Drishti Jain Study Abroad Content Specialist

Study Abroad Content Specialist

Germany is a popular choice among Indian students for pursuing higher education. It is due to the lower or no tuition fees charged, as most universities are financed by the state. While taking admissions, one most important factors is the German Visa for students. To obtain a German Visa, indian students must have a special bank account called a German Blocked Account (Sperrkonto). This is a bank account for international students and job-seeker visa applicants in Germany, used to show financial stability.

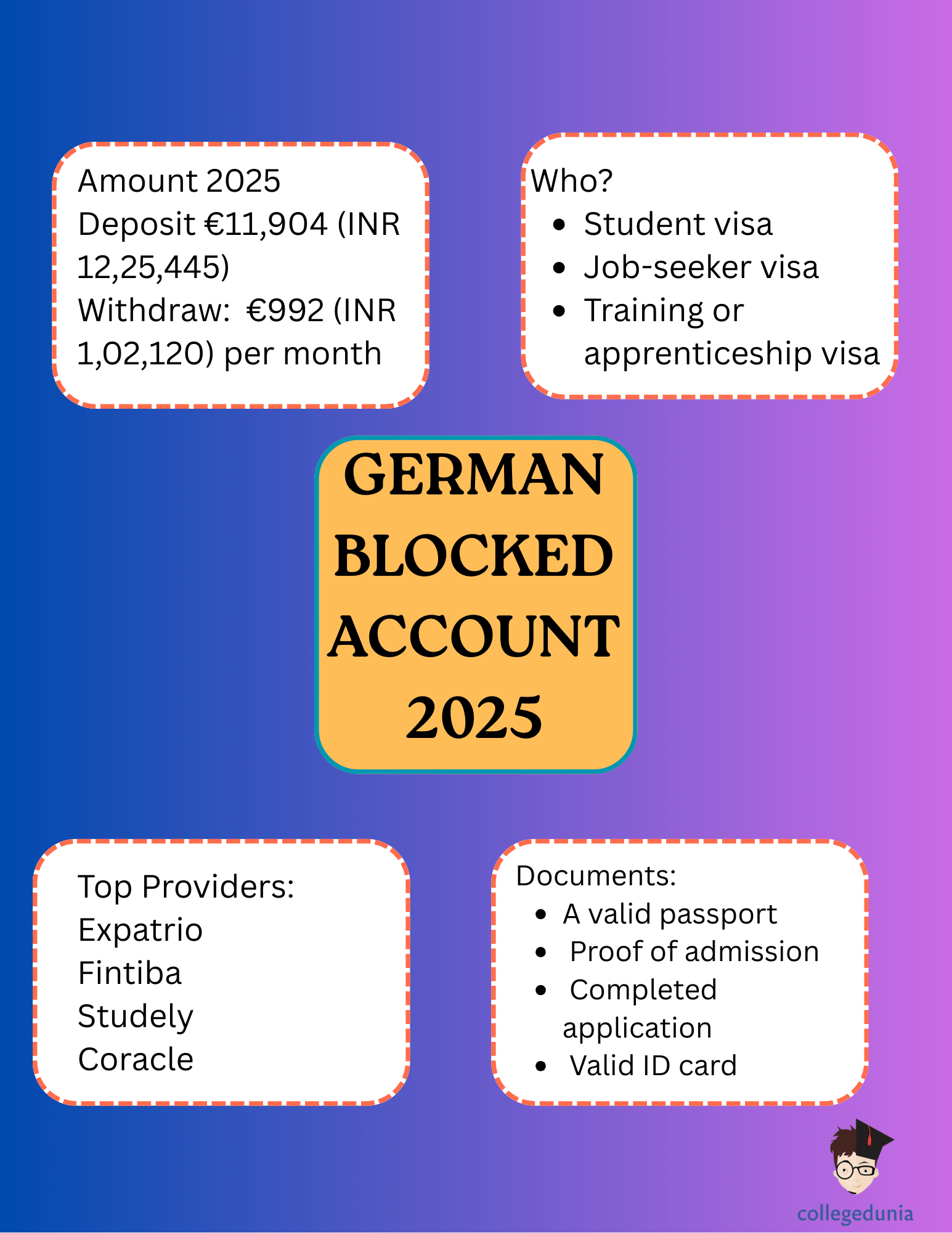

To set up a German Blocked Account (Sperrkonto), applicants must deposit €11,904 (INR 12,25,445), from which they can only withdraw €992 (INR 1,02,120) monthly after arrival to cover living expenses. One can only use the Blocked account Germany amount 2025 upon their arrival in Germany. You can open a blocked account with any provider like Expatrio, Fintiba, Studely, or Coracle.

