate despite best efforts and that it was impossible for them to do so

- (D) Admit such evidence after a scrutiny of the fact it purports to prove, and only do so for proof of relevant facts, and never for the proof of facts in issue as defined under Section 3, Indian Evidence Act, 1872

Correct Answer: (C) May admit such evidence if satisfied that the party adducing such evidence was unable to procure the certificate despite best efforts and that it was impossible for them to do so

View Solution

Question 56:

A plaintiff seeks to adduce a secondary electronic record into evidence without complying with Section 65B, Indian Evidence Act, 1872. The respondent does not object at trial. On appeal, the respondent argues that the evidence was inadmissible for want of a Section 65B certificate. Relying on Sonu v. State of Haryana, (2017) 8 SCC 570, what should the court hold?

- (A) An appellate court should declare the evidence inadmissible in line with the mandatory nature of Section 65B.

- (B) An appellate court should remand the matter to trial declaring the said evidence inadmissible.

- (C) An objection to the method of proof cannot be raised at the appellate stage as the original party could have cured the defect at trial.

- (D) Since the respondent did not object to admissibility, the document automatically stands proved.

Correct Answer: (C) An objection to the method of proof cannot be raised at the appellate stage as the original party could have cured the defect at trial.

View Solution

Question 57:

The Supreme Court in Anvar v. Basheer, (2014) 10 SCC 473, overruled State (NCT of Delhi) v. Navjot Sandhu (2005) 11 SCC 600. Which holding was overruled?

- (A) That in cases of criminal conspiracy, the method of proof of the conspiracy is controlled by Section 10, Indian Evidence Act, 1872, and not Section 65B.

- (B) That irrespective of compliance with Section 65B, contents of electronic documents could be proved through Sections 62–65 of the Indian Evidence Act, 1872.

- (C) That electronic documents, being a special class of general documents, had to be proved through expert opinion under Section 45, Indian Evidence Act, 1872.

- (D) That the document sought to be proved must first be marked and then admitted into evidence for its contents, and that this sequence may not be reversed.

Correct Answer: (B) That irrespective of compliance with Section 65B, contents of electronic documents could be proved through Sections 62–65 of the Indian Evidence Act, 1872.

View Solution

Question 58:

The judgment of the Supreme Court in Tomaso Bruno v. State of U.P., (2015) 3 SCC (Cri) 54, has been held to be per incuriam. In law, a judgment is per incuriam when:

- (A) The judgment is against binding precedent of a higher court or larger bench.

- (B) The judgment is against binding provisions of law applicable to the subject.

- (C) Both (A) and (B)

- (D) Neither (A) nor (B)

Question 59:

X gets his Will drafted by a scribe, attested by two witnesses. After X’s death, one son challenges it. One attesting witness is called, but says he does not remember due execution. Z seeks to examine the scribe as a witness to its execution. Can the scribe be examined at this stage?

- (A) Yes, since one attesting witness has not recalled the execution, any other evidence is admissible under Section 71, Indian Evidence Act, 1872.

- (B) No, since another attesting witness who has not been summoned must first be examined under Section 68, Indian Evidence Act, 1872.

- (C) No, since one attesting witness has denied execution, no other evidence can prove the Will.

- (D) Yes, since the scribe is a direct witness to the execution of the Will, and his evidence is admissible under Section 60, Indian Evidence Act, 1872.

Correct Answer: (A) Yes, since one attesting witness has not recalled the execution, any other evidence is admissible under Section 71, Indian Evidence Act, 1872.

View Solution

Question 60:

When must the certificate under Section 65B(4) of the Indian Evidence Act, 1872 be produced in criminal trials? What has the Supreme Court held?

- (A) It must generally be produced at the time of production of documents, typically with the chargesheet.

- (B) If missing or deficient, it may be supplied at a later stage in the trial, and the court can allow it.

- (C) Any application during trial to add documents must be examined to avoid unfair prejudice to the accused.

- (D) All the above

Question 61:

Partyland’s political scenario involves frequent reversal of previous ruling party’s laws whenever a new party gains majority. Which model of law would Waldron most likely see this as?

