Jasmine Grover Study Abroad Expert

Study Abroad Expert | Updated On - Dec 20, 2025

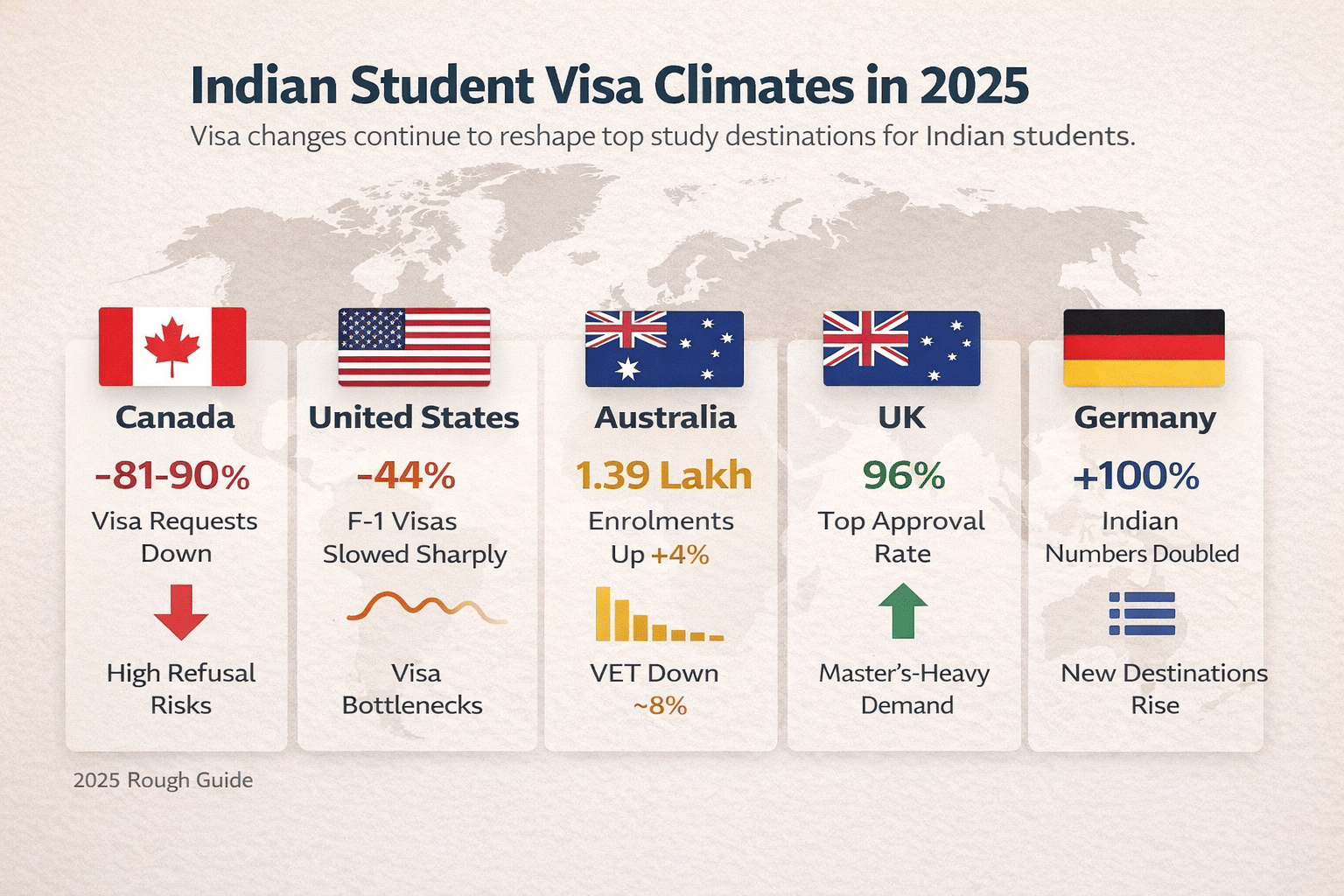

Indian student enrolments overseas dipped 5.7% in 2025, signalling a shift in decision-making rather than a drop in aspiration. According to the Ministry of External Affairs (MEA), around 1.2 million Indian students were studying abroad in 2025, down from about 1.33 million in 2024.