- What is a German Blocked Account?

1.1 Who needs to open a Blocked Bank Account?

- Required Amount for a Blocked Account

- Top Providers for Blocked Accounts

- How to Open a Blocked Amount?

- How to Activate A Blocked Account?

- Additional Details on Blocked Account

6.1 Blocked Account vs Regular Bank Accounts

6.2 Renewal and Extension Process

- FAQs

What is a German Blocked Account?

A German Blocked account is a special bank account required by international students and job-seeker visa applicants in Germany. This bank account showcases their financial stability to cover the living expenses in Germany. This is required to prove to the German authorities that you have enough money to live and study in Germany. For setting up the account, applicants need to deposit €11,904 (INR 12,25,445), from which they can only withdraw €992 (INR 1,02,120) monthly after arrival to cover living expenses.

Who needs to open a Blocked Bank Account?

Applicants who are from a country other than a European Union or Schengen Member State and applying for the following German Visas need to have a German Blocked Account:

- Student visa

- Job-seeker visa

- Training or apprenticeship visa

- Aupair visa

- Visa for the recognition of foreign qualifications

- Visa for language acquisition

- Germany Opportunity Card – Chancenkarte

Exemptions: Citizens from the EU, Norway, Iceland, Liechtenstein, or Switzerland do not need a blocked account.

Required Amount for a Blocked Account

The required amount for a German blocked account when applying for a student visa in 2025 is €11,904 (INR 12,25,445). This ensures sufficient funds for living expenses in Germany, with a monthly withdrawal limit of €992 (INR 1,02,120). Applicants for certain German visas, such as the training/apprenticeship or language acquisition visa, are required to deposit 10% more €13,094 (INR 13,47,948) in total. The table below outlines the specific monthly and annual amounts needed for a blocked account across various years:

| Year | Annual Amount | Monthly Amount |

|---|---|---|

| 2025 | €11,904 (₹12,25,601) | €992 (₹1,02,133) |

| 2024 | €11,208 (₹11,53,725) | €934 (₹96,489) |

| 2023 | €11,208 (₹11,53,725) | €934 (₹96,489) |

| 2022 | €10,332 (₹10,63,807) | €861 (₹88,572) |

| 2021 | €10,332 (₹10,63,807) | €861 (₹88,572) |

| 2020 | €10,236 (₹10,53,568) | €853 (₹87,740) |

| 2019 | €10,200 (₹10,50,000) | €850 (₹87,499) |

Also check Cost of Living In Germany

Top Providers for Blocked Accounts

You can open a blocked account with one of the providers Expatrio, Fintiba, Studely, or Coracle. Looking into different factors and then choosing the right provider is very important.

| Provider | Fees | Processing Time | Online Application | Health Insurance Add-on | Current Bank Account Free Add-on |

|---|---|---|---|---|---|

| Expatrio | €89 (₹9,170.66) processing fee + €5 (₹514.70) monthly fee | Less than 24 hours to open the account; 3–5 days for money transfer | Yes | Yes | Yes. Open 100% online as part of the Expatrio Value Package. |

| Fintiba | €89 (₹9,170.66) processing fee + €4.90 (₹504.51) monthly fee | Ten minutes to open the account; 3–5 days to transfer and get confirmation | Yes | Yes | No |

| Studely | €70 (₹7,205.80) processing fee + €4.70 (₹483.82) monthly fee | 24 hours to open the account; 2–5 days for money transfer | Yes | No | No |

| Coracle | €99 (₹10,191.06) processing fee + No monthly fee | Not specified | Yes | Yes | No |

How to Open a Blocked Amount?