- (A) Partyland is not an actual democracy

- (B) The situation is an illustration of the neutral model of law

- (C) The situation is an illustration of the partisan model of law

- (D) Partyland is not an actual republic

Correct Answer: (C) The situation in Partyland is an illustration of the partisan model of law

View Solution

Question 62:

After a second term, the Public Party in Partyland removes judicial discretion, requiring judges to apply laws strictly as codified. Which model of law do these changes align with?

- (A) The neutral model of law

- (B) The partisan model of law

- (C) Equally with both, the neutral and partisan model of law

- (D) With neither the neutral nor the partisan model of law

Question 63:

Public Party enacts a “workers’ tax” law, but the Worker’s Party in one state refuses to implement it. Which model of law does this refusal align with?

- (A) The partisan model of law

- (B) The neutral model of law

- (C) Equally with both the neutral and partisan model of law

- (D) With neither the neutral nor the partisan model of law

Question 64:

Based on the passage, which of the following is the most accurate statement regarding the Basic Structure doctrine in Indian Constitutional law?

- (A) As it places limits on the amending power of Parliament, it is closer to the partisan rather than the neutral model of law.

- (B) As it emerged from a series of judicial decisions rather than legislation, it is a product of partisan rather than neutral law-making.

- (C) It does not reflect any of the attributes of either the neutral or partisan model of law.

- (D) As it places limits on the amending power of Parliament, it is closer to the neutral rather than the partisan model of law.

Correct Answer: (D) As it places limits on the amending power of Parliament, it is closer to the neutral rather than the partisan model of law.

View Solution

Question 65:

Based on the passage, which of the following is Waldron most likely to agree with?

- (A) Legislators always make laws based on their party’s ideology, rather than any non-partisan interests

- (B) Legislators make laws based on non-partisan considerations

- (C) Laws are made on the basis of the needs and demands of society from time to time

- (D) Law and law-making can be understood using the partisan or the neutral model

Correct Answer: (D) Law and law-making can be understood using the partisan or the neutral model

View Solution

Question 66:

Which of the following most strongly supports the neutral model of law and law-making?

- (A) Once enacted, legislation is regarded as an act of Parliament as a whole, rather than any political party

- (B) Party whips ensure members vote in line with party ideology

- (C) Social welfare laws are enacted for the benefit of weaker sections of society

- (D) Elections to legislatures are hotly contested

Correct Answer: (A) The fact that once enacted, legislation is regarded as an act of Parliament as a whole, rather than any political party

View Solution

Question 67:

Which statement is a proponent of the neutral model of law-making most likely to agree with?

- (A) Democracy is desirable, and increased voter turnout proves law-making is non-partisan

- (B) Legislators should represent their constituents’ interests and vote only for their party’s promised laws

- (C) Child pornography is heinous, and bipartisan political votes for strong punishments show law-making is non-partisan

- (D) Judges are not elected and should not have law-making powers through legislation or case law

Correct Answer: (C) Everyone agrees that child pornography is heinous, and bipartisan votes for punishments show law-making is non-partisan

View Solution

Question 68:

Which of the following arguments most strongly supports the partisan model of law-making?

- (A) Calling a legislation an act of Parliament rather than the act of a political party shows that it is the view of society as a whole on some matter, and thus deserving of respect by members of all political parties

- (B) Merely calling a legislation an act of Parliament does not take away from the fact that it is partisan, since it was introduced by a political party, and voted for by its members on the party’s directions, in furtherance of the party’s ideological agenda.

- (C) Calling a legislation an act of Parliament indicates that politicians have the liberty to vote for or against legislation on the basis of their idea of the rule of law, rather than on the basis of their party’s ideological agenda.

- (D) The mere act of calling a legislation an act of Parliament shows that it is the result of the collective effort of legislators from different political parties, and therefore, non-partisan in nature.

Correct Answer: (B) Merely calling a legislation an act of Parliament does not take away from the fact that it is partisan, since it was introduced by a political party, and voted for by its members on the party’s directions, in furtherance of the party’s ideological agenda.

View Solution

Question 69:

General elections are held again in Partyland, and the Public Party wins power again. It introduces a law allowing legislators to vote against their party whip without being disqualified. Which model of law does this align with?