The decline is modest, but it reflects a year of visa uncertainty, rising costs and policy volatility across major study destinations, prompting Indian families to pause, reassess and diversify their options.

What Changed in 2025?

For years, studying abroad has been a clear goal for many Indian students. In 2025, however, families faced:

- Frequent visa rule changes

- Higher refusal rates

- Rising tuition and living costs

- Limited transition periods for new policies

Across Canada, the US, the UK and Australia, governments introduced tighter compliance checks, restrictions on dependants, changes to post-study work rules and caps on international students. The result was not rejection of overseas education, but greater caution.

Also Read

- Indian Students Face Stricter US Visa Rules Amid Policy Overhaul

- Canada Tightens Student Visa Rules: 80% of Indian Applicants Rejected in 2025

- Australia’s New “115 Rule” Slows Student Visas: What Indian Applicants Must Know

- UK Tightens Visa and English Language Rules: Students and Workers Face Higher Standards from 2026

Canada: Still Popular, But the Sharpest Slowdown

Canada remains the top destination for Indian students, but the slowdown has been significant.

- Indian study permit holders fell from 5.33 lakh (2023) to ~5.10 lakh (2024)

- New study permits for Indians between Jan–Aug 2025: 9,955

- Compared to ~1.5 lakh (2023) and 76,000+ (2024)

- Refusal rate for Indian applicants: 71% in 2025

- India’s share of Canada’s study permit pool dropped from 35% (2023) to 17% (2025)

For many families, Canada’s long-term appeal is now weighed against higher rejection risks and unpredictability.

United States: Campus Numbers Up, Visas Slowing

On-campus Indian enrolments in the US continued to rise:

3.32 lakh (2023) → 3.63 lakh (2024)

However, visa data tells a different story:

- F-1 visas for Indian students fell 44% in the first half of 2025

- Chinese F-1 visas declined by 24%

- Vietnamese F-1 visas rose 20%, indicating growing diversification in US classrooms

This suggests that while demand remains strong, future growth may slow due to visa bottlenecks.

Australia: Record Enrolments, Fewer New Starters

Australia showed mixed signals in 2025:

- 1.39 lakh Indian students enrolled (Jan–Sep 2025), up 4% year-on-year

- New commencements from India fell 8%

- Declines were sharper in the VET sector, while universities held up better

Stricter scrutiny, especially outside universities, has made approvals harder, even as Australia continues to position India as a long-term talent partner.

UK: A Relative Bright Spot for Indian Students

Among the Big Four, the UK stood out for stability.

- 98,015 Indian-sponsored study visas granted up to June 2025

- Approval rate: 96%

- Q2 2025 saw a 44% rise in Indian visa grants

- Indian students accounted for 81% master’s-level visas

Despite earlier concerns over the dependants ban, Indian demand for UK postgraduate courses has remained resilient.

Also Read

Beyond the Big Four: New Destinations Gain Ground

Indian students are increasingly looking beyond traditional destinations.

Germany

- Indian student numbers more than doubled from ~28,900 (2020) to 59,400+ (2024)

- 60% enrolled in engineering and technical fields

France

- Enrolments grew 17% in 2024–25 to about 9,100 students

- Government target: 30,000 Indian students by 2030

Ireland

- Indian enrolments crossed 7,000 in 2023–24

- India is now the largest international student group

New Zealand

- Indian student numbers stabilised at ~12,000 in 2025 after rapid post-pandemic growth

What does this mean for Indian Students?

The 5.7% decline does not signal fading ambition. Instead, it shows a more strategic approach.

Indian families are now asking:

- Where are visa risks lower?

- Where do costs justify outcomes?

- Which countries offer clearer post-study pathways?

As policies tighten and competition rises, students are spreading risk, diversifying destinations and reshaping global education flows—quietly but decisively.

1720429164.png?tr=w-305,h-145,c-force?h=40&w=40&mode=stretch)

Comments