You must open a blocked account before applying for your German visa or residence permit. Here is the step-by-step process to open a German Blocked Account in 2025:

- Check with the German Embassy or Consulate how much money you need to transfer:

Although the amount transferred to the account is the same, you must still check the minimum amount to be transferred beforehand

- Open a blocked account with the provider of your choice:

Select from providers like Expatrio, Fintiba, or ICICI Bank based on your needs.

- Transfer the money:

The provider shares the IBAN and provides detailed instructions. The transfer can be completed through a bank or an international money transfer service/app, and it usually takes around 3 to 5 days.

- Confirmation Letter:

Once the transfer is complete, the provider sends the applicant a Confirmation Document for the Blocked Bank Account.

- Visa:

You will receive a National D Visa, which lets an applicant enter Germany.

- Required Documents:

Applicants must ensure they have all the necessary documents ready. These include a valid passport, proof of admission such as a university admission letter, recent bank statements as evidence of sufficient funds, a completed application form, and a valid ID card.

Also check Tuition Free Universities in Germany for Indian Students in 2025

How to Activate A Blocked Account?

To activate your blocked account, you must have a current account in Germany, which means you must register your address and get the Registration Certificate. You can only access your money after you open a current account. The documents you need to submit to activate your account are:

- Proof of having registered your residence in Germany, such as a lease agreement or the certificate of registration from the city hall (Anmeldung).

- Proof of your current account.

- Your passport with the entry stamp.

- Your German residence permit

Additional Details on Blocked Account

There is some additional information that is crucial for Indian students to keep in mind while applying for a blocked account in Germany.

Blocked Account vs Regular Bank Accounts

The difference between a Blocked Account and a regular Bank Account in Germany is tabulated below:

| Account Type | Purpose | Key Features | Requirements |

|---|---|---|---|

| Blocked Account (Sperrkonto) | Proof of financial means for a visa application | - Limited to €992/month withdrawal- Full access requires a residence permit | Must be opened before the visa application |

| Regular Bank Account (Girokonto) | Daily financial use (transactions, salary, etc.) | - No withdrawal limits- Used for monthly disbursements from the blocked account | Can be opened after address registration and residence permit |

Renewal and Extension Process

International students in Germany who opt for a Blocked Account as proof of their finances need the Blocked Account for 1st year of their studies. In the subsequent year, if they fail to provide proof of finances in other ways, then they have to extend their Blocked Account.

When international student wants to study in Germany, they are compulsorily required to show their proof of Financial stability. The way to do it is by opening a blocked account with one of the providers. Before applying through any provider, it's important to carefully review all the factors, requirements, and your personal needs to ensure you make the right decision.

FAQs

Ques 1: When Should I Apply for a Blocked Bank Account?

Ans: It takes 1 to 6 weeks for the blocked account to get processed. Make sure you start the process well in advance, since you cannot apply for your German Visa until you have your confirmation from the bank.

Ques 2: Can I study in Germany without a Blocked Account?

Ans: Studying in Germany without a blocked account is possible if you fulfill one of the requirements listed below:

- You are from the EU, Norway, Iceland, Liechtenstein or Switzerland.

- You have won a scholarship from an established educational institution in Germany.

- Confirmation that you will receive government funding or have an approved student loan in Germany.

- Proof of sponsorship from a friend or relative living in Germany. Your sponsor has to make a formal request to the Ausländerbehörde to sponsor you.

Ques 3: How Much Does it Cost to Open a Blocked Bank Account?

Ans: The cost to open a blocked account for a German visa ranges from €50 to €150 (₹5,147 to ₹15,441), depending on the provider. Some providers require a refundable buffer of around €100 (₹10,294) to cover bank fees, which is returned when the account is closed.

Ques 4: How do I extend my blocked Bank Account?

Ans: You must contact your provider to extend your blocked account for another year. If your account is with Postbank or Sparkasse, you must complete and submit a form. If you opened the account via an intermediary (Fintiba, Expatrio, Coracle, etc.), you can extend the account online.

Ques 5: Can I Deposit More Than The Required Minimum amount to the Blocked Bank Account?

Ans: Yes, you can. The required €11,904 (₹1,225,601) is the minimum amount accepted by German authorities for a study visa application. You may deposit more, but not less than this amount.

Comments