- (A) The neutral model of law

- (B) The partisan model of law

- (C) Equally with both, the neutral and the partisan model of law

- (D) With neither the neutral nor the partisan model of law

Question 70:

Which statement, if true, would most weaken the neutral model of law’s arguments about common law?

- (A) Common law doctrine evolves over time, and in some instances may take much longer to evolve than the passage of a legislation.

- (B) Common law doctrine only evolves based on a form of reasoning specific to the law and is not affected by the personal values or ideologies of judges.

- (C) The evolution of common law doctrine proceeds in a purely logical manner and is not affected by any partisan values or ideology.

- (D) The evolution of common law doctrine is directed by the partisan interests of judges and is not divorced from political values or ideology.

Correct Answer: (D) The evolution of common law doctrine is directed by the partisan interests of judges and is not divorced from political values or ideology.

View Solution

Question 71:

In A Rajan, which of the following are essential prerequisites for an insider to fall within the mischief of “insider trading” under the Securities and Exchange Board of India (Prohibition of Insider Trading) Regulations, 1992?

- (A) Lack of access to price sensitive information

- (B) A profit motive

- (C) Mens rea

- (D) Abstaining from dealing in securities of a company about which the insider has price sensitive information

Question 72:

Which of the following are the key facts in A Rajan?

- (A) The respondent sold the shares of the company about which he had unpublished price sensitive information (“UPSI”) after the rise in price of the shares consequential to the disclosure of the UPSI.

- (B) The respondent did not possess any UPSI about the company whose shares he sold.

- (C) The respondent sold the shares of the company about which he had UPSI before the rise in price of the shares consequential to the disclosure of the UPSI in his possession.

- (D) The respondent did not sell any shares of the company about which he had UPSI.

Correct Answer: (C) The respondent sold the shares of the company about which he had UPSI before the rise in price of the shares consequential to the disclosure of the UPSI in his possession.

View Solution

Question 73:

Based on the passage, what is `insider trading` under the Insider Trading Regulations?

- (A) Dealing in the securities of a company about which one does not have UPSI, without any desire to make a profit.

- (B) Dealing in the securities of a company about which one has UPSI, without any desire to make a profit.

- (C) Dealing in the securities of a company about which one does not have UPSI, with the desire to make a profit.

- (D) Dealing in the securities of a company about which one has UPSI, with the desire to make a profit.

Correct Answer: (D) Dealing in the securities of a company about which one has UPSI, with the desire to make a profit.

View Solution

Question 74:

Based on the passage, what was the impact of the cancellation of the shareholders’ agreements between SIL and GIPL?

- (A) There was a decrease in the closing prices of the shares after this information was disclosed.

- (B) There was an increase in the closing prices of the shares after this information was disclosed.

- (C) There was no change in the closing prices of the shares after this information was disclosed.

- (D) The company’s securities were delisted from the stock exchange.

Correct Answer: (B) There was an increase in the closing prices of the shares after this information was disclosed.

View Solution

Question 75:

Which of the following approaches has been adopted in several jurisdictions, including India, to determine cases of insider trading?

- (A) Parity of information

- (B) Lifting the corporate veil

- (C) Indoor management

- (D) Constructive notice

Question 76:

What reason did A Rajan give for selling his shares in the company about which he had UPSI?

- (A) He expected a huge rise in the share price of GIPL upon the disclosure of the UPSI in his possession.

- (B) It was a compulsory requirement under the shareholders’ agreement with SIL.

- (C) He needed funds to buy the securities of SIL.

- (D) He needed funds to honour a CDR package.

Correct Answer: (D) He needed funds to honour a CDR package.

View Solution

Question 77:

Which of the following did the court in A Rajan say was clarified in SEBI v. Kanaiyalal Baldevbhai Patel, (2017) 15 SCC 1, as regards the SEBI (Prohibition of Fraudulent and Unfair Trade Practices relating to Securities Market) Regulations, 2003 (the ``FUTP Regulations'')?

- (A) That mens rea is an indispensable requirement to attract the rigour of the FUTP Regulations

- (B) That mens rea is not an indispensable requirement to attract the rigour of the FUTP Regulations

- (C) That mens rea is not an indispensable requirement to attract the rigour of the Insider Trading Regulations

- (D) That mens rea is an indispensable requirement to attract the rigour of the Insider Trading Regulations

Correct Answer: (B) That mens rea is not an indispensable requirement to attract the rigour of the FUTP Regulations

View Solution

Question 78:

The Insider Trading Regulations are no longer in force. Which of the following is the current set of regulations governing insider trading in India?

- (A) The FUTP Regulations

- (B) The SEBI (Issue of Capital and Disclosure Requirements) Regulations, 2018

- (C) The SEBI (Prohibition of Insider Trading) Regulations, 2015

- (D) The SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015

Correct Answer: (C) The SEBI (Prohibition of Insider Trading) Regulations, 2015

View Solution

Question 79:

What did A Rajan hold regarding the information related to the termination of the shareholders’ agreements between GIPL and SIL?

- (A) It was not in the respondent’s possession

- (B) It had no impact on the closing price of GIPL’s shares

- (C) It was not price sensitive information

- (D) It was price sensitive information

Correct Answer: (D) It was price sensitive information

View Solution

Question 80:

In A Rajan, the court opined that a person who wanted to indulge in insider trading would have:

- (A) Held on to the shares, and only sold them after the news about the termination of the shareholders’ agreements with SIL was made public.

- (B) Sold the shares before the news about the termination of the shareholders’ agreements with SIL was made public.

- (C) Held on to the shares and not sold them under any circumstances.

- (D) Never have bought GIPL’s shares in the first place.

Correct Answer: (A) Held on to the shares, and only sold them after the news about the termination of the shareholders’ agreements with SIL was made public.

View Solution

Question 81:

Ukraine filed the application excerpted above concerning “a dispute... relating to the interpretation, application and fulfilment of” an international convention (the “Convention”), whose name has been replaced with ‘[1]’ in the excerpt above. What is the full name of the Convention?

- (A) Convention on the Elimination of All Forms of Discrimination against Women, 1979

- (B) Convention on the Prevention and Punishment of the Crime of Genocide, 1948

- (C) International Covenant on Civil and Political Rights, 1966

- (D) Convention against Torture and Other Cruel, Inhuman or Degrading Treatment or Punishment, 1984

Correct Answer: (B) Convention on the Prevention and Punishment of the Crime of Genocide, 1948

View Solution

Question 82:

Article IX of the Convention provides that disputes between Contracting Parties relating to the interpretation, application or fulfilment of the Convention shall be submitted to the International Court of Justice (“ICJ”) at the request of:

- (A) The United Nations High Commissioner for Refugees

- (B) Any State not party to the dispute

- (C) The Secretary-General of the United Nations

- (D) Any of the parties to the dispute

Correct Answer: (D) Any of the parties to the dispute

View Solution

Question 83:

Article II of the Convention defines ‘genocide’ to mean certain acts, “committed with intent to destroy, in whole or in part, a national, ethnical, racial or religious group”. Which of the following is not included in the list of such acts under Article II of the Convention?

- (A) Killing members of the group

- (B) Promoting the cultural activities of the group

- (C) Imposing measures intended to prevent births within the group

- (D) Forcibly transferring children of the group to another group

Correct Answer: (B) Promoting the cultural activities of the group

View Solution

Question 84:

The ICJ held hearings for provisional measures in response to Ukraine’s application excerpted above on March 7, 2022. Which of the following did the Russian Federation do in relation to these hearings?

- (A) It appeared before the ICJ, and also submitted written pleadings objecting to the ICJ’s jurisdiction over the matter

- (B) It chose not to appear before the ICJ, and did not submit any written pleadings either

- (C) It chose not to appear before the ICJ, and submitted written pleadings objecting to the ICJ’s jurisdiction over the matter

- (D) It appeared before the ICJ, but chose not to submit any written pleadings

Correct Answer: (C) It chose not to appear before the ICJ, and submitted written pleadings objecting to the ICJ’s jurisdiction over the matter

View Solution

Question 85:

Which of the following relates to the conditions under which States may resort to war or the use of armed force in general?

- (A) Jus gentium

- (B) Jus ad bellum

- (C) Jus in bello

- (D) Jus cogens

Question 86:

Who among the following is the author of the work Mare Liberium, and is also often called the ‘Father’ of modern international law?

- (A) Jeremy Bentham

- (B) Baruch Spinoza

- (C) Hugo Grotius

- (D) Mohamed ElBaradei

Question 87:

Article 38(1) of the Statute of the International Court of Justice recognises certain sources of law that it must apply in deciding disputes submitted to it. Which of the following is or are included under Article 38(1)?

- (A) International conventions, whether general or particular, establishing rules expressly recognised by the contesting states

- (B) International custom, as evidence of a general practice accepted as law

- (C) The general principles of law recognised by civilised nations

- (D) All the above

Question 88:

Article 38(2) of the Statute of the International Court of Justice provides that Article 38 “shall not prejudice the power of the Court to decide a case ex aequo et bono, if the parties agree thereto”. Which of the following is the meaning of the phrase ex aequo et bono?

- (A) The thing speaks for itself

- (B) According to the right and good

- (C) By that very fact or act

- (D) Towards all

Correct Answer: (B) According to the right and good

View Solution

Question 89:

Which among the following was established by the UN General Assembly in 1947, under Article 13(1)(a) of the UN Charter, to “initiate studies and make recommendations for the purpose of … encouraging the progressive development of international law and its codification”?

- (A) The International Law Commission

- (B) The International Court of Justice

- (C) The International Criminal Court

- (D) The World Trade Organisation

Correct Answer: (A) The International Law Commission

View Solution

Question 90:

Who among the following first coined the term ‘genocide’?

- (A) Hersch Lauterpacht

- (B) Judge Radhabinod Pal

- (C) Raphael Lemkin

- (D) Mirjan Damaška

Food Corporation of India (“FCI” or “Corporation”), the Appellant herein, procures and distributes foodgrains across the length and breadth of the country as a part of its statutory duties. In the process, it enters into many contracts with transport contractors. In one such contract, the subject matter of present appeals, the Corporation empowered itself (under clause XII (a)) to recover damages, losses, charges, costs and other expenses suffered due to the contractors’ negligence from the sums payable to them. The short question arising for consideration is whether the demurrages imposed on the Corporation by the Railways can be, in turn, recovered by the Corporation from the contractors as “charges” recoverable under clause XII (a) of the contract. In other words, does contractors’ liability for “charges”, if any, include demurrages?

“XII [Road Transport Contract]. Recovery of losses suffered by the Corporation (a) The Corporation shall be at liberty to reimburse themselves for any damages, losses, charges, costs or expenses suffered or incurred by them, or any amount payable by the Contractor as Liquidated Damages as provided in Clauses X above. . . ”

Interpretation of contracts concerns the discernment of the true and correct intention of the parties to it. Words and expressions used in the contract are principal tools to ascertain such intention. While interpreting the words, courts look at the expressions falling for interpretation in the context of other provisions of the contract and also in the context of the contract as a whole. These are intrinsic tools for interpreting a contract. As a principle of interpretation, courts do not resort to materials external to the contract for construing the intention of the parties. There are, however, certain exceptions to the rule excluding reference or reliance on external sources to interpret a contract. One such exception is in the case of a latent ambiguity, which cannot be resolved without reference to extrinsic evidence. Latent ambiguity exists when words in a contract appear to be free from ambiguity; however, when they are sought to be applied to a particular context or question, they are amenable to multiple outcomes.

It was observed that “. . . Extrinsic evidence, in cases of latent ambiguity, is admissible both to ascertain where necessary, the meaning of the words used, and to identify the objects to which they are to be applied.”

The Corporation in the present contract has chosen not to include the power to recover demurrages and as such the expression “charges” cannot be interpreted to include demurrages. Demurrage is undoubtedly a charge, however, such a textual understanding would not help us decipher the true and correct intention of the parties to the present contract. After examining the contract in its entirety, including its nature and scope, the Court concluded that the contractors’ liability in the present contract was clearly distinguishable from other contracts entered into by the Corporation in 2010 and 2018, which included loading and unloading of foodgrains from the railway wagons within the scope of contractors’ duties, thereby necessitating the inclusion of demurrages as a penalty for non-performance of contractual duties.

[Extracted from: Food Corporation of India v. Abhijit Paul, (CA 8572-8573/2022), Judgment of Justices A.S. Bopanna and P.S. Narasimha, 18 November 2022]

Question 91:

According to the Court, how was this Road Transport Contract different from FCI’s earlier contracts with transport contractors?

- (A) FCI’s earlier contracts had expired

- (B) The present contract did not include loading and unloading of foodgrains from the railway wagons within the scope of contractor’s duties

- (C) Earlier contracts were executed by FCI with contractors who were both handlers and transporters

- (D) Earlier contracts were not validly executed

Correct Answer: (B) The present contract did not include loading and unloading of foodgrains from the railway wagons within the scope of contractor’s duties

View Solution

Question 92:

What is the extrinsic evidence that the Court used?

- (A) Work order under the Road Transport Contract

- (B) FCI’s Handling and Transport Contracts of 2010 and 2018

- (C) Tender documents filed by the contractors

- (D) FCI’s Handbook on Movement Operations

Correct Answer: (B) FCI’s Handling and Transport Contracts of 2010 and 2018

View Solution

Question 93:

The Court referred to Union of India v. Raman Iron Foundry (1974) to explain that contractual terms cannot be interpreted in isolation, following strictly etymological rules or be guided by popular connotation of terms, at variance with the contractual context. This principle of interpretation of contracts is known as:

- (A) Ejusdem generis

- (B) Mischief rule

- (C) Literal rule

- (D) Rule of contextual interpretation

Correct Answer: (D) Rule of contextual interpretation

View Solution

Question 94:

In Clause XII (Road Transport Contract), discussed above, the FCI may reimburse itself for damages etc., as Liquidated Damages. What does the term ‘liquidated damages’ mean?

- (A) Stipulated amount payable on breach of contract

- (B) Amount payable for actual damage caused due to breach

- (C) Amount intended to secure performance of contract

- (D) Damages payable for breach, where the exact amount is not pre-agreed

Correct Answer: (A) Stipulated amount payable on breach of contract

View Solution

Question 95:

The High Court had held that the Corporation was only entitled to recover losses incurred due to the contractor’s dereliction of duties under Section 73 of the Indian Contract Act, 1872. What does Section 73 provide for?

- (A) Obligation of parties to perform their promise

- (B) Compensation for breach of contract where penalty stipulated for

- (C) Compensation for loss or damage caused by breach of contract

- (D) Effect of refusal of party to perform promise wholly

Correct Answer: (C) Compensation for loss or damage caused by breach of contract

View Solution

Question 96:

The Court used the expression “Ex praecedentibus et consequentibus optima fit interpretatio”. What does this mean?

- (A) Of the same kind

- (B) The best interpretation is made from the context

- (C) An exception proves the rule

- (D) No action arises on an immoral contract

Correct Answer: (B) The best interpretation is made from the context

View Solution

Question 97:

In the case excerpted above, the Court used the following as an internal aid to interpret the contract:

- (A) Schedules

- (B) Title

- (C) Words and expressions

- (D) Proviso

Question 98:

What was the latent ambiguity in the contract discussed in the case excerpted above?

- (A) if the parties had capacity to perform the contract

- (B) if the parties intended to execute the contract

- (C) whether the term “charges” was exclusive of liability for demurrages

- (D) whether the Corporation can recover charges under the contract

Correct Answer: (C) whether the term “charges” was exclusive of liability for demurrages

View Solution

Question 99:

What does the term ‘latent ambiguity’ mean?

- (A) A glaring ambiguity, obvious from the face of the contract

- (B) A contractual term is reasonably, but not obviously, susceptible to more than one interpretation

- (C) A contractual term written in plain language and clearly understood

- (D) A contractual term that is illegal and against the public good

Correct Answer: (B) A contractual term is reasonably, but not obviously, susceptible to more than one interpretation

View Solution

Question 100:

Which one of the following cases is a key precedent on contextual interpretation of contracts?

- (A) Louisa Carlill v. Carbolic Smoke Ball Company, [1892]

- (B) Dunlop Pneumatic Tyre Co. Ltd. v. New Garage \& Motor Co. Ltd., [1914]

- (C) Investors Compensation Scheme Limited v. West Bromwich Building Society, [1997]

- (D) Home Office v. Dorset Yacht Co. Ltd., [1970]

Correct Answer: (C) Investors Compensation Scheme Limited v. West Bromwich Building Society, [1997]

View Solution

Question 101:

The main complaint against the Defendant in the case excerpted above is that their mark is “____” to the Plaintiff’s registered trademarks.

- (A) reasonably close in expression

- (B) same as

- (C) different from

- (D) deceptively similar

Question 102:

In order to prove infringement of copyright here, the Defendant’s work:

- (A) should be the exact reproduction of the Plaintiff’s work/label

- (B) looks similar to or like a copy or is reproduction of substantial part of the Plaintiff’s work

- (C) bears no resemblance to the Plaintiff’s work/label

- (D) should be created only by the Defendant or its authorised agents

Correct Answer: (B) looks similar to or like a copy or is reproduction of substantial part of the Plaintiff’s work

View Solution

Question 103:

Which one of the following is not part of the Plaintiff’s claim for infringement in this case?

- (A) trademark

- (B) tagline

- (C) patent

- (D) trade dress

Question 104:

What is the test of prior use of trademark?

- (A) open, continuous, extensive, uninterrupted use and promotion for a long time

- (B) owner waives rights over trademark and permits subsequent use of the mark

- (C) reasonable parody, comment of a registered trademark

- (D) use of trademark in good faith mainly for a descriptive purpose

Correct Answer: (A) open, continuous, extensive, uninterrupted use and promotion for a long time

View Solution

Question 105:

Section 29 of the Trademarks Act, 1999, applicable in this case, considers which of the following as an infringement of a trademark?

- (A) Misrepresentation of ownership of a trademark

- (B) Infringement of an unregistered trademark

- (C) Interference with exclusive right to use a registered trade mark

- (D) Infringement of a registered trademark by use of an identical or deceptively similar trademark in relation to identical or similar goods

Correct Answer: (D) Infringement of a registered trademark by use of an identical or deceptively similar trademark in relation to identical or similar goods

View Solution

Question 106:

Use of a trademark violates exclusive rights of the prior user or proprietor when:

- (A) usage has introduced differences or changes in the work

- (B) usage is likely to cause confusion and deception amongst members of the trade and public

- (C) usage of the work is authorised by the user or proprietor

- (D) the trademark enjoys goodwill

Correct Answer: (B) usage is likely to cause confusion and deception amongst members of the trade and public

View Solution

Question 107:

Dilution of a brand by the Defendant would result in commission of which of the following?

- (A) a civil wrong

- (B) not actionable per se

- (C) a criminal wrong

- (D) violates fundamental rights

Question 108:

What is the defence of acquiescence?

- (A) no confusion or difference in essential features of the trademark

- (B) waiver of right over trademark and permission for use of the mark

- (C) invalidity of the registered trademark

- (D) use of the trademark in good faith

Correct Answer: (B) waiver of right over trademark and permission for use of the mark

View Solution

Question 109:

Which decision established the three elements of passing off, otherwise known as the “Classical Trinity”?

- (A) Academy of Motion Picture Arts v. GoDaddy.Com, Inc., (2015)

- (B) Yahoo! Inc. v. Akash Arora and Another, (1999)

- (C) Reckitt \& Colman Products Ltd. v. Borden Inc., (1990)

- (D) Coca-Cola Company v. Bisleri International Pvt. Ltd., (2009)

Correct Answer: (C) Reckitt & Colman Products Ltd. v. Borden Inc., (1990)

View Solution

Question 110:

Which of these is not, in itself, a defence to infringement of a registered trademark?

- (A) honest and concurrent use

- (B) acquiescence

- (C) prior adoption and use

- (D) fair use

Question 111:

Which of the following criteria should a company satisfy during the immediately preceding financial year to qualify for CSR under the Companies Act, 2013?

- (A) Net profit of Rs. 5 crores or more

- (B) Net profit of Rs. 1,000 crores or more

- (C) Turnover of Rs. 5,000 crores or more

- (D) Net worth of Rs. 5,000 crores or more

Correct Answer: (A) Net profit of Rs. 5 crores or more

View Solution

Question 112:

What is the minimum spending obligation on CSR activities for a company under Section 135 of the Companies Act, 2013?

- (A) 5% of the average net worth of the company of the preceding three financial years